As a researcher with a background in financial markets and experience following the crypto industry closely, I believe that Michael Sonnenshein’s resignation from Grayscale Investments is a significant development, particularly given the mass investor departures from its GBTC ETF. The influx of capital into spot Bitcoin ETFs last week, as well as the renewed interest in spot Ethereum ETFs, adds to the intrigue surrounding this dynamic sector.

Michael Sonnenshein, the CEO of Grayscale Investments, has stepped down from his position at the asset management company following a significant number of investors withdrawing their funds from its GBTC Exchange-Traded Fund (ETF).

On May 20th, according to the Wall Street Journal’s report, Sonnenshein will be stepping down as the company’s head in August, with Peter Mintzberg taking over the role instead. Mintzberg brings a wealth of experience to the table, having served as Goldman Sachs’ global head of strategy for their asset management operations for several decades.

Grayscale did not immediately respond to commentary requests from crypto.news.

As a researcher, I’ve recently noticed an intriguing turn of events regarding Grayscale’s converted GBTC fund. Following several weeks of outflows, last week marked the first instance of net inflows in approximately 19 trading weeks, totaling $31.6 million between May 13 and May 17, according to Fineqia International research analyst Matteo Greco’s disclosure to crypto.news.

As a researcher examining recent trends in Bitcoin investment vehicles, I’ve noticed that last week’s Grayscale Bitcoin Trust (GBTC) outflows amounted to relatively small figures compared to the substantial $17.6 billion in exits that have occurred since the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs in January.

At the moment of publication, it was uncertain what role the recent mass exit from Grayscale might have played in Sonnenshein’s resignation as CEO. However, earlier reports indicated that the investment firm had experienced a significant loss – approximately 50% – of its managed assets within just half a year following GBTC’s transition from a trust to an exchange-traded fund.

Spot Bitcoin ETFs scored $950 million in net inflows last week

Greco stated that GBTC wasn’t the sole US Bitcoin ETF to witness significant investor capital influx last week. In total, the 11 ETFs from Grayscale, BlackRock, Fidelity, ARK 21Shares, Bitwise, Invesco Galaxy, VanEck, Valkyrie, Franklin Templeton, WisdomTree, and Hashdex gathered approximately $950 million in weekly new investments, based on SoSoValue’s analytics.

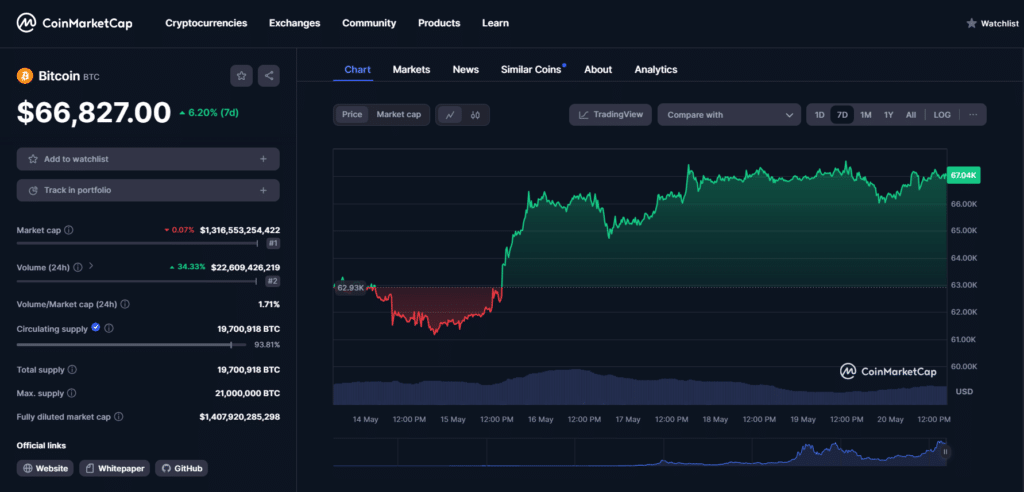

Last week, Greco observed that the revived enthusiasm caused Bitcoin’s value to rise by 7%, reaching approximately $66,300 as its largest digital currency closing price. This development came after a period of minimal daily price fluctuations and five consecutive weeks of moderate demand for the Bitcoin spot ETF.

Spot Ethereum ETF scenarios

Analysts at Fineqia International predict that increased inflows into Bitcoin ETFs and Bitcoin’s price rebound will draw investors’ focus towards Ethereum (ETH) ETFs as well.

The Securities and Exchange Commission (SEC) in the United States is anticipated to make its final rulings regarding filings submitted by VanEck and ARK 21Shares by May 23rd and May 24th respectively. However, according to Greco’s statement, there is a widespread belief among market participants that the SEC will not grant approval for these particular products, in contrast to their earlier decision to greenlight Bitcoin ETFs in January.

Worries about the liquidity of Ethereum’s current spot and futures markets, as well as its past designation as a security by the SEC, fuel doubts about rapid approval. In case of rejection, applicants would be required to resubmit their filings, which could result in approval as late as Q4 2024 or Q1 2025.

Matteo Greco, Fineqia International research analyst

Alternatively, while processing 19b-4 applications for proposed rule changes, the SEC might hold off on approving S-1 registration statements for companies seeking to sell securities to the public.

As a researcher studying the world of cryptocurrency and exchange-traded funds (ETFs), I can explain that for Ethereum spot ETFs to begin trading on U.S. national exchanges, both involved firms require approval from the Securities and Exchange Commission (SEC). This step offers the SEC an opportunity to delve deeper into the Ethereum market and potentially determine Ethereum’s classification as a security or not, using the extra time granted by this process.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-05-20 18:22