As a researcher with a background in cryptocurrencies and financial markets, I find the ongoing developments surrounding Ethereum ETFs intriguing. The recent bearish sentiment towards Ethereum-backed ETFs, despite its strong performance this year, is not surprising but concerning.

Despite Ethereum surpassing Bitcoin in terms of returns this year, pessimism persists among investors regarding an Ethereum ETF.

According to Bloomberg’s latest report, investors are showing signs of pessimism towards Ethereum in the spot exchange-traded fund (ETF) market, despite trading not having started yet. This bearish stance is supported by the observations of Fundstrat’s Digital Asset Strategy Head, Sean Farrell.

In a memo, Farrell pointed out that despite the pessimistic view, hedge funds have the potential to greatly enhance these ETFs by exploiting arbitrage opportunities – the differences between Ethereum’s spot and futures market prices. According to Fundstrat Global and Galaxy Digital’s forecasts, Ethereum spot ETFs could draw in $5 billion in new investments during the initial five months. However, Galaxy Digital issues a warning that the absence of staking capabilities within these ETFs might dampen interest.

In spite of the negative forecast, the green light for a spot Ethereum ETF may represent a significant turning point for the crypto sector. Notably, VanEck has indicated its plans to introduce a new spot ETF focused on Solana.

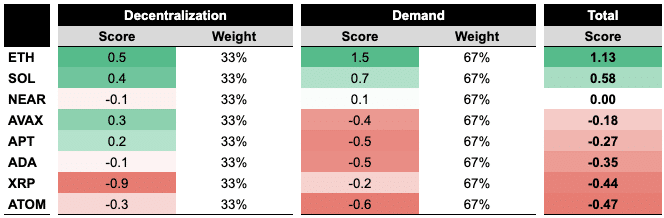

As a crypto investor, I’m keeping a close eye on the latest developments in the market, and one exciting piece of news comes from GSR Markets, an established player in the crypto space. Their analysts believe that the approval of spot Ethereum ETFs could open the floodgates for more decentralized projects to join traditional financial markets. Based on this trend, I’m optimistic that once Solana secures its ETF approval, investment firms may follow suit and file applications for NEAR Protocol (NEAR), Avalanche (AVAX), Aptos (APT), and other promising projects in the top 100 cryptocurrencies.

As an analyst, I want to share some insights regarding the SEC’s approval process for Ethereum and Solana Exchange-Traded Funds (ETFs). While there have been reports suggesting that the SEC might approve Ethereum ETFs as early as Jul. 4 (Reuters), it is essential to note that this timeline is still uncertain. Conversely, according to Eric Balchunas, a senior ETF analyst at Bloomberg, it’s unlikely that Solana ETFs will secure the SEC’s approval before 2025.

Starting from the new year, Ethereum’s value has increased around 51% based on MarketWatch’s statistics, surpassing Bitcoin by a margin of 6%, and leaving Solana behind by about 13%.

Read More

- Ludus promo codes (April 2025)

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Tap Force tier list of all characters that you can pick

- ZEREBRO/USD

- Val Kilmer Almost Passed on Iconic Role in Top Gun

2024-06-28 11:16