In a twist as unexpected as a plot from Doctor Zhivago, it appears that short-term Bitcoin (BTC) enthusiasts are hugging their digital treasures tighter than a bear in winter, despite the chill of unrealized losses. Onchained, the poetic quant from CryptoQuant, opines that these holders are like the eternal optimists, recording far fewer realized losses compared to their paper ones. 🧐

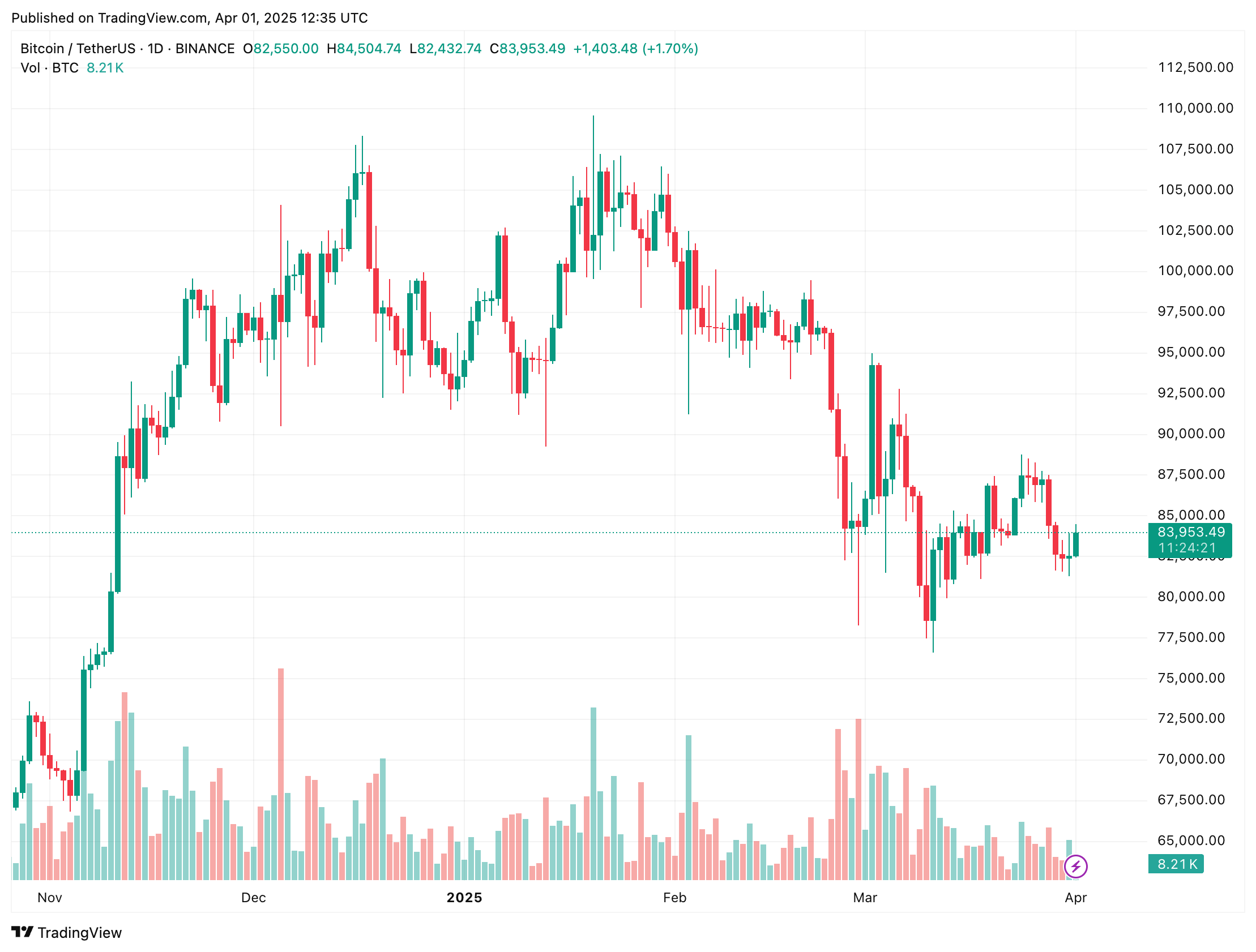

Is it a rally they scent on the wind, or merely the scent of their own stubbornness? The first three months of the year have been a rollercoaster, with Bitcoin’s value plunging like a tragic hero, from the heights of $97,000 to the depths of $83,000. Yet, these holders cling to their coins like a lover’s embrace, defying the logic of the market. 🎢

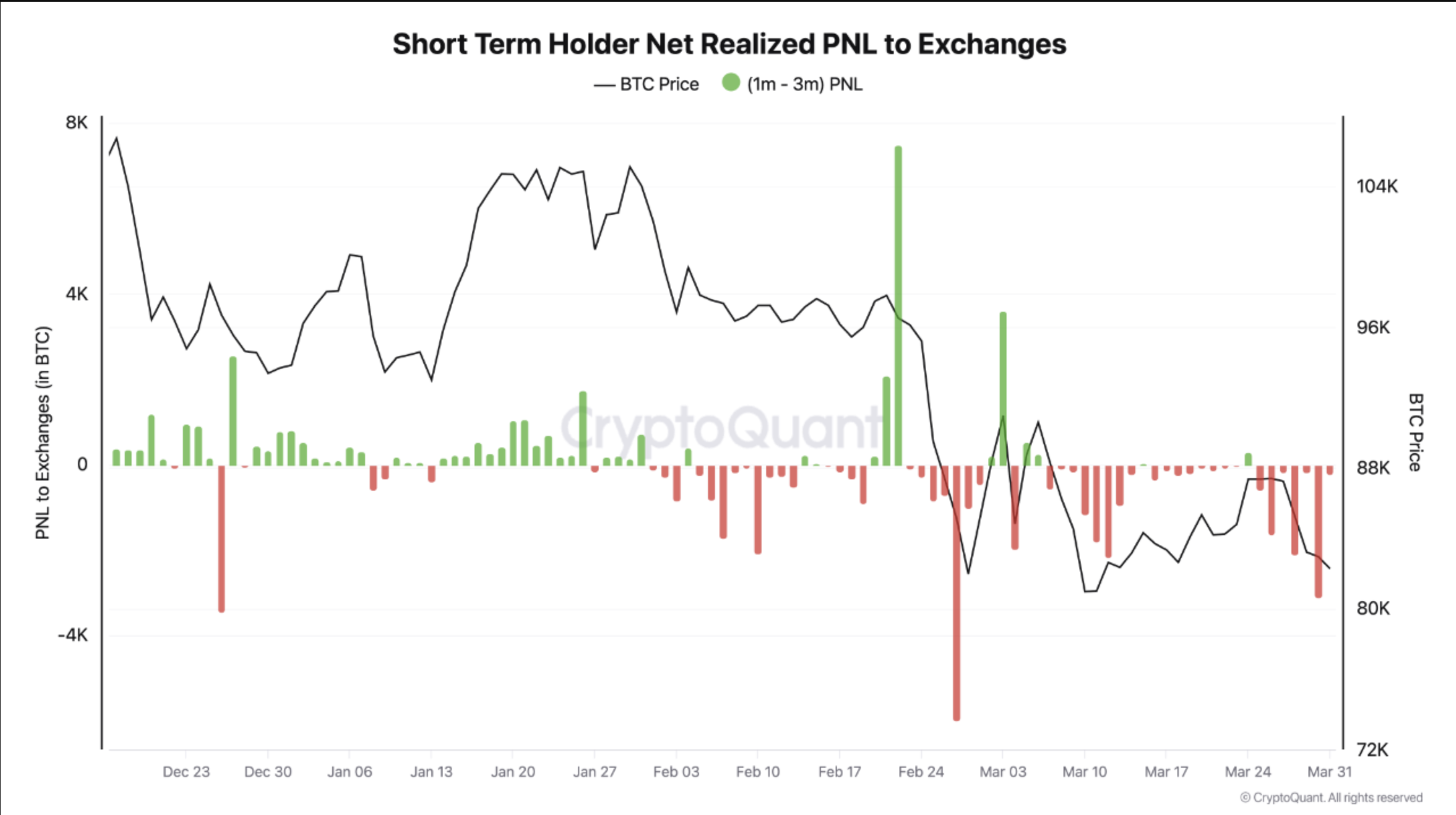

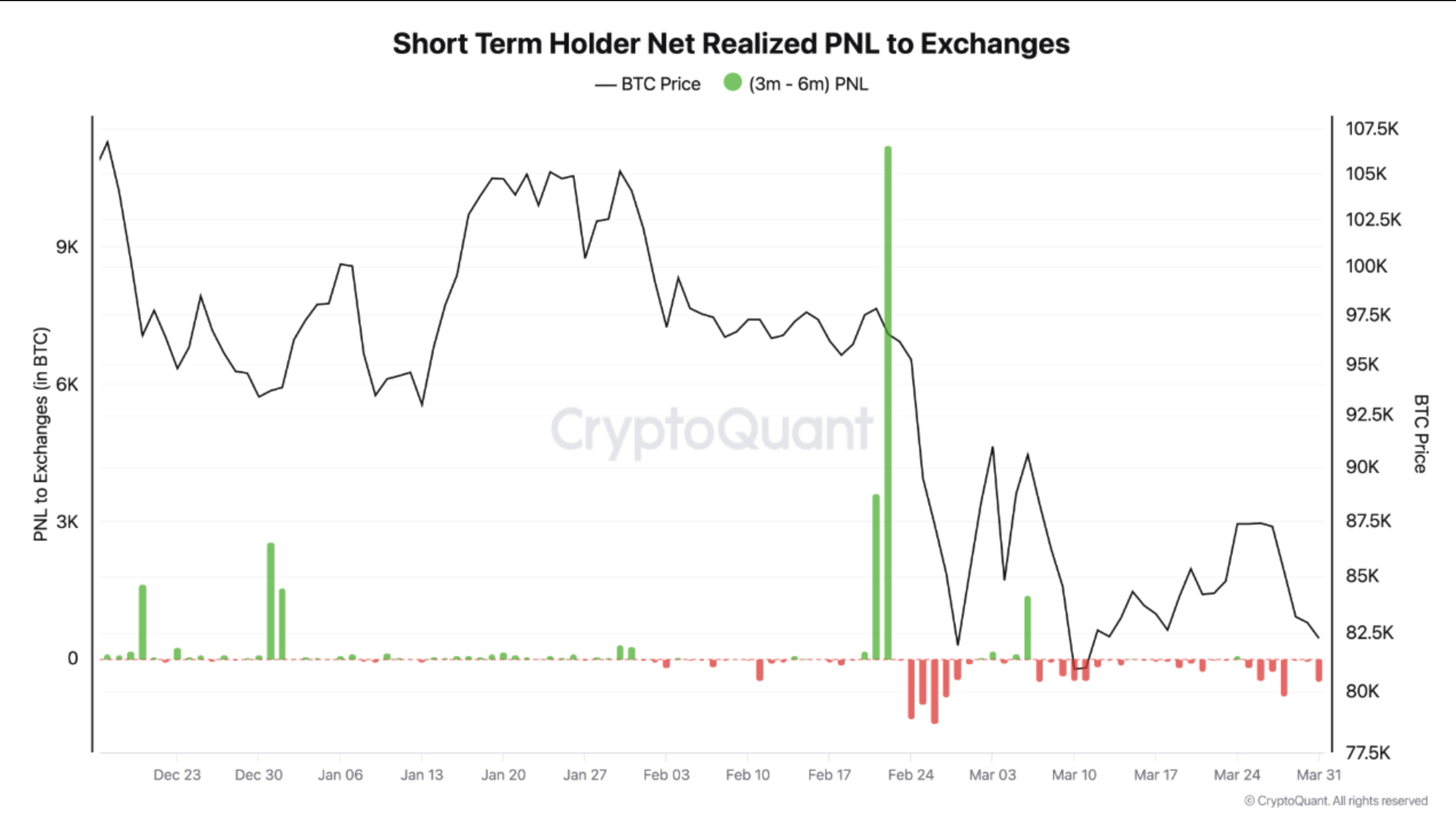

Onchained, with the insight of a bard, observes a curious shift in the dance of the market. Short-term BTC holders, those who’ve known their coins for a mere season, have become the most eager sellers, even if it means parting with a piece of their soul. 🕺

But lo! A glimmer of hope, like the first light of dawn. The selling pressure to exchanges has waned, as if the holders have decided that patience is a virtue worth more than a quick sale. Could it be that they believe in the phoenix-like rise of Bitcoin? 🌅

This change in the tide of selling behavior is as mysterious as the Russian winter. Are these holders the unsung heroes, ready to brave the storm for a brighter day? The analyst, ever the cautious observer, warns that the future is as unpredictable as the Russian roulette, but the insights are as rich as a novel. 📚

“Are short-term holders the new knights of the round table? If so, this could be the dawn of a new era, where volatility is tamed, and the stage is set for the grand return of Bitcoin.”

Onchained reveals that these holders guard 28% of BTC’s circulating supply, a treasure trove that, if turned to long-term holding, could launch Bitcoin to the stars, or at least beyond the $150,000 mark. 🚀

As the market teeters on the brink of a comeback, like a symphony reaching its crescendo, other signs point to a potential surge. Arthur Hayes, the crypto maestro, suggests that the bottom may have been hit, though the dance with the stock market continues. And while Bitcoin lags behind the golden child, gold, it still manages to rise, if only for a moment. 🌟

Read More

- Gold Rate Forecast

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- EUR NZD PREDICTION

- Mini Heroes Magic Throne tier list

2025-04-02 05:12