As a researcher with a background in blockchain technology and crypto finance, I find the recent developments at Galaxy Digital highly intriguing. The news that Galaxy will become the largest validator in the Solana network is significant for several reasons.

Michael Novogratz’s digital banking institution, Galaxy Digital, is on track to assume the role of the largest validator within the Solana blockchain network.

As a crypto investor, I’m excited to share that Galaxy Digital, the globally recognized financial services company spearheaded by Bitcoin advocate Michael Novogratz, is poised to surpass Coinbase as the leading validator on the dynamic Solana network. This achievement represents a pivotal moment in the fierce competition among players in the realm of blockchain validation.

Galaxy is set to take over as the leading validator on Solana in approximately 16 hours, having recently staked around 3 million SOL. This surge is likely a result of the FTX estate sale. With their 25% fee on Miner Extractable Value (MEV), they are poised to generate at least 22 million dollars annually from this new position.— mert | helius | hSOL (@0xMert_) June 20, 2024

Mert Mumataz, Helius CEO, initially pointed out that Galaxy Digital is expected to become Solana’s largest validator, most likely as a result of the FTX estate sale. Reports indicated that between 25 and 30 million locked-in SOL coins were sold by the FTX estate at a price of $64 per coin.

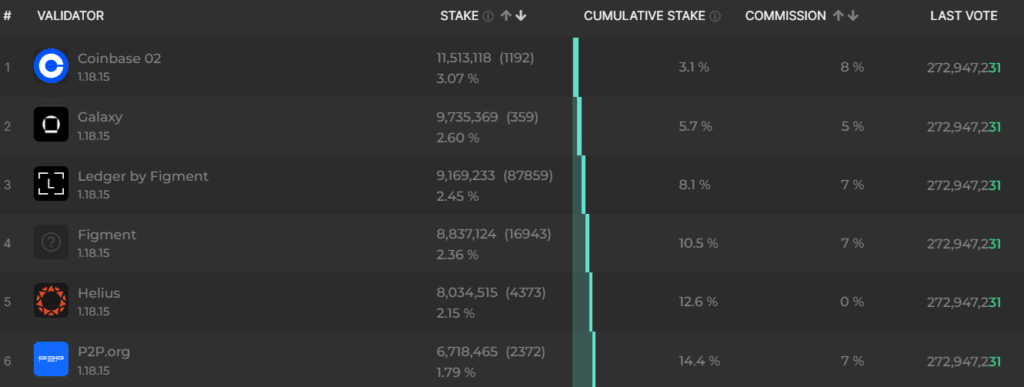

Based on information from Solana Beach, Galaxy Digital holds the second-largest position in terms of staked SOL tokens with approximately 9.7 million. According to Mumtaz’s prediction, Galaxy Digital is projected to surpass Coinbase by June 22. Notably, Galaxy Digital is anticipated to generate an annual income of around $22 million solely from staking fees.

The precise number of Solana tokens (SOL) held by Galaxy Digital by Novogratz is uncertain. Based on a Bloomberg article, Galaxy was among the initial bidders in the auction for FTX’s locked SOL and procured tokens on behalf of investors through a special-fund with approximately $620 million in assets. Forbes speculates that this fund may now own around 9,687,500 SOL tokens, which translates to roughly $1.3 billion based on current market prices.

As an analyst at a financial firm, I’ve taken notice of Pantera Capital’s recent bullish stance towards Solana. In their latest newsletter, they’ve highlighted Solana’s meteoric rise over the past year as a significant development in the blockchain ecosystem. They see Solana as a potential challenger to Ethereum‘s dominance and have positioned it within a multi-polar model of blockchain platforms.

Read More

- Cookie Run Kingdom Town Square Vault password

- Maiden Academy tier list

- Pi Network’s Grand Migration: 10 Million and Counting!

- Kingdom Come Deliverance 2: Lion’s Crest DLC Quest Guide

- Former ‘Bachelorette’ Star Katie Thurston Reveals Breast Cancer Diagnosis: “Waiting on Learning What Stage”

- Cuddly Cats Take Over in the Wildest Night of the Living Dead Remake!

- NEAR Protocol Launches New Governance Proposal

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Unleashing the Digital Rupee: The Wallet You Didn’t Know You Needed! 🤑💰

- Carrie Underwood Says It Was ‘Impossible’ Not To Feel Nostalgic In Return To American Idol, But One Part Was Apparently Pretty Painful

2024-06-20 14:16