- So, Polygon‘s token decided to throw a little party, gaining15% in just three days, but spoiler alert: it’s more like a gathering in a haunted house on the1-day and1-week charts. 🎉👻

- Before POL can throw its cap in the air and yell “Uptrend!”, it needs to turn those pesky $0.3 and $0.285 resistances into its personal cheerleaders. 📈📉

Imagine this: Polygon [POL], formerly known as MATIC (because who doesn’t love a good rebrand?), decides to go on a little adventure, gaining a solid15% in mere days. Day traders are practically throwing confetti, but let’s not pop the champagne just yet. 🍾❌

The higher timeframe is like that grumpy neighbor who always complains about your music being too loud—it’s bearish, folks. So, swing traders and POL enthusiasts might want to keep their party hats on standby. 🐻🎩

POL: The Plot Thickens Across Timeframes – Caution is the New Black 🕵️♂️

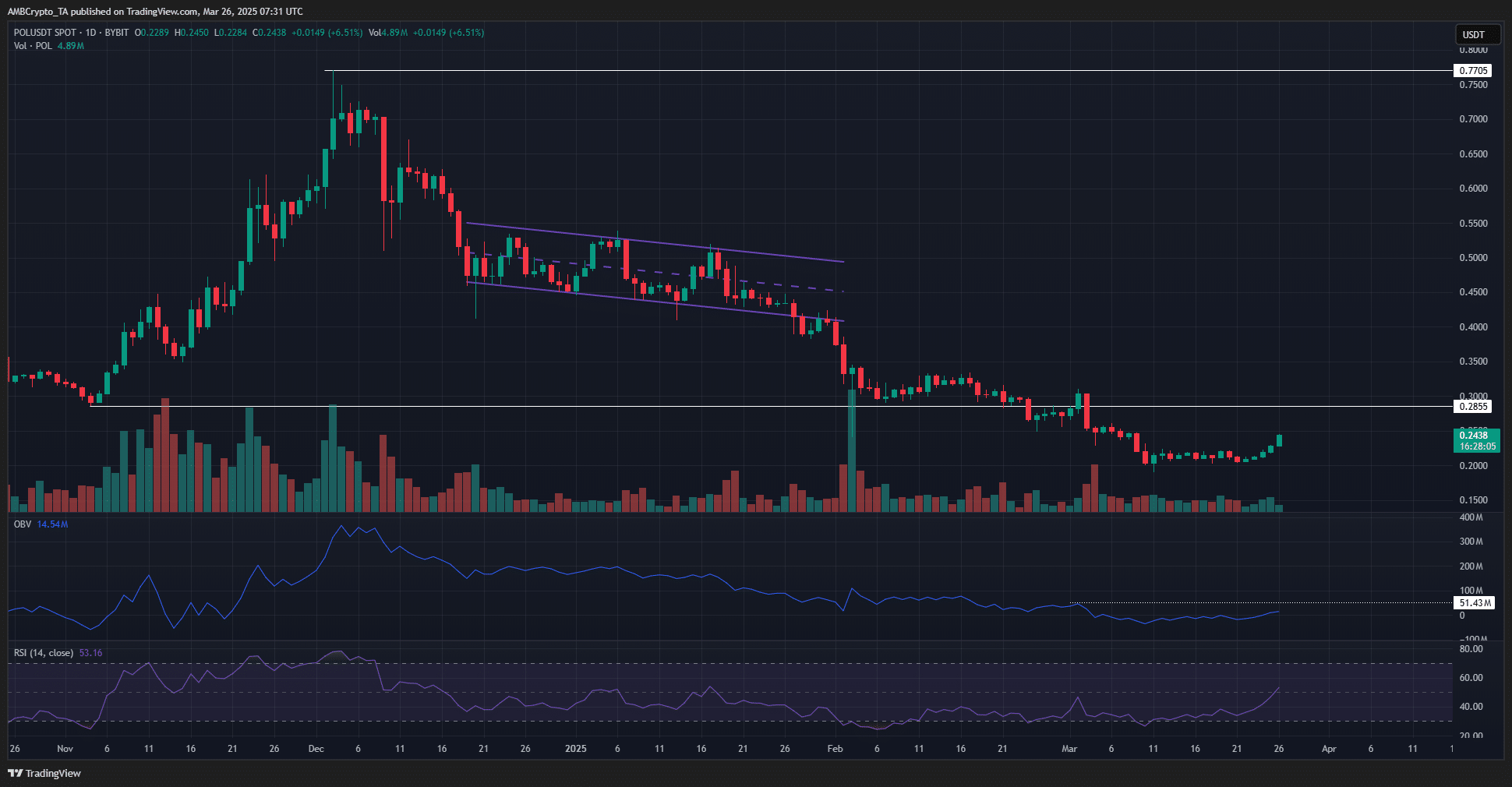

Early this year, Polygon was like a ski enthusiast, gracefully navigating a descending channel. But then, towards the end of February, it took a nosedive, accelerating its descent like an over-caffeinated snowboarder. The daily chart is still trying to find its ski poles, folks. ⛷️❄️

On the weekly chart, we’ve got some key swing levels marked at $0.285 and $0.77. As of now, POL is trading below these levels, making the market structure look about as inviting as a bear hug from a real bear. 🐻🤗

But wait, there’s a twist! The OBV and RSI are trying to throw a bullish rave, hinting at some potential momentum shift. It’s like they’re passing out flyers to a party that might not happen. 🎉❓

However, the $0.285–$0.3 zone is like that exclusive club with a bouncer who doesn’t believe in guest lists. Breaking through seems about as likely as getting a table at the hottest restaurant in town without a reservation. 🚫🍽️

Switching to the4-hour chart, it’s like POL suddenly remembered it was supposed to be the life of the party. The RSI is in overbought territory, making it the equivalent of that guy who’s had one too many at the open bar. 🍹📈

The price has broken above the local resistance zone at $0.22, like someone finally finding the courage to ask the DJ for their favorite song. And the OBV? It’s hitting highs like it’s discovered the secret to eternal youth. 🎶📊

Yet, despite the short-term bullish fiesta, the overall trend is still dancing to a bearish beat, as indicated by the Fibonacci levels. It’s like trying to enjoy a sunny day while knowing there’s a storm brewing. ☀️⛈️

If POL can shimmy above $0.26, the H4 chart might just throw on its party hat. But let’s not forget about those resistance levels at $0.265 and $0.285. They’re like the chaperones at a high school dance, ready to spoil the fun. 💃🕺

So, dear bulls, maybe hold off on the conga line for now. Observing POL’s moves around $0.26 and $0.285 is like waiting to see if the DJ plays your song request. Patience might just save you from a bearish plot twist. 🐻🎶

Read More

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Roblox: Project Egoist codes (June 2025)

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Run! Goddess tier list – All the Valkyries including the SR ones

- Castle Duels tier list – Best Legendary and Epic cards

- Hero Tale best builds – One for melee, one for ranged characters

- EUR CNY PREDICTION

- Brown Dust 2 celebrates second anniversary with live broadcast offering a peek at upcoming content

2025-03-27 00:11