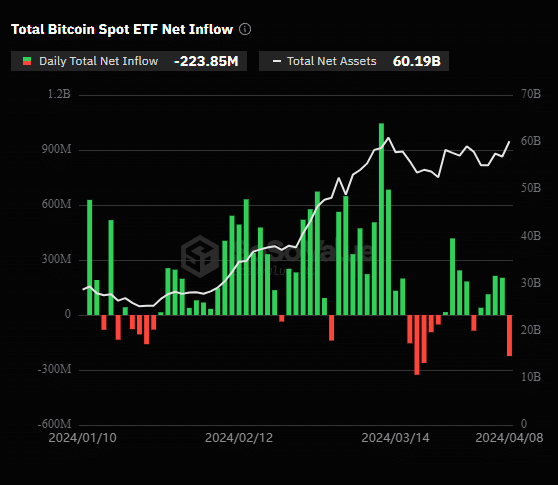

Bitcoin ETFs saw a net outflow of $223 million on Monday after four consecutive days of net inflow.

Based on SoSo Value’s report, Bitcoin ETFs experienced their largest outflow in over two weeks on Monday. The previous week had seen four successive days of inflows, amounting to approximately $570 million. This led to a surge in Bitcoin’s price, reaching $72,000.

On Monday, a large amount of Bitcoin (BTC) was sold, resulting in a 6% decrease in its daily trading volume. Consequently, the price fell back to $69,000.

The ETF managed by Bitwise experienced its largest one-day inflow of approximately $40.3 million. In contrast, over $303 million were taken out from Grayscale’s ETF, GBTC.

After the SEC gave its approval for ETFs in January, Bitcoin’s price fluctuations have primarily influenced the amount of money flowing into these investment vehicles. Institutions are expected to increase their impact on Bitcoin’s market behavior, as the London Stock Exchange is set to debut Bitcoin ETNs next month.

As the Bitcoin halving draws near, there’s debate among analysts about its impact on the market in the coming weeks. Some industry insiders like Anthony Scaramucci and Mark Plamer are bullish, predicting the price will surge past $150,000 as we enter a prolonged bull market post-halving.

Although not every investor holds the same viewpoint, a recent survey conducted by Deutsche Bank revealed that approximately 30% of their investors anticipate Bitcoin’s price to fall beneath $20,000 before the year concludes.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-04-09 18:10