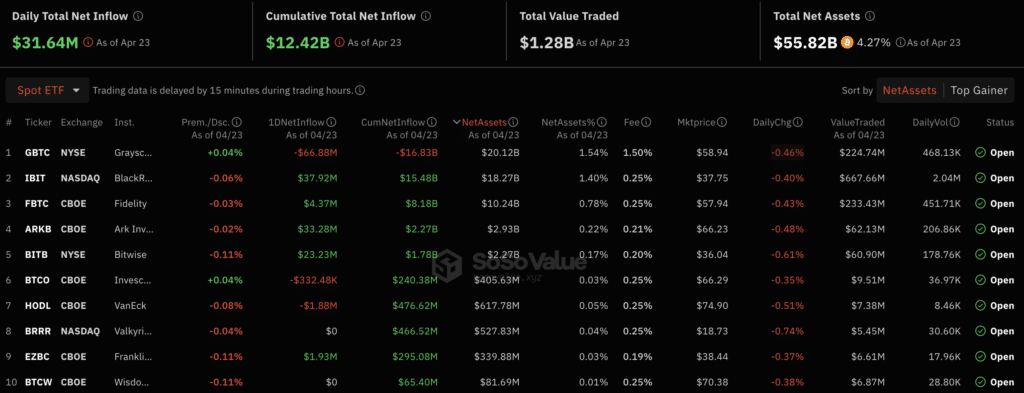

On April 23, net daily capital inflows into spot Bitcoin ETFs totaled $31.64 million.

Based on SoSo Value’s report, although there was a drop from $62 million to $31 million in asset inflows between April 22 and 23, there has been a persistent uptrend in trading activity for the past three days.

During this period, Bitcoin funds received $153.29 million from inflows.

The day before, the BlackRock iShares Bitcoin Trust (IBIT) crypto fund recorded the largest capital inflow. It gained $37.92 million, increasing its assets under management to an impressive $15.48 billion.

With a total of $33.28 million, ARK Invest and 21 Shares come in second place; Bitwise’s fund follows closely behind with $23.23 million. The remaining Bitcoin ETFs collectively earned $6.3 million.

On the other hand, VanEck’s HODL fund and Invesco’s, as well as Galaxy Digital’s BTCO, each reported outflows totaling $1.88 million and $332,480 respectively.

The IBIT Bitcoin ETF has seen continuous investment for 70 straight days. As a result, it ranks among the top 10 performing exchange-traded funds based on capital inflows.

The current streak of increasing inflows for $IBIT has lasted for 69 days. With just one more day, it will join the Top 10 longest streaks and match that of $JETS. It’s intriguing to note this; although it might be amusing if the streak for both ended today, implying a change in financial fortunes as per @thetrinianalyst.

— Eric Balchunas (@EricBalchunas) April 22, 2024

IBIT manages a total of $18.18 billion in assets. BlackRock has brought on board several new approved partners for its Bitcoin ETF. This expansion enables investors to purchase and redeem shares using regular currency.

Simultaneously, on April 15, Hong Kong gave the green light for the trading of spot Exchange-Traded Funds (ETFs) based on Bitcoin and Ethereum. The HashKey Capital and Bosera Capital funds are set to start operations in Hong Kong from April 30.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-04-24 18:28