Following a Bitcoin halving, American cryptocurrency stocks experienced a 20% rise. This growth was driven in large part by an overall uptrend in the financial market.

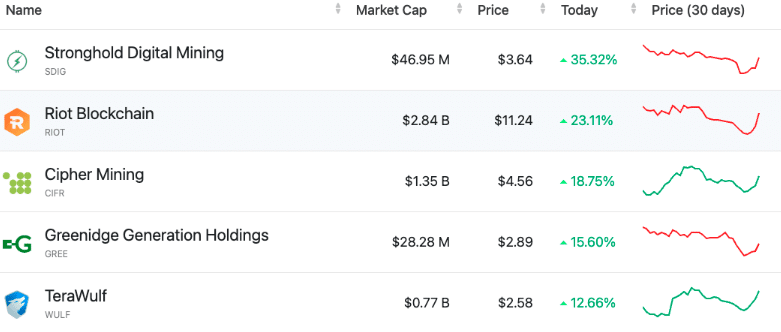

On April 22, Marathon Digital (MARA), CleanSpark (CLSK), Riot Platforms (RIOT), Cipher Mining (CIFR), and Hut 8 (HUT) were the leading stocks with each experiencing over 20% growth. However, SDIG (Stronghold) outperformed the others with a remarkable 35.3% surge, and Riot followed closely behind, rising by approximately 23%.

The Valkyrie Bitcoin Mining ETF, represented by the ticker symbol WGMI, saw a notable increase of 11%, encompassing both Bitcoin mining companies and chipmakers like Nvidia (NVDA). Contrary to earlier assumptions, the revenue from Bitcoin mining proved to be more substantial than anticipated due to the recent reduction in mining rewards, now set at 3.125 BTC per block.

Investment analysts explain that the Nasdaq Composite and S&P 500 grew by 1.1% and 0.8%, respectively, due to the de-escalation of tensions in the Middle East and upcoming earnings reports from tech companies. However, these short-term gains come with potential long-term risks. Uncertainties surrounding inflation rates, rising bond yields, and the possibility of Federal Reserve interest rate adjustments loom large.

As a result, the cost of a Bitcoin unit increased by 4.2%, reaching an all-time high of $66,620 post the halving. It’s worth mentioning that Coinbase and MicroStrategy experienced favorable trends, while the crypto market saw bullish momentum from enthusiastic investors.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-04-23 07:16