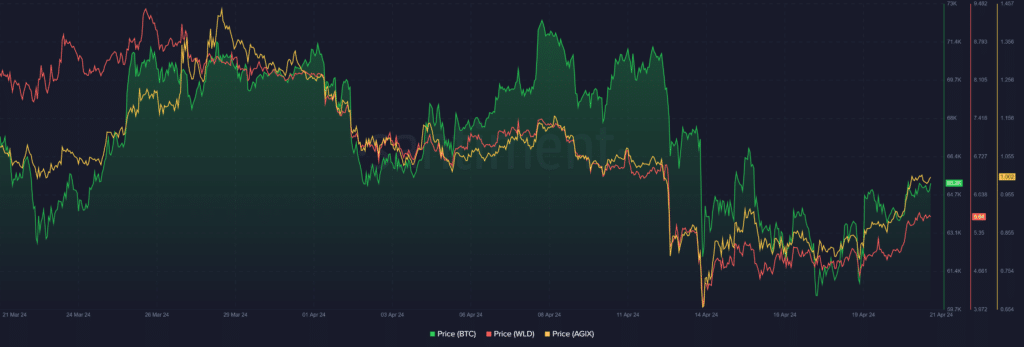

Bitcoin (BTC) experienced some minor setbacks in its value, but managed to regain some ground towards the end of a week marked by downward trends. In contrast, coins with a focus on artificial intelligence like Worldcoin (WLD) and SingularityNET (AGIX) experienced modest increases in value.

While Bitcoin saw a decrease of around 1.26% this past week, the total value of all cryptocurrencies combined grew by approximately the same percentage, resulting in an addition of over $30 billion and bringing the market capitalization up to roughly $2.4 trillion as of the most recent assessment.

The surge was mainly driven by outstanding showings from well-known alternative cryptocurrencies during the final market upswing.

This is how most of the mainstream cryptocurrencies performed this week:

Bitcoin retests $59k

This week, Bitcoin continued the downward trend from last week, resulting in a loss of more than 5% in value over the past seven days.

If the first cryptocurrency started the week with a value above $65,000, it experienced significant drops and ended up closing below its 50-day moving average on April 16.

For the first time since January, Bitcoin ended a trading day with a price lower than its 50-day moving average, indicating that investors’ attitudes have moved from optimistic to pessimistic.

During the market downturn, Bitcoin touched the $59,000 mark again on April 17 for the first time since March 4. However, it ended the day with a 4% decrease, even though it regained the $60,000 level beforehand.

It’s worth noting that Bitcoin experienced a 3.65% price increase on April 18 after hitting the $59,000 mark, which acted as a catalyst for its rebound.

Despite the return of bearish forces, Bitcoin’s recent surge in growth remained strong. This upward trend continued uninterrupted until the halving event on April 20.

Bitcoins price peaked at an astounding $65,450 shortly following the halving event, yet it continued to be sold at a deficit on a weekly basis. The upward trajectory has since slowed down as of now, with Bitcoin being bought and sold for $64,962 at this moment.

Although it’s only a small 1.19% decrease from its initial price this week, Bitcoin currently has a higher value than its 50-day moving average, which is $64,577.

AGIX breaches 3-week symmetrical triangle

Last week, SingularityNET experienced significant losses and fell beneath its 50-day moving average on April 12, reaching a six-week low of $0.6070 the next day. The downtrend continued into this week despite a slight recovery, resulting in a 5.41% decrease in AGIX‘s value on April 15.

For the past three weeks, AGIX‘s chart showed a symmetrical triangle pattern where bears were attempting to prevent price increases and bulls were utilizing the lower trendline as a base. The AI-centric token continued its downward trend until it reached the support level of $0.7666 on April 18.

After the retest, AGIX bounced back alongside the broader market in late March. However, its robust upward trend wasn’t noticeable until April 20, when it experienced a sharp increase of 15.40%. This surge allowed AGIX to break above the upper boundary of the symmetrical triangle. Simultaneously, it surpassed the 50-day moving average.

Although there was a slight drop in price today, AGIX continues to trend upward. The 0.382 Fibonacci retracement level, which is at $0.9291, has acted as a support for any potential declines, preventing the token from moving back into its symmetrical triangle. In order to surpass the $1 mark and solidify its position above it, AGIX must overcome the resistance at Fib. 0.5, which is located at $1.030.

WLD faces stern resistance at $6.09

Worldcoin, another AI-focused token, made some notable moves this week. Interestingly, despite starting the week with a 6.88% drop on April 15, Worldcoin remained in a consolidation phase, as it immediately recouped most of these losses in a 6.16% rebound the next day.

From the 19th of April, there was an intense struggle between the bulls and the bears over Worldcoin’s price. Just before the weekend, there was a significant surge of 14.19% in a single day on April 20, boosted by optimistic feelings towards Bitcoin’s halving event. The market saw a new high for Worldcoin at $5.66 on that Saturday, but its progress was halted afterwards.

According to IntoTheBlock’s (ITB) analysis of on-chain data, the token WLD may find it challenging to surpass the $6 psychological mark again, which it lost about two weeks ago during its 14.12% decline on April 12. In order for WLD to regain this level, it must first overcome a significant resistance point, where approximately 448 investors bought around 268,340 tokens at an average price of $6.09 each.

Although Worldcoin has gained 7% in value over the past week, there’s still a pessimistic outlook among investors regarding its short-term prospects. However, an indicator called the relative strength index (RSI), which is at 42 for Worldcoin at present, indicates that this cryptocurrency may have further potential for growth.

At its last check, WLD is currently valued at $5.5. In order for its price to rise above $6, it requires support from the overall market.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Grimguard Tactics tier list – Ranking the main classes

- Maiden Academy tier list

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Fortress Saga tier list – Ranking every hero

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- Hero Tale best builds – One for melee, one for ranged characters

- DOGE PREDICTION. DOGE cryptocurrency

- The Entire Hazbin Hotel Season 2 Leaks Explained

2024-04-22 00:10