As a seasoned financial analyst with extensive experience in the crypto market, I have witnessed firsthand how political events, particularly elections, can significantly impact digital asset prices. The recent failed assassination attempt on former U.S. President Donald Trump and the subsequent news of President Joe Biden’s exit from the race are prime examples of this volatility.

Analysts from QCP Capital predict that news surrounding the US election will cause continued volatility in the cryptocurrency market. The outcome of the election could significantly influence the future of digital assets not only in the United States but also around the world.

As a market analyst at QCP Capital, I’ve observed an intriguing correlation between political events and digital asset price movements. Following the failed assassination attempt on former U.S. President Donald Trump on July 13 in Pennsylvania, Bitcoin (BTC) and the broader virtual currency market experienced a noticeable surge in value. This trend underscores the impact of geopolitical developments on the cryptocurrency sector.

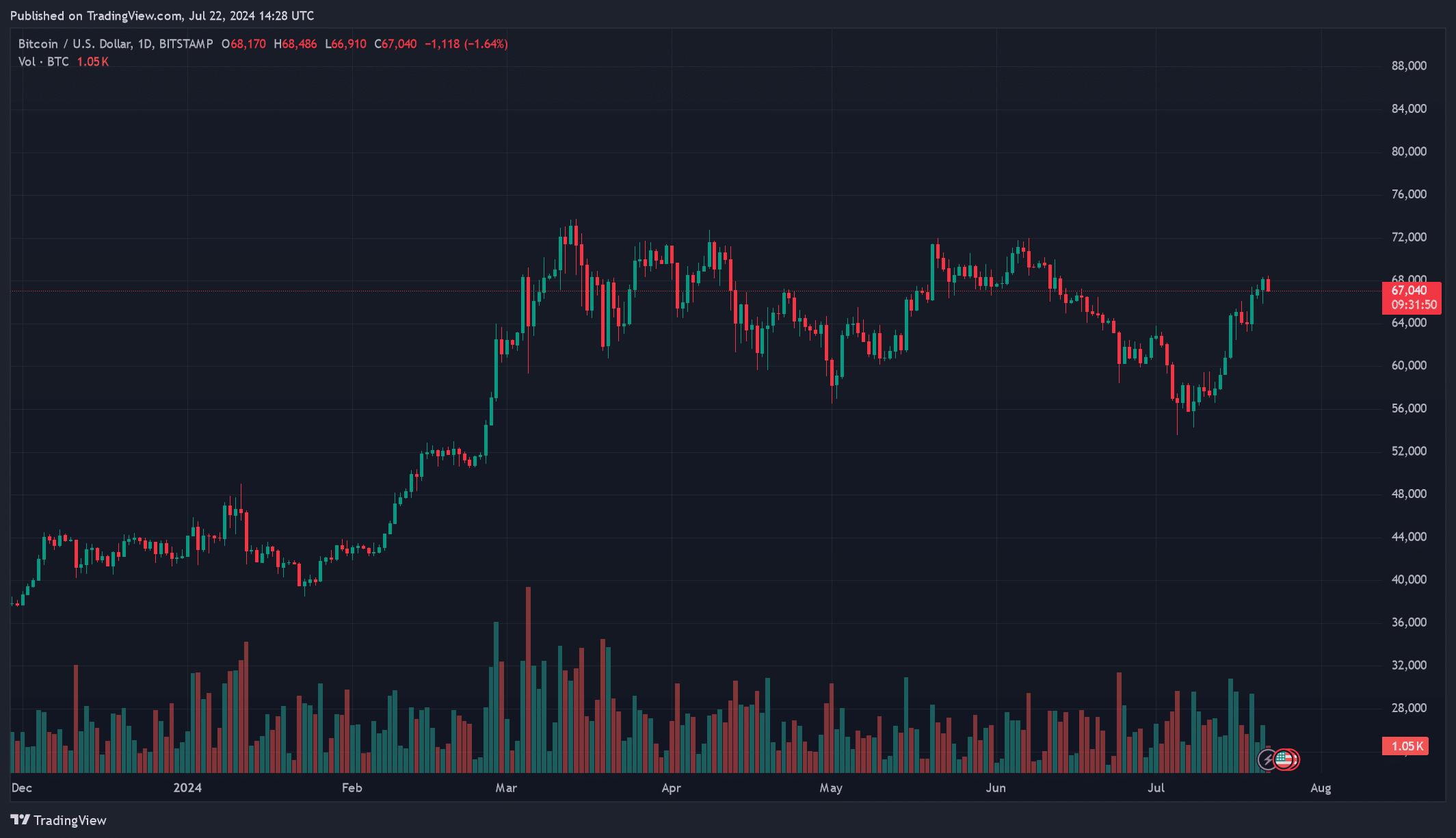

The crypto market experienced a significant surge last week, with its overall value increasing by more than 10%. During this period, Bitcoin reached and then surpassed the $68,000 mark once again. However, market momentum was disrupted when news broke about President Joe Biden withdrawing from a particular race. As a result, Bitcoin dipped below $67,500 over the weekend before bouncing back and recovering its losses.

Based on QCP Capital’s analysis, the upcoming Bitcoin conference in Nashville could potentially cause fluctuations in Bitcoin’s price. Notably, former President Trump is scheduled to appear at this event, and there have been whispers that he may announce plans for establishing a national Bitcoin reserve.

Crypto options market

Digital asset options markets have experienced heightened volatility as a result of the uncertainty surrounding the upcoming presidential election’s outcome, according to QCP analysts.

Analysts observed that the cost of options not currently in the money has risen substantially over the last day, suggesting anticipation for larger market swings ahead.

The market could be experiencing significant price fluctuations, but the company expects positive price trends to prevail. Potential reasons cited for this prediction include anticipated Federal Reserve interest rate reductions and a favorable outcome in the U.S. election for cryptocurrencies.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- 9 Most Underrated Jeff Goldblum Movies

- USD CNY PREDICTION

- Henry Cavill Reveals Struggles Behind the Scenes of ‘Warhammer 40k’ Live-Action Series

2024-07-22 17:54