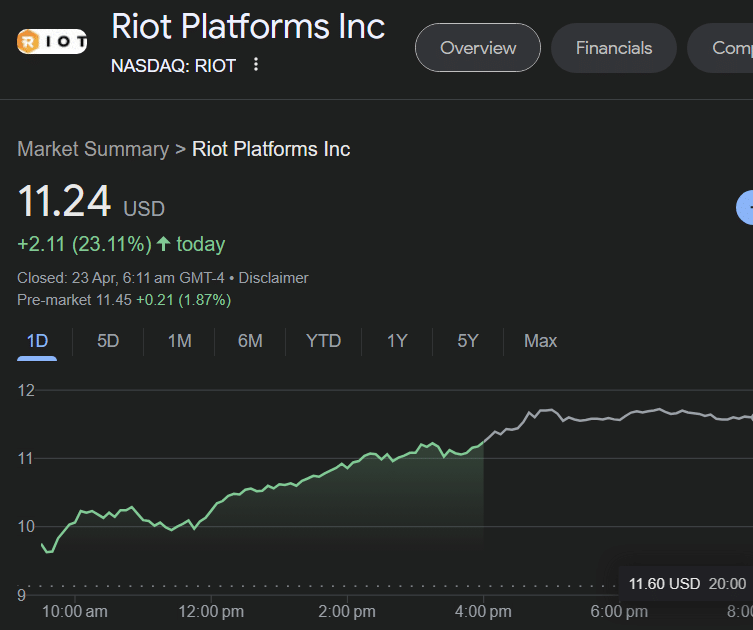

Riot’s shares experienced a significant increase of over 20%, ignited by positive forecasts from analysts anticipating considerable improvement in the company’s fiscal results.

There’s been a lot of excitement among investors about Riot’s financial results, following some optimistic analyst forecasts. This enthusiasm was clear in the market, where Riot Platform’s stock (RIOT) on Nasdaq jumped 23% to reach $11.24 by April 23, based on Google Finance data.

On April 22nd, analyst Mike Colonnese from H.C. Wainwright maintained a Buy recommendation for Riot Platforms, predicting a price of $20.00. He highlighted the company’s promising growth trend and robust financial health as his reasons for remaining bullish.

Colonnese brought attention to Riot’s ambitious goals to boost its hash rate from 12.4 EH/s to 31.5 EH/s by the end of 2024 and further up to 41 EH/s by the end of 2025. This expansion plan is reinforced by the initiation of the first 400 MW power substation at Riot’s new data center in Texas.

In addition, the company’s financial strength is highlighted by its more than $1.2 billion in liquid assets, enabling it to effectively pursue growth opportunities in the future.

Colonnese pointed out that Riot’s affordable production method at present and the poor performance of its stock so far this year presented an appealing investment prospect for him. Moreover, he highlighted the advantage of MicroBT’s manufacturing presence in Pennsylvania, which leads to shorter delivery times for essential mining rigs, thereby supporting Riot’s short-term growth plans.

Despite Colonnesse admitting previous delays in implementation of Riot’s growth strategies, he continues to trust the team’s abilities to successfully carry out their expansion plans.

On the same day, independently, Roth MKM analyst Darren Aftahi voiced an optimistic viewpoint towards Riot Platforms after attending their Analyst Day in New York.

After his analysis, Aftahi kept a Buy recommendation for the stock, setting a goal price of $25.50. He believed that the company would reach an EBITDA of $54.7 million with sales of $391.5 million during fiscal year 2024. His projection indicated even better results in fiscal year 2025, anticipating a higher EBITDA of $144.5 million on increased revenue of $516.4 million.

The analyst’s confidence stems from Riot’s robust financial foundation, evident in its over $1.3 billion cash and Bitcoin reserves as of late March.

After the reduction in reward, it’s our opinion that RIOT is among a handful of mining companies with the potential for a substantially increased hash rate within the next 6-12 month timeframe.

According to the analyst’s assessment, the initial activation of Corsicana’s first facility is an essential element that could significantly boost Riot’s hash rate in the short term. This increase in hash rate would likely result in a rise in Riot’s stock value as well.

Read More

- Cookie Run Kingdom Town Square Vault password

- Maiden Academy tier list

- Wizardry Variants Daphne tier list and a reroll guide

- Girls Frontline 2 Exilium tier list

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Chhaava OTT release: Where is Vicky Kaushal and Rashmika Mandanna’s film expected to stream after theatrical run? Find out

- ‘Bachelor’ Co-Executive Producers Exit Franchise

- Tap Force tier list of all characters that you can pick

- 10 Hardest Bosses In The First Berserker: Khazan

- Grimguard Tactics tier list – Ranking the main classes

2024-04-23 13:34