As a researcher with a background in finance and experience in following the cryptocurrency market, I find the recent price surge in Bitcoin (BTC) intriguing. The U.S. labor market report has once again proven to be a significant catalyst for Bitcoin’s growth. Following the release of the report, expectations regarding the Federal Reserve’s key rate have been revised, causing an increase in risk appetite and a shift towards accumulation by large Bitcoin holders, or “whales.”

As an analyst, I would put it this way: The Bitcoin price has held steady above the $60,000 mark after today’s release of the U.S. labor market report.

After the release of the U.S. jobs report, there was a significant increase in the value of Bitcoin (BTC). This event led financial experts to adjust their predictions for the Federal Reserve’s interest rate cut from November to September.

The statistics’ unveiling caused Bitcoin to surge by over 4%, pushing its value closer to $62,000 as indicated by CoinMarketCap’s latest figures.

According to Ki Young Ju, the CEO of CryptoQuant, approximately 47,000 bitcoins were amassed by large-scale Bitcoin investors, or “whales,” in preparation for the release of the Federal Reserve’s report.

#Bitcoin whales accumulated 47K $BTC in the past 24 hours. We’re entering a new era. — Ki Young Ju (@ki_young_ju) May 3, 2024

As a researcher studying macroeconomic trends, I’ve noticed that recent data has led markets to reconsider their expectations for the Federal Reserve’s key interest rate in 2024. Instead of one anticipated cut of 0.25% at a later date, there is now a growing belief that there will be two cuts of this size. The first is expected to occur in September rather than November, following the release of certain statistics.

Investment analysts at Bloomberg have indicated that the upcoming report on consumer price trends, scheduled for release on May 15th, holds significant importance for investors.

As a researcher studying the labor market, I can report that it continues to show strength. However, I would need to observe more signs of a slowdown or an unexpected significant decrease in employment before becoming concerned about the Federal Open Market Committee (FOMC) altering its employment mandate following such robust job gains. Ultimately, the FOMC will likely maintain its current stance and wait for clearer indications regarding inflation before making any adjustments.

Ali Jaffery, CIBC Capital Markets expert

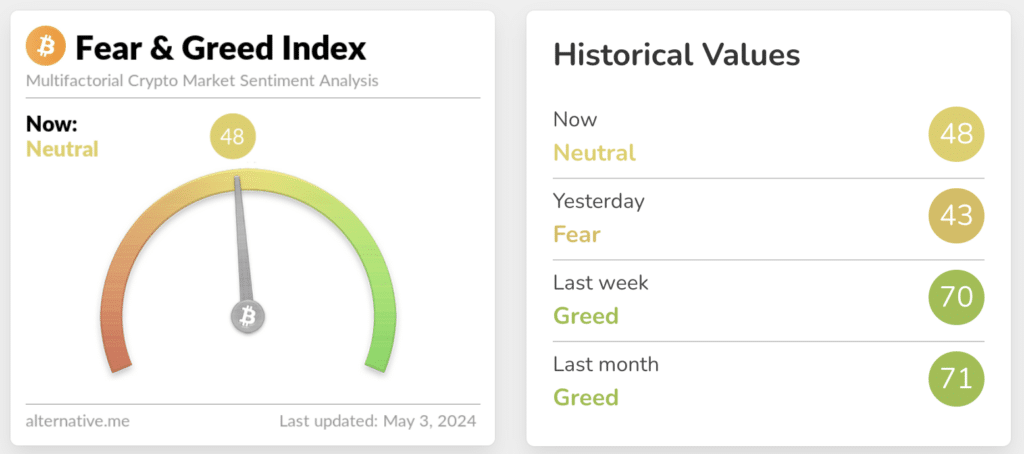

Following the unveiling of the latest U.S. employment data, investor confidence surged in international markets. The S&P 500 index started off with a gain of 1.2%, while the cryptocurrency fear and greed index advanced by five points, transitioning from the fear sector to the neutral sector.

Lately, Bitcoin’s price dipped beneath the $60,000 mark. Amid Bitcoin’s decline, Santiment analysts noted an increase in chatter surrounding the “#buythedip” hashtag and Bitcoin references due to recent data releases in the US.

As a financial analyst, I’ve noticed that Bitcoin took a dip to $60K for the first time since April 18th, sparking concerns due to renewed fears of inflation in the United States. The buzz around Bitcoin and buy-the-dip calls is intensifying, indicating a heightened sense of polarization among traders once more.

— Santiment (@santimentfeed) April 30, 2024

Based on the perspective of industry experts, this surge in sentiment suggests a deepening divide between traders. Some are bullish and see it as an opportunity to buy, while others exercise caution.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Overwatch Stadium Tier List: All Heroes Ranked

2024-05-03 21:18