According to Glassnode’s analysis, the growing popularity of staking platforms could influence Ethereum‘s function as a monetary asset in the future.

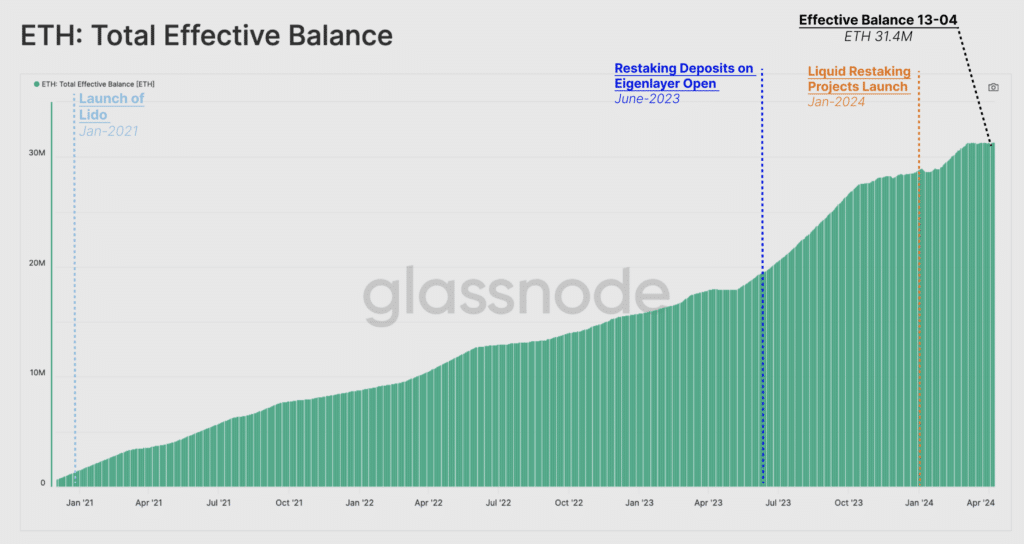

As of April 13, the introduction of EigenLayer and LRT staking mechanisms boosted Ethereum’s portion of staked coins to approximately a quarter of the total supply, amounting to around 31.4 million ETH. Analysts noted a significant uptick in the overall volume of coins being staked.

Despite the fact that fewer Ethereum (ETH) tokens mean smaller rewards for non-validators, a substantial number of locked assets could still result in increased overall reward payouts and contribute to inflation, according to Glassnode’s analysis.

Following the merger event, approximately 1.01% of new coins became part of Ethereum’s overall supply. At the same time, around 3.55% of existing ETH coins were taken out of circulation.

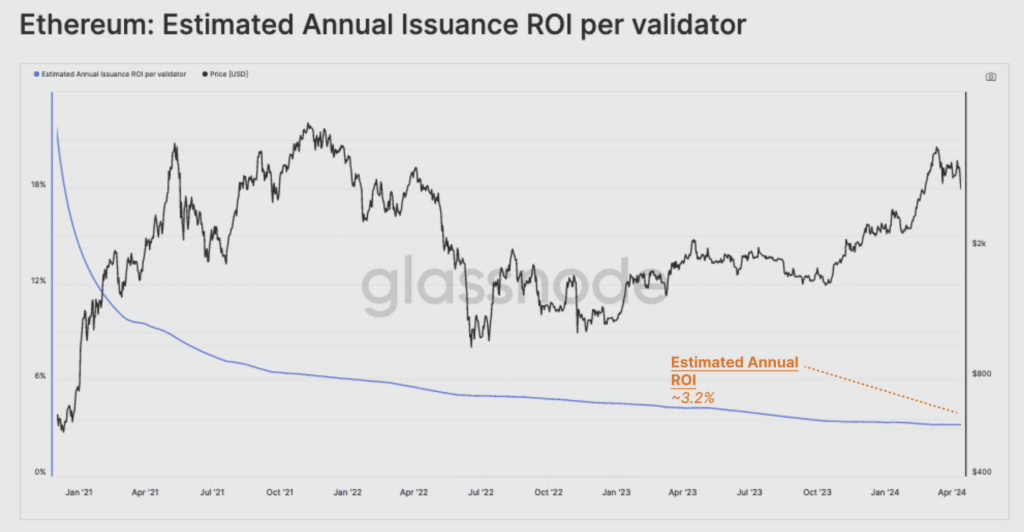

Due to the metric rise, each validator now earns only 3.2% annually as compensation for maintaining network security.

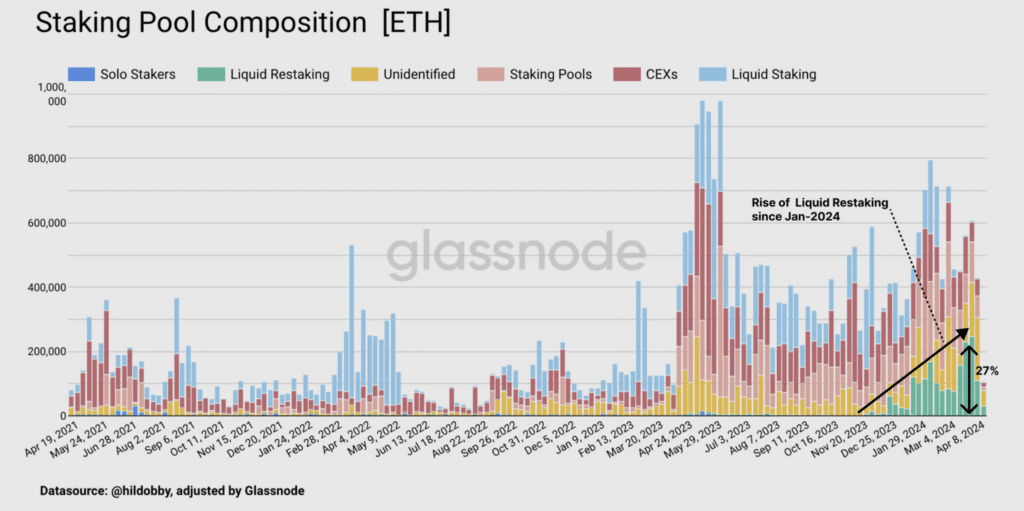

Experts note that apart from the initial plan, advancements such as MEV, liquid staking, and their related counterparts have resulted in heightened demand for staking. In fact, approximately a quarter (27%) of the coins transferred to the deposit contract are utilized by these liquid restaking protocols.

With an increase in ETH being staked, the impact of inflation becomes less felt among an increasingly smaller group of asset owners. Essentially, as more individuals join in securing the network, the rewards shift towards them, creating a wealth redistribution mechanism.

Over the long term, the true return on investment from Ethereum’s real yield component might diminish its appeal for ownership and undermine Ethereum’s role as a valuable currency within the Ethereum network.

Users can now stake their assets repeatedly on the primary blockchain and extra protocols through the process called “restating”. The restaking field has experienced significant expansion since the start of the year.

In early April, the aggregated value secured in staking platforms surpassed $8 billion. Ether.fi led the way with a stake value of approximately $3.2 billion.

Read More

Sorry. No data so far.

2024-04-16 20:58