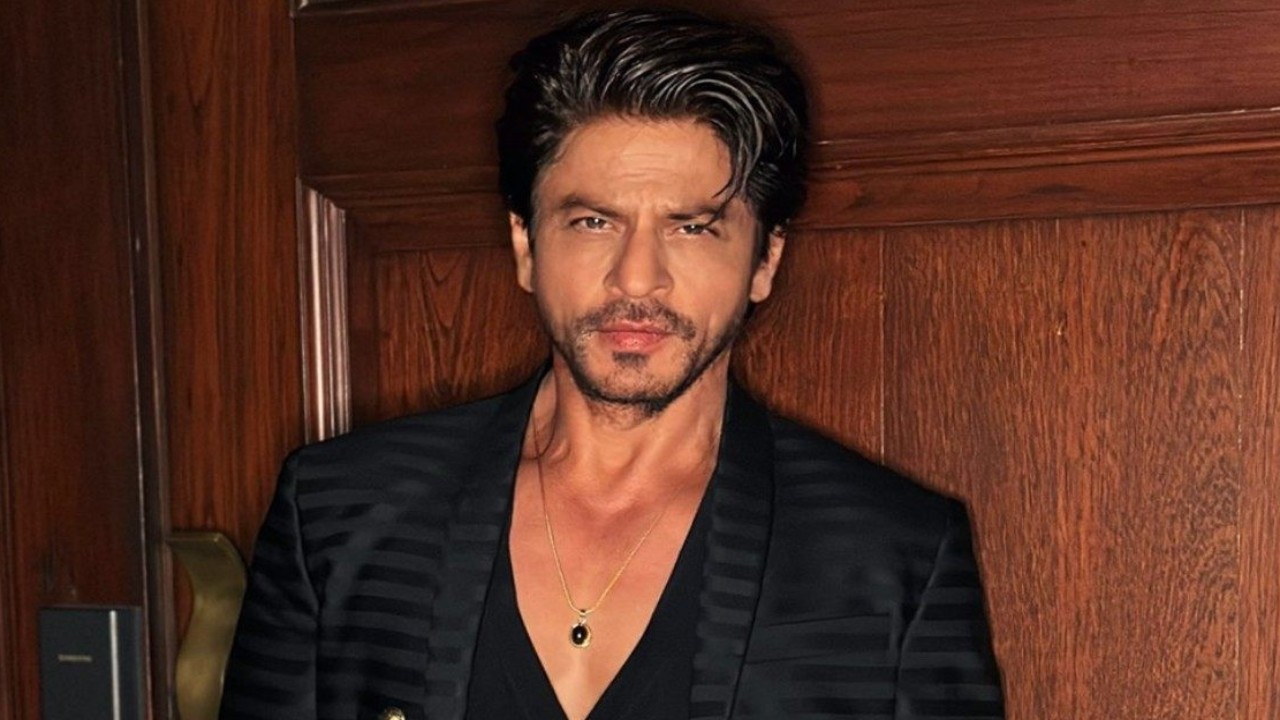

In a significant victory, actor Shah Rukh Khan has managed to clear up a tax issue. The Income Tax Appellate Tribunal (ITAT) has decided in his favor, overturning the tax authorities’ reassessment process and the order they issued for the fiscal year 2011-2012. According to The Times of India, the ITAT has effectively ended the reassessment proceedings against him.

Over a disagreement about his income tax declaration, the tax authority contested Shah Rukh Khan’s claimed income of approximately 83.42 crore rupees, refusing to grant him foreign tax credits for taxes already paid in the United Kingdom.

Consequently, the officer recalculated his reported earnings as a significantly larger sum of approximately 8417 million rupees. This reevaluation occurred beyond the usual timeframe, specifically in the years following 2012-13, which was the relevant assessment year.

According to the decision made by the Income Tax Appellate Tribunal (ITAT) bench, it was found that the income tax department’s reassessment of the case lacked legal justification, resulting in a significant win for the actor from Jawan during his long-standing disagreement over foreign tax credit claims.

The legal matter concerned the tax assessment on Shah Rukh Khan’s income derived from the film “RA One,” that premiered back in 2011.

According to the latest news, I, as an ardent admirer, can’t help but share my excitement over the deal between the magnificent King himself and Red Chillies Entertainment, the film powerhouse he co-founded. This agreement outlines that a whopping 70% of our future cinematic journey will unfold right here in the UK!

Consequently, about 70% of the earnings were classified as foreign income and became subject to UK taxes, including withholding tax. To carry out this setup, the actor’s compensation was channeled through Winford Production, a company based in the UK. Nonetheless, tax officials contended that this payment structure resulted in a reduction of revenue for India.

The ITAT panel, made up of Sandeep Singh Karhail and Girish Agrawal, determined that the reassessment process was not valid due to the fact that the assessing officer did not provide any new substantial evidence after the four-year legal timeframe, justifying a reassessment.

Furthermore, the court pointed out that this issue was previously evaluated during the initial examination. Given these circumstances, they determined that the subsequent review process contained several legal inconsistencies.

Read More

- Cookie Run Kingdom Town Square Vault password

- Rick Owens Gives RIMOWA’s Cabin Roller a Bronze Patina

- Alec Baldwin’s TLC Reality Show Got A Release Date And There’s At Least One Reason I’ll Definitely Be Checking This One Out

- ‘The Last of Us’ Gets Season 2 Premiere Date

- After The Odyssey’s First Look At Matt Damon’s Odysseus, Fans Think They’ve Figured Out Who Tom Holland Is Playing

- Judge Fines Oregon Man with $120 Million in Crypto Fraud Case

- NEIGHBORHOOD Unveils SS25 Collection Featuring Keffiyeh-Inspired Pieces

- Unveiling the Enchanting World of Peer-to-Peer Crypto: A Witty Guide

- Disney+ Lost A Ton Of Subscribers After The Company Raised Prices, But It Didn’t Seem To Matter For Another Streamer

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2025-03-10 08:37