As a seasoned cryptocurrency analyst with several years of experience under my belt, I have seen my fair share of market fluctuations and price surges. Today’s rally by Mantra (OM) has caught my attention, and I must admit, it looks impressive.

The use of the mantra “OM” hit an unprecedented peak (reached a new all-time high or ATH) recently, according to available data. There has been a significant increase in the number of active addresses associated with it.

At approximately 01:15 UTC today, the value of OM reached a peak of $1.32. Despite experiencing a price adjustment, the asset has experienced a gain of 21% over the last 24 hours and is currently being traded at a price of $1.28.

Significantly, Mantra experienced a 39% surge in value during the previous seven-day period, placing it at the forefront of price gains among the top 100 cryptocurrencies.

Additionally, OM‘s market capitalization exceeded the $1 billion threshold, positioning it as the 69th largest digital asset. Likewise, Mantra experienced a significant increase in daily trading volume, amounting to $80 million.

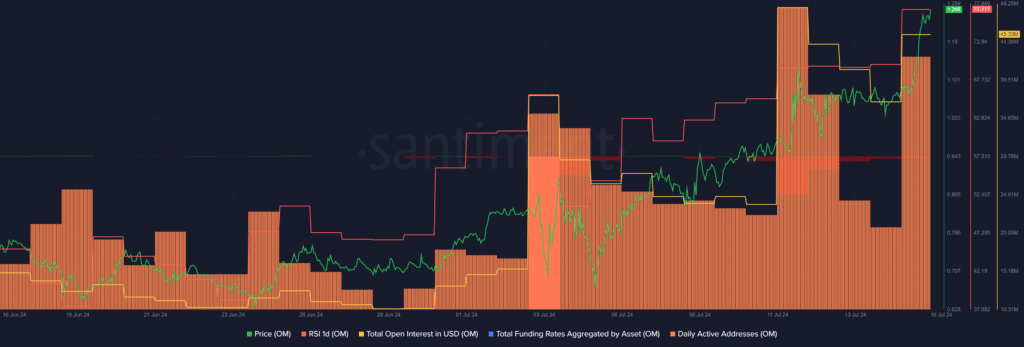

Based on Santiment’s data, there was a significant surge of 98% in the number of active Mantra addresses within the last 24 hours. This growth, which brought the figure from 157 to 310, indicates that some OM holders have cashed out their short-term profits as the token continues to thrive in the bullish market.

According to market intelligence data, the total open interest for Mantra increased from $36.7 million to $45.3 million within the last 24 hours. This significant jump in open interest often leads to heightened price volatility as a result of increased liquidation activities.

According to Santiment’s analysis, the overall funding rate compiled by OpenMarkets currently stands at a modest negative 0.007%. This figure indicates that more traders are holding short positions than long ones in the market. Anticipating a reversal, market participants are bracing for potential price spikes that could trigger approximately $1.5 million in liquidations.

Based on the latest data from Santiment, the RSI for Mantra’s OM (Open Market) value is presently at a level of 77 using the OM Relative Strength Index (RSI). This signifies that the price of Mantra may be overbought at its current point.

An RSI of below the 50 mark could put OM in the bullish zone again.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2024-07-16 11:39