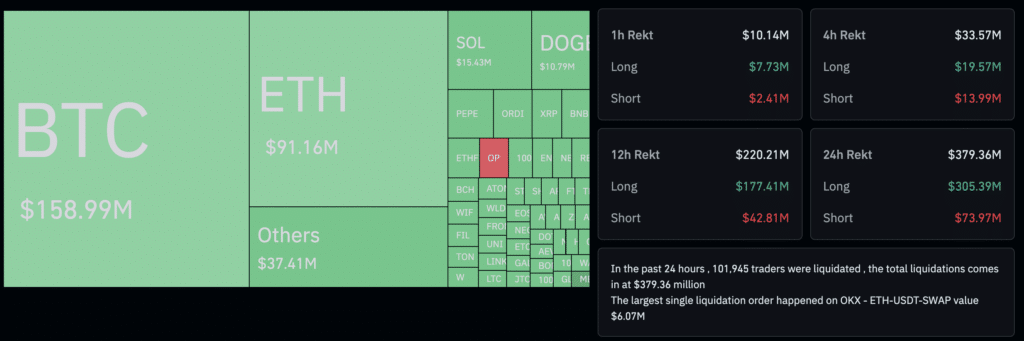

As an experienced analyst, I believe that the recent decline in Bitcoin’s price below $60,000 and the increase in liquidations on futures contracts are closely related to the news of Binance Founder Changpeng Zhao being sentenced to four months in prison. The market has been showing high volatility, with a significant increase in volume of liquidations, reaching almost $380 million per day.

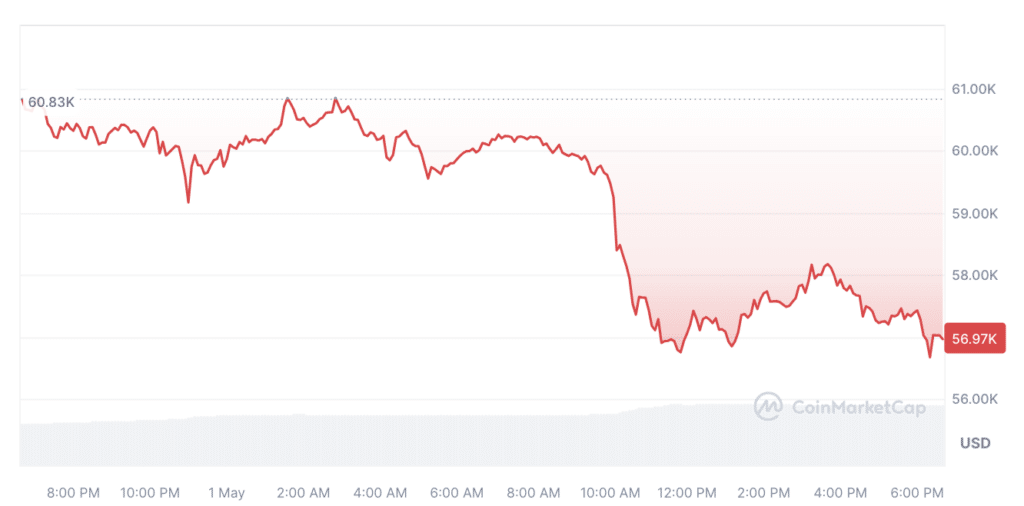

The price of Bitcoin dipped beneath $60,000 not long after the court’s decision on Binance Founder Changpeng Zhao was made public.

According to CoinMarketCap data, Bitcoin (BTC) is trading at $56,900 at the time of writing.

Amidst high volatility in the crypto market, there has been a significant surge in the daily liquidation volume for futures contracts. This amounted to approximately $380 million, as reported by Coinglass.

After the sentence of four-month imprisonment against Changpeng Zhao, the ex-CEO of Binance crypto exchange, the cryptocurrency market started to experience a downturn.

As a researcher reporting for crypto.news, I’d like to share that according to Alex Kuptsikevich, FxPro’s senior market analyst, the closing price on April 30 marked a new low since late February. This development underscores the prevailing downward trend in the market and signals a break below key support levels including March, April, and the psychologically significant round figure.

Kuptsikevich added that he does not expect Bitcoin to recover from its fall anytime soon.

As a researcher studying the trend of Bitcoin’s monthly performance over the past decade and a half, I have observed that out of the total 13 years in question, Bitcoin ended up with a positive return for the month seven times. The average percentage increase during these upward months was approximately 31.3%. Conversely, Bitcoin experienced a negative monthly return six times, with an average decline of about 14.5%. Additionally, I have discovered that over the last three years, May has been a particularly challenging month for Bitcoin investors, with an average decline of around 20%.

Alex Kuptsikevich, the FxPro senior market analyst

Arthur Firstov, Mercuryo’s Chief Business Officer, points out that Bitcoin’s classification as a risk asset came into focus during a turbulent day marked by a substantial decline in the cryptocurrency market.

From my perspective as a researcher, the recent significant price drops in prominent digital currencies like Ethereum and Solana serve as noteworthy indicators. These trends could foreshadow potential shifts in conventional markets in the lead-up to today’s policy decision by the Federal Reserve. Intriguingly, Bitcoin’s every fluctuation now garners close attention from traditional finance institutions.

Arthur Firstov, Chief Business Officer at Mercuryo

Zhao received a prison term of four months. During the trial, his lawyers highlighted his assistance to investigators and U.S. officials. Additionally, they stressed that Zhao no longer plays a role in overseeing Binance’s operations.

Upon hearing the verdict, I observed a significant drop in Bitcoin’s value, and almost the entire cryptocurrency market shifted into the negative territory.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-05-01 19:36