As a researcher with extensive experience in the NFT market, I find the recent trends intriguing. The data shows that while the global NFT sales volume experienced a significant decrease, the number of buyers and sellers skyrocketed. This paradoxical situation indicates a complex phase in the NFT market.

As a researcher observing the NFT market, I’ve noticed a notable decrease in activity over the past month. Metrics such as sales volume, number of transactions, and average price have all taken a hit.

According to Crypto Slam data:

-

Global NFT sales volume reached $476.3 million in June, marking a 47.22% decrease.

The number of NFT buyers skyrocketed to 1.259 million — an astonishing 1700.83% increase.

The number of sellers climbed to 744,965 — up by 1059.64%.

The increase in buyers and sellers was juxtaposed against a 51.4% drop in NFT transactions month-over-month

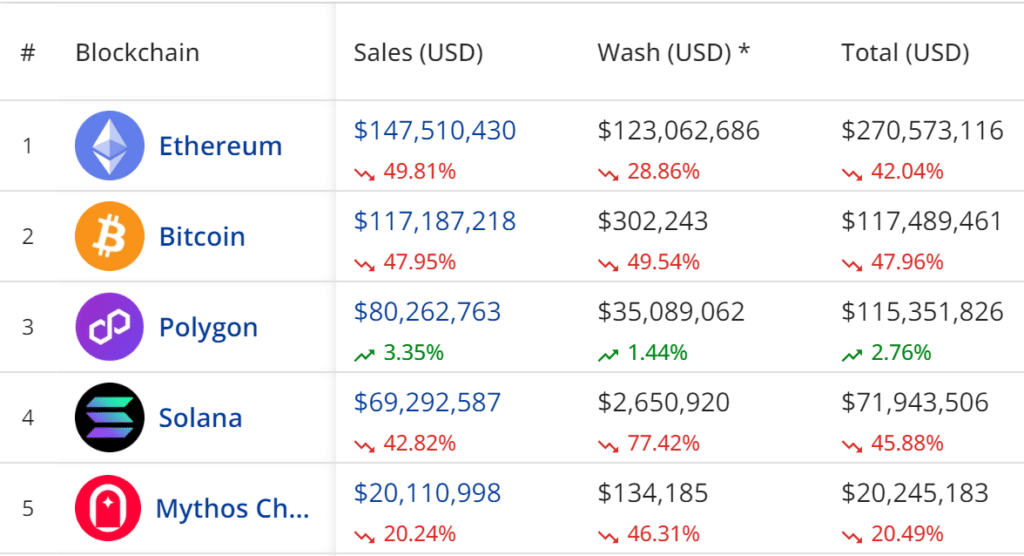

Top blockchains by NFT sales volume

Leading NFT collections in June

Despite the general market downturn, several NFT collections stood out in June.

In the realm of BRC-20 NFTs on Bitcoin, $PIZZA led the charge, recording impressive sales of approximately $29.1 million through over 43,000 individual transactions.

In the previous month on Mythos, DMarket rang up over $23.7 million in sales through approximately 830,000 deals. Yet, this month’s earnings from the collection came in at around $18.9 million, representing a 21.8% decrease.

In the Ethereum blockchain, CryptoPunks remained a top seller, raking in a total of $16,405,442 from only 141 deals. The Bored Ape Yacht Club (BAYC) likewise remained favored by collectors, recording a sales increase of 6.54% to reach $13 million.

An alternate cryptocurrency platform, NodeMonkes, completed the list of the top five performers, generating sales amounting to $12.7 million from a total of 929 transactions.

Over the past month, the NFT creation platform on OKX by Polygon experienced the most significant increase among all, with sales volume soaring by an astounding 132,509.44%. This remarkable surge translated into a total of $2.4 million in sales.

As a crypto investor, I’ve noticed that the NFT collections with the poorest performance in June were Blast’s Fantasy Top and DeGods on Ethereum. Sales for Blast’s Fantasy Top dropped by a significant 83.33%, while DeGods on Ethereum experienced a sales volume decrease of approximately 82.9%.

Top-selling NFTs of the month

With respect to expensive NFT collectibles, CryptoPunks number 627 was sold for an astonishing $836,149 on Ethereum, marking the most expensive transaction of the month. The fifth Punk in Bitcoin’s Ordinal Punks collection went for $306,725, while an NFT from Cardano fetched $219,102.

At a price of $110,917, the Solana blockchain was represented by the Mad Lads #4575 NFT, while the TTAvatars #1280003 NFT on Polygon was sold for $100,500.

The fan token market also saw substantial activity.

On the Chiliz blockchain, AS Roma’s ASR token topped the sales chart with a staggering $1.27 billion. Galatasaray’s GAL token came in second place with sales of approximately $344 million, and Paris Saint-Germain’s PSG token recorded sales amounting to $225.8 million.

The top five teams in terms of revenue were led by Real Madrid and Manchester United, each generating over $800 million. Following closely behind were OG and FC Barcelona, with sales of approximately $132 million and $126.2 million, respectively.

Market outlook

In simpler terms, the drop in NFT sales along with an increasing number of traders signifies a intricate stage in the NFT market’s development.

As an analyst, I’ve noticed a substantial decline in the number of transactions taking place. Despite this drop, there’s been a surge in interest and engagement that has reached unprecedented levels. However, it seems that the average transaction value has decreased, which could be indicative of a growing trend towards more economically accessible NFTs or a prudent investment strategy among market participants.

The market may be maturing, indicating a decrease in the excitement surrounding high-value deals, and instead fostering wider, more inclusive participation.

In the shifting market conditions, NFT platforms and collections that respond flexibly with a broad range of inclusive choices could potentially rise to prominence within the NFT industry.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cookie Run Kingdom Town Square Vault password

- Overwatch Stadium Tier List: All Heroes Ranked

- Seven Deadly Sins Idle tier list and a reroll guide

2024-06-30 20:40