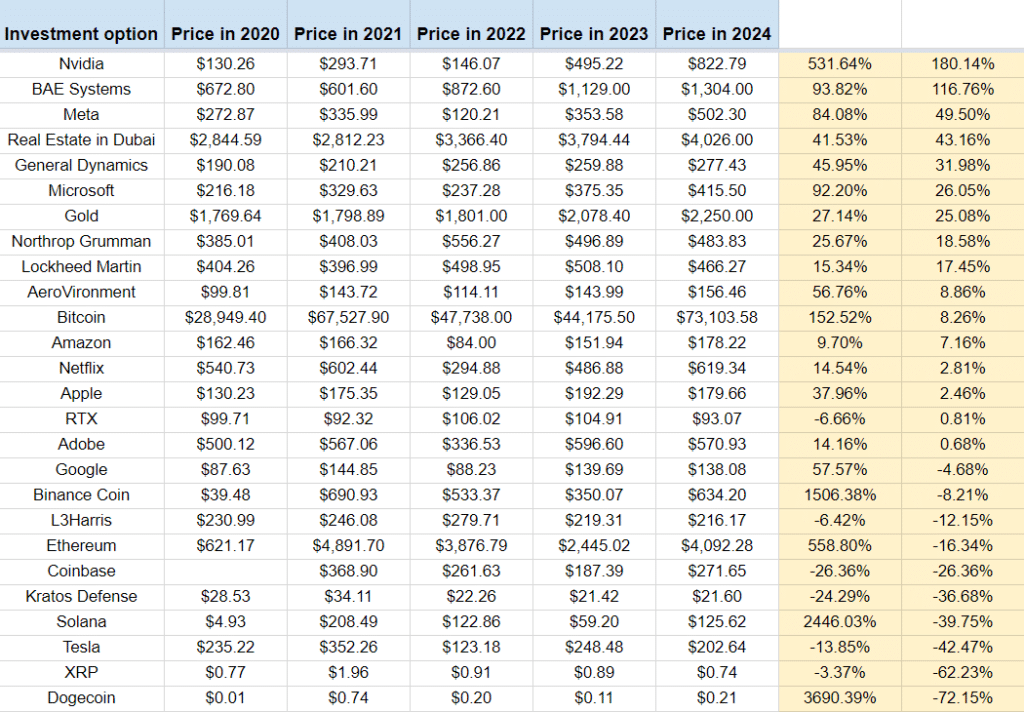

Recent studies show that Nvidia’s stock price experienced an impressive 180% rise during the post-COVID era, followed by notable gains for BAE Systems and Meta with increases of around 100% and 25% respectively. Meanwhile, Bitcoin recorded a more modest 8.26% growth in value during this same timeframe.

A study conducted by Banking Methods recently revealed insights into the behaviors of stocks and cryptocurrencies, particularly Bitcoin’s trends.

Based on the study’s results, Nvidia stood out as the top performer among investments, experiencing a remarkable 180% growth in worth during the post-COVID era. The value of Nvidia’s shares soared from $293 in 2021 to an astonishing $822 in 2024, highlighting its allure for investors even amidst unpredictable market trends.

Behind defense and security firm BAE Systems, which saw a significant jump of 116.76% in its stock price, came in second place. In the meantime, Meta, previously known as Facebook, claimed the third position with a 49.50% increase in stock value.

Microsoft, Gold, Northrop Grumman, Lockheed Martin, and AeroVironment are also included in the list, but their returns don’t shine as brightly as the top three stocks. Bitcoin’s growth in the post-COVID period was more subdued, with a 8.26% increase in value. Despite outperforming several other cryptocurrencies like Binance Coin (BNB), Solana (SOL), and Ethereum (ETH), Bitcoin ranked 11th and didn’t make it to the coveted top 10.

Nvidia has been an outstanding company recently, but according to Google Finance, its stock price has seen a decline. In just the past month, the price dropped by around 16%, from $950 to $795. This significant decrease calls into question whether Nvidia’s growth trend will continue in the future.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-04-23 10:41