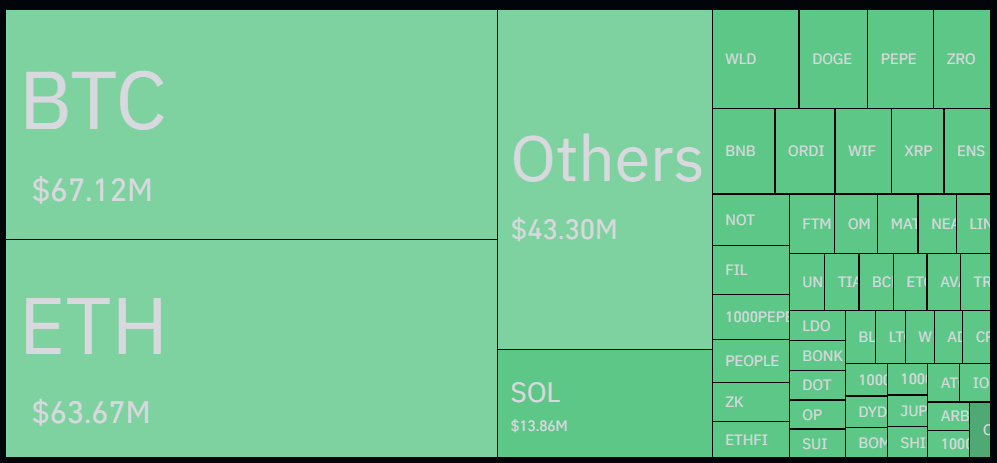

As a researcher with extensive experience in the cryptocurrency market, I find the recent surge in crypto liquidations and plunging market capitalization concerning. According to data from Coinglass, the total crypto liquidations have more than doubled in the past day, reaching $265 million, with over 102,000 traders being liquidated. Bitcoin, the largest cryptocurrency by market cap, accounted for the majority of these liquidations, with a staggering $67 million worth.

Over the last 24 hours, the value of cryptocurrencies being sold off exceeded its previous level by more than double, coinciding with a significant drop in the total market capitalization, reaching its lowest point in the past two months.

Based on information from Coinglass, there was a significant increase of 114% in crypto liquidations within the last 24 hours, amounting to a total of $265 million. Out of this sum, approximately $236 million was from liquidated long positions.

According to Coinglass figures, approximately 11% of the liquidations, amounting to $29 million, were initiated against short-position holders. Over the specified period, a total of over 102,000 traders experienced liquidations.

Bitcoin (BTC) is currently topping the list with approximately $67 million worth of liquidations in the past 24 hours. Earlier today, the value of this digital asset dipped below the $58,000 threshold, causing a wave of anxiety and uncertainty among investors.

Ethereum, the second largest cryptocurrency after Bitcoin, is not too far behind in terms of liquidations, with a total of approximately $63.6 million. Over the past 24 hours, Ethereum has experienced a decline of 4.4%, and its current trading price stands at $3,215 as reported.

At the forefront among cryptocurrency exchanges in terms of trading volume, Binance reported approximately $112 million worth of liquidations, accounting for around 42%. Following closely was OKX with around $87 million in liquidation events.

Based on information from Coinglass, the worldwide cryptocurrency open interest has dropped by approximately 4.7% within the last 24 hours and now stands at roughly $58.5 billion.

With sideways market movements, there is likely a decrease in market volatility and a reduction in the number of liquidations. As open interest declines, price swings become less frequent and less extreme.

According to CoinGecko’s data, the total value of all cryptocurrencies decreased by 3.4% within the last 24 hours, reaching $2.29 trillion. This figure has not been attained since May 1st when the market experienced a brief upturn in price.

Market behaviors can be uncertain when widespread fear, uncertainty, and doubt (FUD) pervade the market. According to a recent Glassnode analysis on July 3rd, Bitcoin investors exhibit signs of hesitation as the currency hovers around the $64,000 threshold.

Read More

- DEEP PREDICTION. DEEP cryptocurrency

- CRK Boss Rush guide – Best cookies for each stage of the event

- Summoners Kingdom: Goddess tier list and a reroll guide

- Ludus promo codes (April 2025)

- CXT PREDICTION. CXT cryptocurrency

- Maiden Academy tier list

- Mini Heroes Magic Throne tier list

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

2024-07-04 10:18