The five-day streak of investors withdrawing their funds from Grayscale’s Bitcoin ETF preceded the Bitcoin halving event. This routine adjustment in the Bitcoin code, happening approximately every four years, is designed to preserve the digital currency’s scarcity.

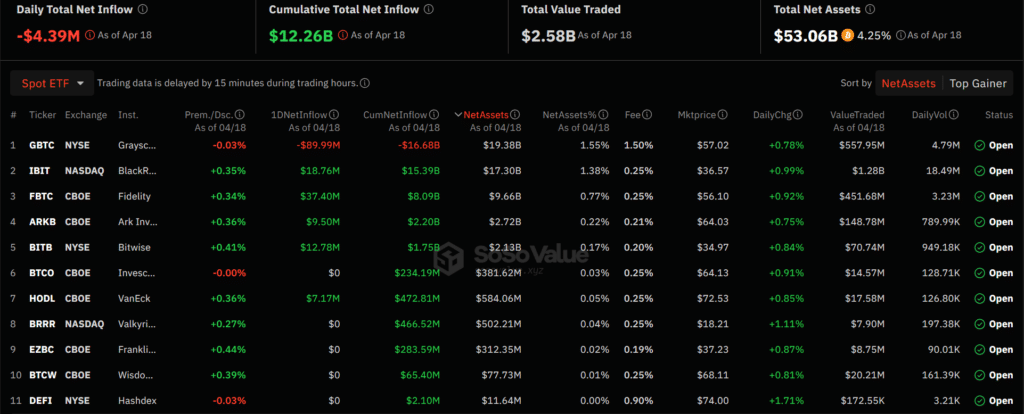

According to SoSoValue’s data collection, there were withdrawals amounting to $89.9 million from Grayscale, adding up to a total of $1.6 billion in net sell-offs for GBTC since its launch in January.

The total redemptions for all ten Bitcoin (BTC) ETFs amounted to $4.3 million. This was partly offset by increased demand from Fidelity and BlackRock, which had net inflows of $37.3 million and $18.7 million respectively. In other words, while these two firms saw investors adding a combined total of approximately $56 million to their Bitcoin ETF products, a net outflow of $4.3 million was recorded across all ten ETFs due to other redemptions.

On April 18, it was an uncommon event that a rival surpassed BlackRock in terms of Bitcoin ETF investments in the market.

Grayscale AUM down 50% in four months

At its inception, GBTC was the largest Bitcoin spot ETF on the market thanks to its decade-long lead time. However, this advantage has been significantly eroded as upstarts like BlackRock have made substantial gains in market share.

According to crypto.news, the value of Grayscale’s Bitcoin Trust (GBTC) assets under management has dropped approximately 50% within a four-month period. At that time, GBTC had managed just under $20 billion in assets, whereas BlackRock boasted over $17 billion in investor interest.

Experts, including Eric Balchunas from Bloomberg, explain that the mass withdrawals from the Grayscale Bitcoin Trust (GBTC) are due to ongoing bankruptcy cases such as FTX and Genesis. Additionally, some analysts point to Grayscale’s high management fee of 1.5% as another reason for investors choosing to liquidate their holdings.

In reaction, Michael Sonnengshein, Grayscale’s CEO, announced intentions to gradually reduce GBTC fees. Additionally, they suggested launching a Bitcoin Mini Trust ETF to offer reduced costs and reclaim interest from the market.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2024-04-19 20:08