As a seasoned crypto investor with several years of experience in the market, I’m cautiously optimistic about Bitcoin’s recent price action. The miner selling pressure that had been weighing on the asset for over a month seems to have subsided, as evidenced by the decline in miners’ selling volume and concerns.

The one-month downward trend for Bitcoin (BTC) may have come to an end, as the intensity of miner sell-offs lessens.

At present, Bitcoin has experienced a 2.2% price rise over the last 24 hours and hovers near the $63,000 threshold. The market value of this cryptocurrency stands at an impressive $1.24 trillion. Notably, the daily trading volume for Bitcoin has seen a significant surge of 57%, amounting to $21 billion in transactions.

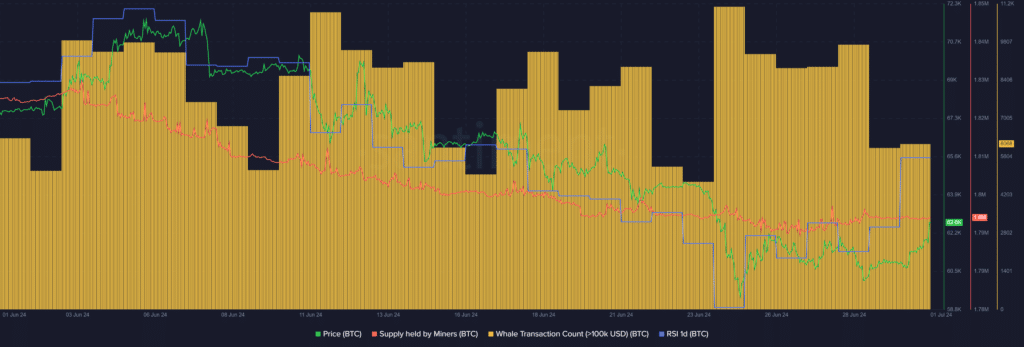

Based on information from CryptoQuant, miner selling pressure and related worries regarding Bitcoin have noticeably decreased over the past month. The amount of Bitcoin sold by miners dropped dramatically from a high of 14,000 BTC in May to under 1,000 BTC as July began.

“The demand for cryptocurrencies mined has grown considerably, causing a noticeable decrease in the amount they’re putting up for sale. The market is efficiently absorbing the reduced mining supply.”

“The worrying trend of Bitcoin miners offloading their coins has eased noticeably. The market is currently absorbing their sales at a rapid pace.” – Dan Coin Investor’s take.

— CryptoQuant.com (@cryptoquant_com) July 1, 2024

As a crypto investor, I’ve noticed an intriguing development based on recent data from Santiment. The supply of Bitcoin (BTC) held by miners has decreased from approximately 1.83 million coins to around 1.8 million coins within the past month. This decrease could be indicative of an impending retail accumulation phase for Q3, which might suggest that individual investors are gearing up to buy more Bitcoin.

Over the last 24 hours, there was a slight uptick in the count of distinct whale-level Bitcoin transactions valued over $100,000 on our market intelligence platform. The figure went from 5,923 to 6,068 transactions.

As I examine the patterns of whale activities in the crypto market, I anticipate a decrease in price fluctuations for the leading cryptocurrency due to their consolidated actions.

Additionally, the Bitcoin Relative Strength Index (RSI), as reported by Santiment, stands at 44. This signifies that Bitcoin isn’t overbought or oversold presently. A possible steady rise in its price might ensue.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-07-01 14:00