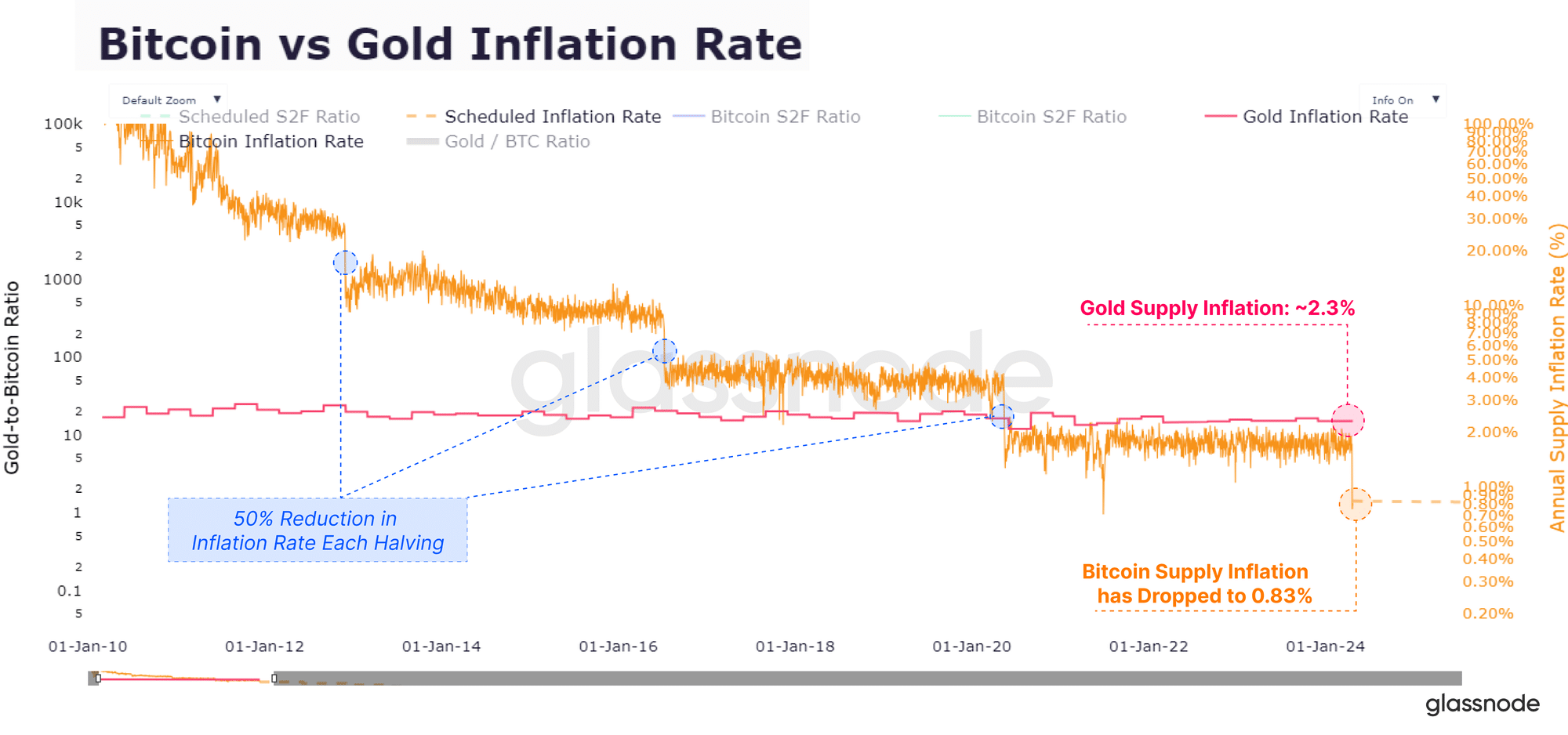

The upcoming Bitcoin halving, which happens for the fourth time, is generating much interest due to its similarities to gold in terms of scarcity, according to insights from Glassnode analysts.

Based on Glassnode’s analysis, an important milestone was reached when the production of new bitcoins (BTC) became less frequent than the mining of new gold, highlighting a significant change in the comparison between these assets.

According to reports, the halving that occurred on Saturday resulted in a decrease in block rewards. The reward for each block went from 6.25 Bitcoins to 3.125 Bitcoins. This equates to around 450 Bitcoins being issued daily. The halving event thus significantly influenced Bitcoin’s supply flow.

Yassine Elmandjra of ARK Investment Management made a comparable statement, explaining that the production rate of new Bitcoins following its halving is currently less than the historical expansion of gold’s supply.

Elmandjra’s point in the ARK Disrupt newsletter, explained simply, is that after the Bitcoin halving, there was a notable decrease in its supply growth. This observation makes Bitcoin more comparable to gold due to their limited supplies. Glassnode analysts also confirmed this trend in Bitcoin’s supply growth reduction.

The impact of Bitcoin’s halving events on its available supply for trading might lessen over time as the cryptocurrency grows larger and its ecosystem becomes more complex.

These assessments offer valuable perspectives on the changing relationship between Bitcoin and gold, revealing how Bitcoin’s scarcity is becoming more apparent in comparison to the established precious metal.

Today, Bitcoin’s price is down 2.5% and just plunged below $65,000 at the time of writing.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-04-24 18:41