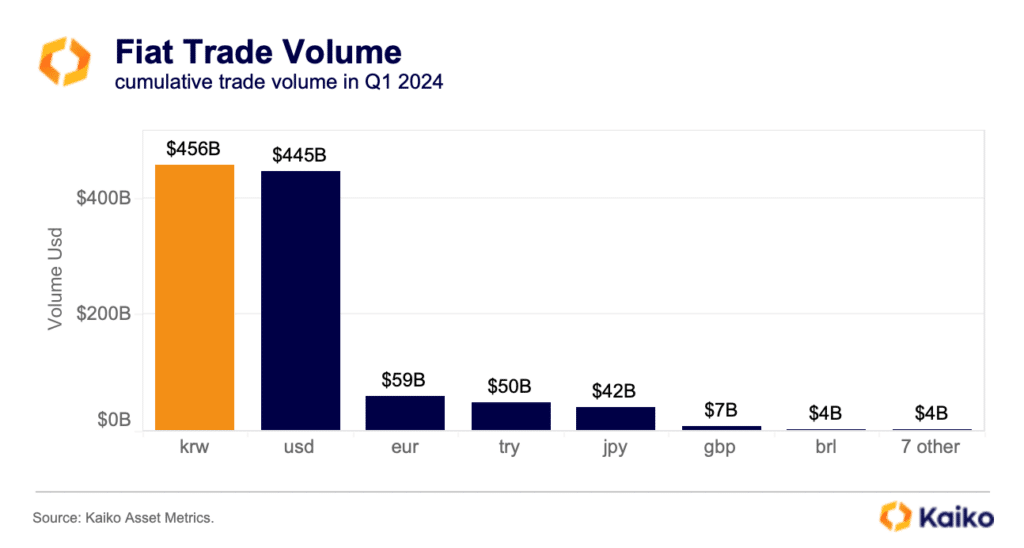

During the first quarter of 2024, the cryptocurrency markets in South Korea experienced their greatest trading activity in more than two years. The Korean Won (KRW) surpassed the US Dollar (USD) as the currency with the highest cumulative trade volume, according to Kaiko’s data.

In the beginning of March, trading activity in South Korean cryptocurrency markets reached a peak not seen since late 2019, fueled by a more favorable economic situation and intensified competition amongst domestic exchanges, as indicated by data from the blockchain analysis company, Kaiko.

Although Upbit has held a strong position in the South Korean cryptocurrency market for the past three years, accounting for an average market share of 82%, new developments seem to be introducing more competition. Toward the end of 2023, Bithumb and Korbit initiated zero-fee campaigns.

In contrast to Korbit’s market share, which remained stagnant at roughly 1% in 2024, Bithumb underwent remarkable expansion. Following the introduction of its zero-fee policy in October 2023, Bithumb witnessed a threefold increase in market share. However, Kaiko’s analysts pointed out that despite this surge in trading volume, Bithumb suffered a steep revenue loss of approximately 60% in 2023, compelling the exchange to abandon its zero-fee strategy.

A notable drop in income might have led the exchange to end their zero-fee promotion on February 5th, only five months following its start.

Kaiko

In the beginning of April, Kaiko reports a small drop in KRW trading volumes. However, the market mood in the Asia-Pacific area might improve due to the recent green light given for Bitcoin and Ethereum spot ETFs in Hong Kong.

According to crypto.news’ previous article, HashKey and Bosera International have received conditional approval from Hong Kong’s Securities and Futures Commission for two Bitcoin ETFs. This development is significant for Asian investors, as it could lead to the listing of these ETFs on the Hong Kong Stock Exchange within approximately two weeks.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cookie Run Kingdom Town Square Vault password

- Overwatch Stadium Tier List: All Heroes Ranked

- Seven Deadly Sins Idle tier list and a reroll guide

2024-04-16 15:10