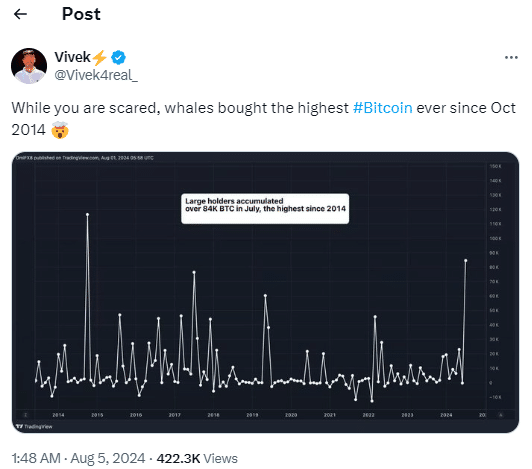

As a seasoned crypto investor with a decade of experience under my belt, I’ve witnessed the ebb and flow of the digital currency market. The recent buying spree by Bitcoin whales, accumulating around 84,000 BTC in July 2024, has me feeling a bit like a gold miner during the California rush – only instead of panning for gold, I’m digging up digital gold!

In simple terms, large Bitcoin investors (referred to as whales) purchased approximately 84,000 Bitcoins during July 2024, marking the largest monthly buying spree in the past decade. This significant surge in purchasing activity has pushed Bitcoin accumulation to levels not witnessed since October 2014.

Ever since Bitcoin underwent its fourth halving back in May, I’ve noticed that market heavyweights have been seizing the opportunity to amass more BTC. This accumulation is happening amidst higher price volatility and has resulted in the highest monthly total of Bitcoin purchases in the last decade.

A noteworthy recent event involved a ‘whale’ (large investor) selling 46,000 Bitcoin from the Bitfinex trading platform. This substantial withdrawal suggests that institutional investors may be preparing for another price surge by accumulating large amounts of Bitcoin, hinting at their readiness for a potential bull market.

According to data from analytical companies, it seems that many big players in the crypto market, often referred to as “whales,” have been buying Bitcoin during this recent price decline. This surge in purchases can be attributed to last month’s market volatility and a high level of investor optimism indicated by the Greed and Fear Index.

As a result, the wallets that received at least 0.1% of Bitcoin’s current supply (added in July), accounted for over 84,000 Bitcoins.

A large number of Bitcoin whales amassing coins during price drops suggests a positive market expectation, as numerous traders predict an impending rise towards $70,000. This strong buying trend combined with optimistic market views paves the way for a substantial price movement.

As an analyst, I observed a surge in Bitcoin holdings among the market’s influential players, or “whales,” during July 2024. This trend suggests heightened trust in the digital currency and potentially significant price fluctuations over the coming months.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2024-08-05 10:45