As a researcher with a background in the cryptocurrency and Bitcoin mining industry, I find Marathon Digital’s recent announcement of increasing its hash rate target to 50 EH/s by 2024 to be an exciting development. Marathon’s CEO, Fred Thiel, mentioned that the company could potentially double its mining scale in 2024 due to the added capacity from recent acquisitions.

Marathon Digital has raised its projected hash rate capacity for the year 2024 from 35-37 exahashes per second (EH/s) to 50 EH/s due to recent acquisitions that have increased its mining capabilities.

According to a press release on April 25, Marathon’s CEO, Fred Thiel, mentioned that the company might be able to expand its mining operations significantly in 2024 due to the newfound capacity.

Thiel additionally verified that the new objective is sufficiently financed, requiring no further fundraising.

In our announcement today, we revealed that we have raised our hash rate objective for the fiscal year 2024 from an estimated 35-37 Exahashes per second (EH/s) to a new goal of 50 EH/s. For more details, please refer to our comprehensive press release.

— MARA (@MarathonDH) April 25, 2024

In March, the company purchased a Bitcoin mining facility with a capacity of 200 megawatts from Digital Applied for $87.3 million. Additionally, two other sites with a total capacity of 390 megawatts were acquired from Generate Capital for $179 million in December.

Marathon currently outperforms Core Scientific and Riot Platforms in cryptocurrency mining hash rate, with a rate of 24.7 exahashes per second (EH/s), compared to their respective rates of 16.9 EH/s for Core Scientific and 12.4 EH/s for Riot Platforms, according to Hashrate Index data.

As a hash rate analyst, I can tell you that surpassing the 50 Exahash per second (EH/s) mark in Marathon’s mining operations in 2024 would represent a more than doubling of our hash rate from the year’s start.

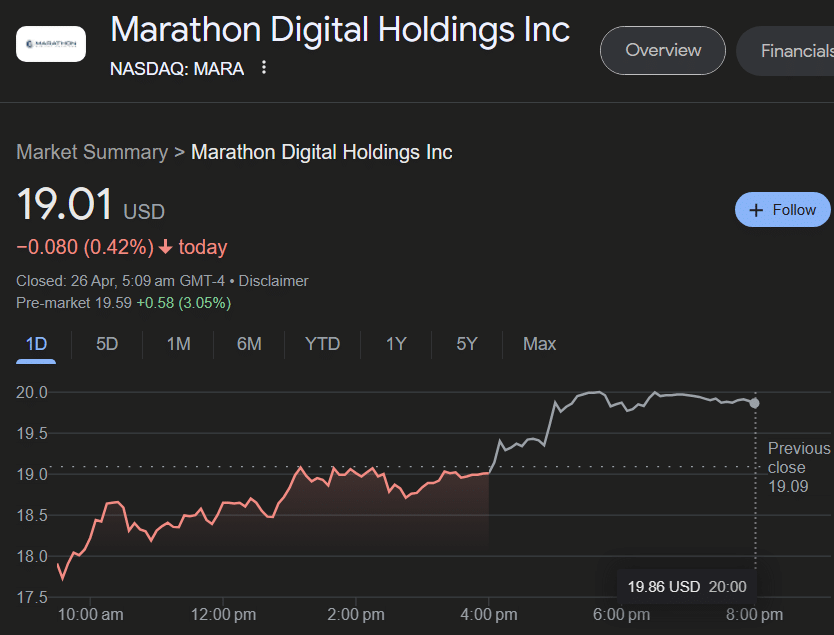

I observed a decrease of 0.42% in Marathon’s (MARA) stock price to $19.01 on April 25, based on data from Google Finance. However, this downward trend was reversed in after-hours trading following the announcement, resulting in a notable rise of 3.05%.

Since the Bitcoin halving occurred around block 840,000 on April 20, which is the fourth such event in Bitcoin’s history, Marathon’s mining operations have experienced an increase of over 15%. This upward trend is also reflected among other miners within the industry.

As a researcher studying the dynamics of the cryptocurrency market, I’ve discovered that a significant portion of the demand at block 840,000 can be attributed to enthusiasts of memecoins and non-fungible tokens (NFTs). These individuals were eager to make their mark by inscribing and etching “rare satoshis” using the Runes protocol.

Despite this surge, transaction fees dropped to $28.20 by April 24, according to YCharts.

As a researcher observing the crypto mining industry, I’ve noticed a surge in growth within this sector. Companies such as Riot Platforms are experiencing notable market fluctuations as well.

On April 23rd, Riot’s stock price experienced a significant increase of over 20%. This surge was driven by positive assessments from financial analysts who anticipate substantial improvements in the company’s fiscal results.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- Overwatch Stadium Tier List: All Heroes Ranked

- Outerplane tier list and reroll guide

2024-04-26 12:40