As a researcher with a background in financial markets and cryptoasset analysis, I find the recent trend of Ethereum (ETH) surpassing Bitcoin (BTC) in liquidations an intriguing development. The data from Coinglass highlights that ETH has seen more significant long-position liquidations over the past 24 hours, which is a clear indication of increased market volatility and uncertainty for Ethereum holders.

Ethereum (ETH) liquidations surpass Bitcoin’s (BTC) for the second time over the past seven days.

Based on information from Coinglass, crypto market liquidations amounted to approximately $195.11 million during the last 24 hours. At present, Ethereum accounts for the largest portion of these liquidations, with a total of around $64.75 million. This includes $57.18 million worth of long positions and $7.57 million in short positions.

In the past 24 hours, Bitcoin experienced liquidations totaling approximately $46.74 million. Among these were $32.85 million worth of long positions and $13.89 million worth of short positions.

Based on the current data, it appears that the preponderance of long positions in the global cryptocurrency market is being liquidated as we experience a correction. The total market capitalization has decreased from $2.53 trillion to $2.46 trillion within the last day.

Over the past week, Ethereum’s liquidation events have outpaced Bitcoin’s not once, but twice. Specifically, on May 1st, Ethereum recorded a significant liquidation volume of $91.76 million compared to Bitcoin’s $68.51 million.

As a researcher investigating the current state of the cryptocurrency market, I’ve noticed that the overall open interest has decreased by 2.12% within the last 24 hours. At present, this figure stands at approximately $57.17 billion based on Coinglass data.

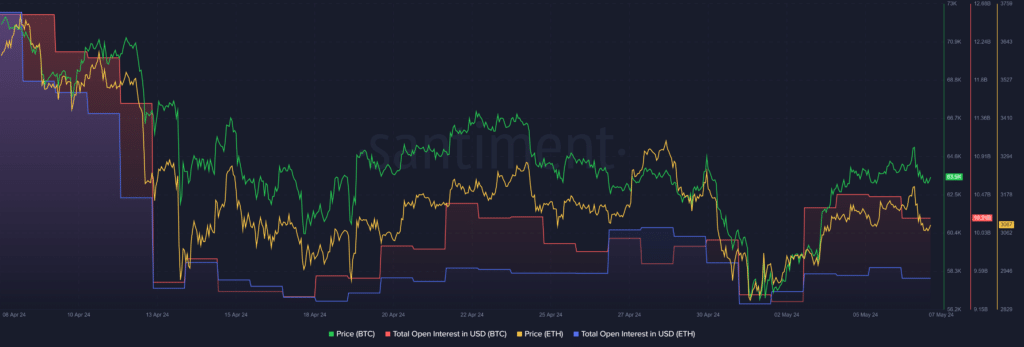

Based on Santiment’s figures, the total open interest for Bitcoin decreased from $10.45 billion to $10.21 billion within the last 24 hours. Simultaneously, the Bitcoin price experienced a decline of approximately 1.5% and is currently valued at $64,200.

As an analyst examining market intelligence data, I’ve observed a decrease of 1.7% in ETH open interest over the last day, which currently stands at approximately $4.89 billion. Simultaneously, Ethereum has experienced a 2.7% decline in value over the past 24 hours and is being traded at around $3,110 as of this analysis.

As a crypto investor, I would observe that with the decline in global cryptocurrency open interest, it’s natural to anticipate reduced price swings for the major digital assets.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Maiden Academy tier list

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- AOC 25G42E Gaming Monitor – Our Review

- Starseed Asnia Trigger tier list and a reroll guide

2024-05-07 13:58