As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely monitored Cardano’s (ADA) recent price fluctuations and market trends. The data I have gathered paints a concerning picture for this once promising altcoin.

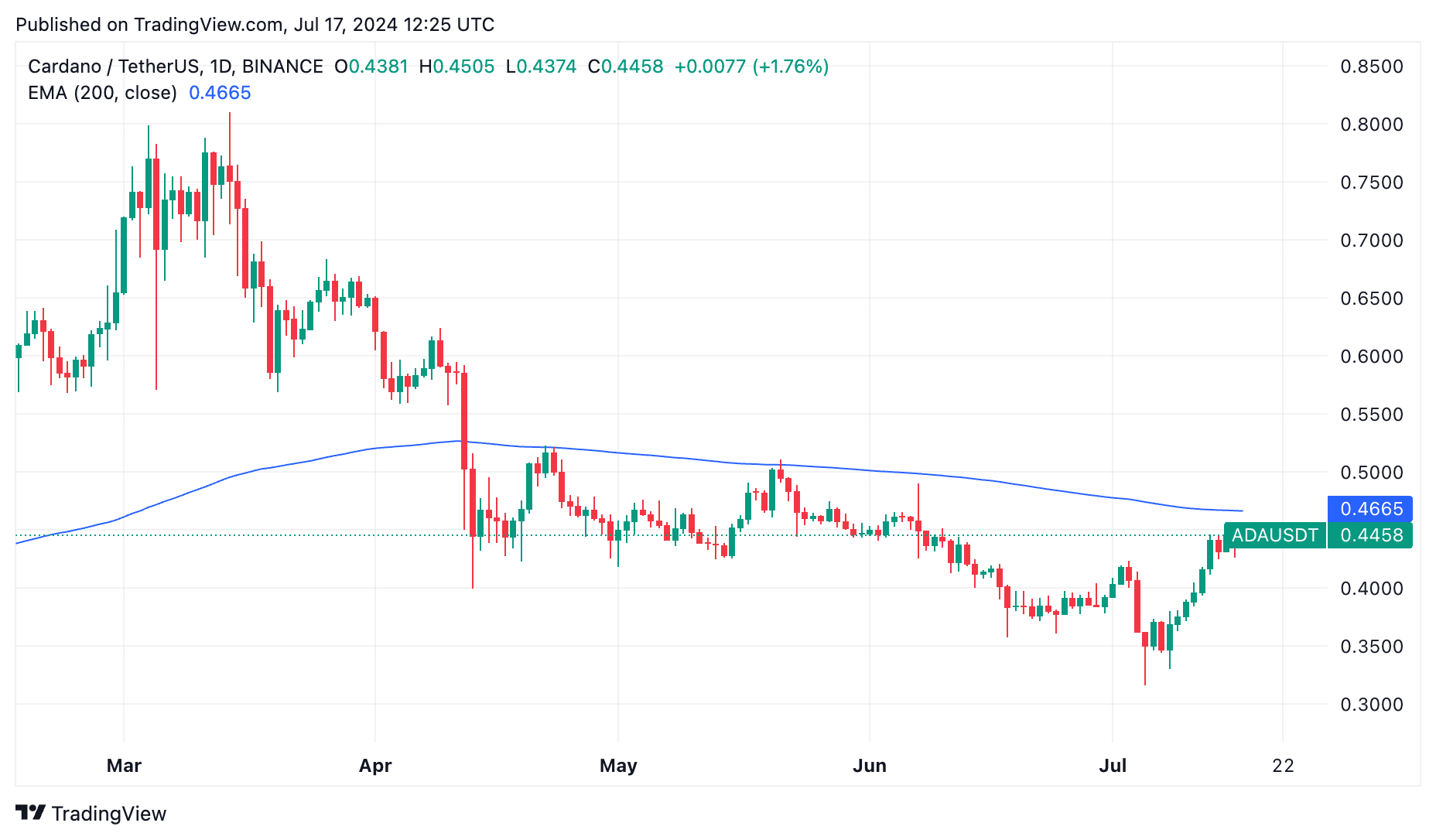

Cardano has risen after bottoming at $0.3174 earlier this month

Cardano (ADA) has experienced a notable recovery, rising by approximately 40% from its lowest point this month. However, it still lags behind, sitting 45% below its peak value this year. Despite being among the larger cryptocurrencies, Cardano has endured significant stress in recent months. Its market capitalization has dropped significantly, shrinking from over $90 billion in 2021 to $15.9 billion as of Wednesday.

Based on external information, there seems to be a decline in both developer and investor engagement with Cardano as of late. According to DeFi Llama’s data, the number of monthly developer commits dropped from 3,380 in May to 3,300 in June, and currently hovers around 2,000 this month.

Furthermore, the total value locked (TVL) in Cardano’s decentralized finance (DeFi) applications has dropped from a peak of 633 million ADA in late December 2023 to currently stand at 538 million ADA as of Wednesday. In contrast, up-and-coming blockchains such as Base, Blast, Sui, Mode, and Aptos boast significantly larger TVLs of $XXX million, $YYY million, $ZZZ million, $MMM million, and $NNN million, respectively.

Cardano differs from Solana, BNB Chain, and Ethereum as it currently lacks a prominent meme coin or decentralized exchange (DEX) with significant trading volume. In contrast, Minswap, its largest DEX, recorded only about $1 million in transactions within the last 24 hours, whereas Raydium on Solana processed an impressive $851 million during the same period.

Cardano holds a modest market presence within the shrinking NFT sector, with transactions totaling approximately $1.6 million in the past month. The count of Cardano wallets has dipped below 30,000, and the stabled coin balance hovers around $20 million.

Cardano’s sentiment is waning

Traders’ sentiment towards Cardano has been on a downward trend since July 5th. In comparison, smaller meme coins such as Pepe and Dogwhatech are witnessing daily trading volumes of over $700 million. This discrepancy is also reflected in the futures market.

According to data from Santiment, trader interest in the coin has reached a multi-month low. The primary concerns for most traders revolve around the coin’s poor performance and insufficient developer activity.

🥳😱 The mood of traders is aligning with the price trend. This week, XRP has seen a surge, resulting in numerous optimistic views. On the contrary, Cardano is experiencing its most pessimistic sentiment in over a year. Going against the popular opinion and making opposite trades might yield benefits.— Santiment (@santimentfeed) July 17, 2024

The returns on staking with Cardano are relatively modest compared to other cryptocurrencies, according to information from StakingRewards, with the yield being under 3%.

Based on technical analysis, the 200-day moving average lies above Cardano’s current price. This implies that the present price increase could be a temporary phenomenon.

In good news, the Crypto Fear and Greed Index is close to turning green due to increasing optimism over a potential Federal Reserve interest rate reduction. Consequently, Cardano’s (ADA) price may surge if Bitcoin continues its upward trend and surpasses its yearly high of $73,400.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Overwatch Stadium Tier List: All Heroes Ranked

2024-07-17 15:52