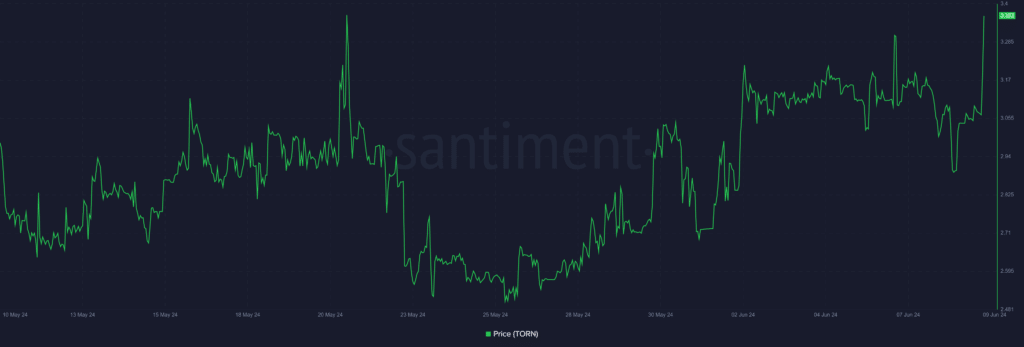

As a researcher with a background in crypto and defi, I find it intriguing to observe the recent price surge of TORN, despite the overall bearish market conditions. The 11.8% increase in the past 24 hours, pushing the token to trade at $3.36, is noteworthy. However, it’s important to remember that this price action still leaves TORN down by 99.23% from its all-time high of $437.41.

The price of Tornado.cash (TORN) and its decentralized finance (DeFi) total value locked (TVL) have experienced significant growth, contrasting the wider cryptocurrency market’s stagnation during bearish trends.

TORN is up by 11.8% in the past 24 hours and is trading at $3.36 at the time of writing.

The value of this asset has reached over $17 million in market capitalization, and it has a daily trading volume of approximately $51,000. At present, TORN occupies the position of being the 957th largest cryptocurrency.

Moreover, the asset briefly touched an intraday high of $3.39 earlier today, at around 08:40 UTC.

As a researcher looking into the price trends of TORN, I’ve noticed that despite the recent surge in prices, the token is still significantly undervalued compared to its previous peak. To be precise, TORN has lost an astounding 99.23% of its value since reaching an all-time high of $437.41 on February 13, 2021. It’s also important to mention that just five months ago, on January 10, the Tornado Cash token reached a new low of $1.31.

The price surge for TORN occurs despite a 0.5% drop in the total value of all cryptocurrencies within the last day, which now stands at approximately $2.67 trillion.

Based on Defi Llama’s figures, the TVL or Total Value Locked in Tornado Cash defi platform grew by 7% within the last 24 hours, amounting to $614.18 million – a figure not seen since May 5, 2022. Among the tokens, Wrapped Ethereum (WETH) holds the largest portion in this protocol.

Today, the privacy tool Tornado.cash on Ethereum’s decentralized finance (DeFi) platform recorded approximately $41.63 million in incoming transactions.

The demise of Tornado Cash began in August 2022, as the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on this platform due to suspected money laundering activities. Following this announcement, law enforcement authorities apprehended its founder, Alexey Pertsev, in the Netherlands a few days later.

On May 30th, Vitalik Buter, a co-founder of Ethereum, gave 30 Ether (ETH) to the Juicebox initiative titled “Free Alexey & Roman.” This action expressed his backing for the creators of Tornado Cash.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- CRK Boss Rush guide – Best cookies for each stage of the event

2024-06-09 22:04