As a researcher with experience in the crypto market, I find it intriguing that while the number of Aave holders has been decreasing, the token itself is emerging as a top gainer. This paradoxical situation could be attributed to several factors.

Over the past week, the count of Aave token holders has seen a downward trend, but surprisingly, Aave has emerged as the leading gainer within this specified timeframe.

Aave has gained 5% over the past 24 hours, currently priced at $102.2 – a price point last reached in late May.

Over the past week, the value of the asset increased by 25.3%, mirroring the surge in the broader crypto market. Currently, its market capitalization amounts to $1.52 billion, ranking it as the 53rd largest cryptocurrency in existence.

Aave RSI

The price surge of the asset is occurring in tandem with a 7.5% growth over the last week in the total value locked within the decentralized lending protocol of defi, now standing at an impressive $12.3 billion.

According to Defi Llama’s data, the platform collected approximately $5.38 million in fees and earned around $862,600 in revenue during that particular period.

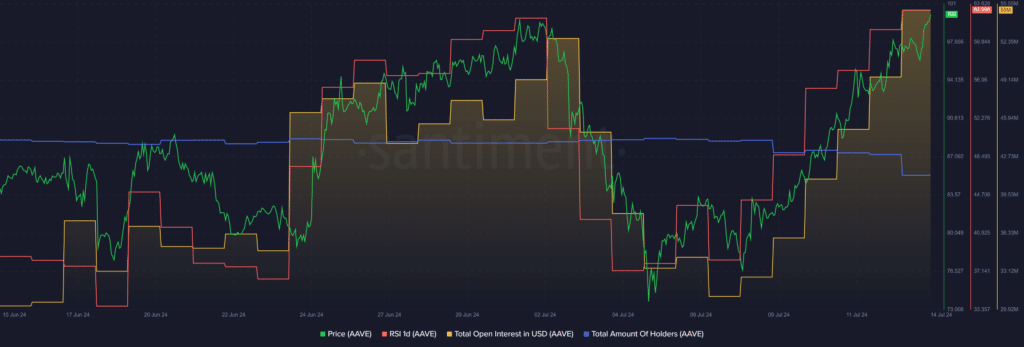

According to Santiment’s data, there was a decrease of approximately 440 unique addresses holding Aave tokens within the past week, bringing the total down to 167,900.

Based on the information I’ve gathered from the market intelligence platform, the total open interest for Aave has surged from $31 million on July 7th to $55 million at the present moment. Given this rise, it’s reasonable to anticipate heightened volatility in the asset price. The actions of large investors, or whales, and an uptick in liquidations could be contributing factors.

Over the past week, the Aave Relative Strength Index (RSI) has been steadily climbing, rising from a level of 38 to reach 63. This indicates that the token is starting to become overbought, suggesting that some short-term profit-taking is to be expected given these conditions.

For Aave to remain in the bullish zone, its RSI would need to cool down below the 50 mark.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-07-14 13:40