As a seasoned crypto investor with a decade of experience navigating the tumultuous seas of digital assets, I find myself standing at the precipice of uncertainty once again. The recent 32% collapse of Ethereum in just a week has sent ripples through my portfolio, and I can’t help but feel a sense of déjà vu.

In the past week, Ethereum has plummeted by 32%, and it experienced a significant 18% decline within just the last day. This downward trend is part of a broader slump in the cryptocurrency market, marking its most substantial drop this year to date.

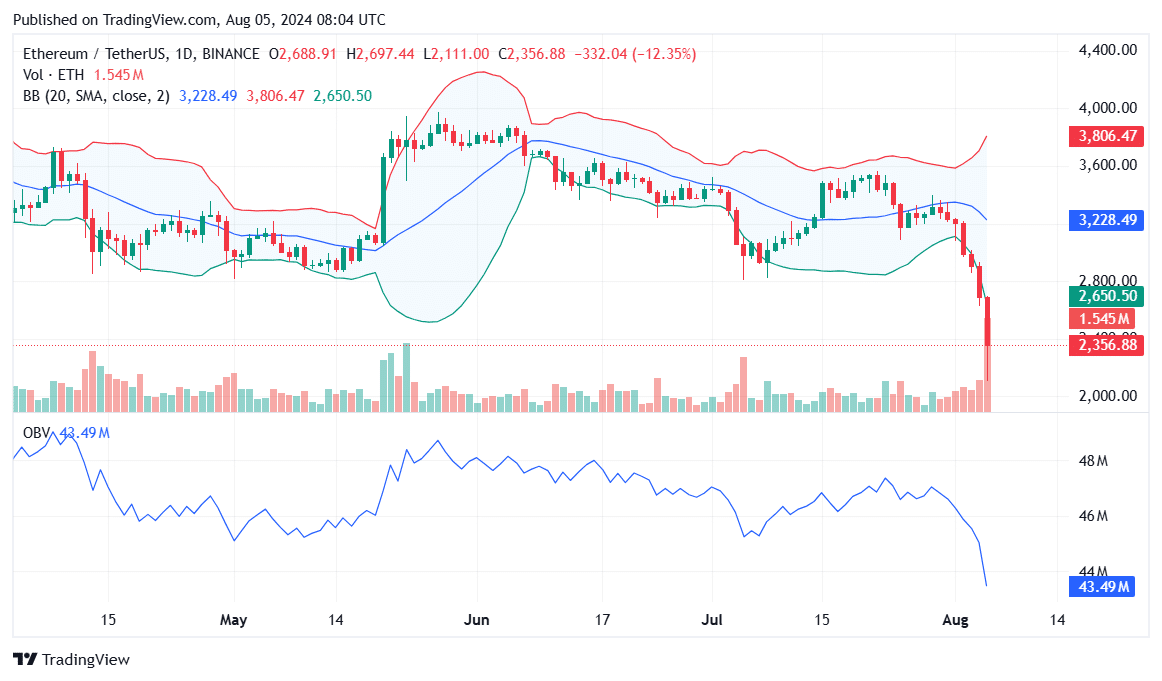

Today’s Ethereum (ETH) price trend on the daily chart demonstrates a significant dip, with the current rate sitting at around $2,350 – a decrease of approximately 12.35% compared to yesterday. This steep fall has caused Ethereum to drop below the lower Bollinger Band, which stands at $2,650. The Bollinger Band, often used as an indicator, suggests that the asset might be oversold at this point.

In simpler terms, when the lines that form Bollinger Bands widen, it signals increased market volatility. If Ethereum’s value stays below the lower band, it usually means the asset is overbought and may experience a rebound soon. However, if the price doesn’t recover quickly, this could indicate a bearish trend, with strong downward pressure on the asset.

The On-Balance Volume (OBV) of ETH, which reflects the balance between buying and selling pressure, supports a bearish trend. At present, the OBV is at approximately 43.49 million, showing a significant decrease in sync with the price fall, implying that sell activity has noticeably increased.

From my analysis perspective, as I observe a correlation between increased trading volumes and decreasing prices, a continued downtrend in Ethereum’s On-Balance Volume (OBV) suggests prolonged selling activity. This selling pressure could potentially lead to further drops in the price of Ethereum.

ETH weekly chart at critical condition

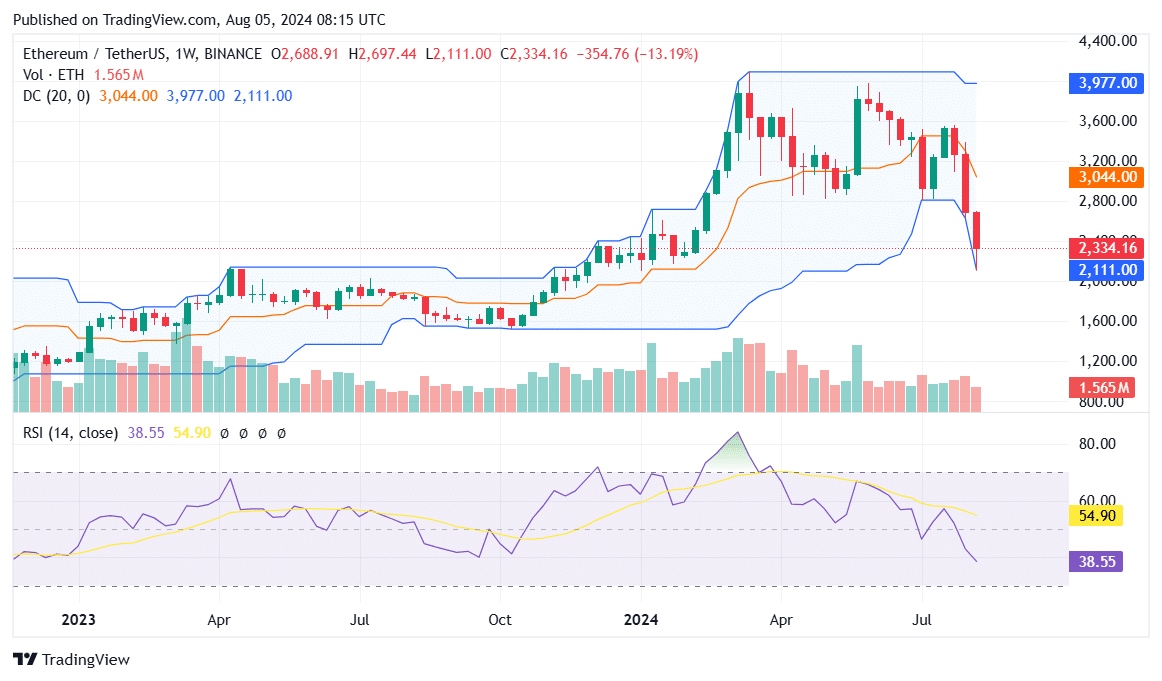

As a seasoned trader with years of experience under my belt, I must admit that the current state of Ethereum’s price trend leaves me somewhat concerned. The recent break below the lower Donchian Channel at $2,111 is a red flag that often indicates a potential downtrend. While the upper and middle Donchian Channels stand at $3,977 and $3,044 respectively, it’s important to remember that past performance does not guarantee future results.

As a researcher, I’ve observed that a break of the lower channel suggests a robust downtrend. This indicates the price has plunged to levels unseen in the last 20 trading sessions, implying potential bearish continuation. A weekly close under this point might hint at increased vulnerability to further price drops.

Additionally, the Relative Strength Index (RSI), as shown on the weekly graph, is presently at 38.55, having decreased from its previous peak of 54.90. If the RSI continues to fall below 30, it would suggest an oversold state, possibly triggering a short-term rebound that could reach or surpass the $2,800 level.

It appears that the recent trend indicates a decrease in strength. If a significant turnaround doesn’t occur, it’s likely that Ethereum (ETH) will continue to experience downward pressure.

What next for Ethereum?

Moving forward, Ethereum’s short-term fate is heavily influenced by its capacity to regain important support points. If it manages to surge beyond the lower Bollinger Band, currently at approximately $2,650 on the daily chart, it may help maintain its price level.

On the long-term perspective, returning inside the Donchian Channels, especially if it’s above the midline at around $3,044, could indicate a favorable trend.

As a crypto investor, I’m closely watching Ethereum’s trend. If this bearish wave persists, I anticipate Ethereum might approach resistance at the $2,000 mark, and there could be potential for it to dip even lower if the overall market conditions remain challenging.

As a research analyst studying Ethereum, I propose a forecast suggesting that it may find stability near its current value in the immediate future. However, there’s a possibility of another downturn if macroeconomic scenarios, like interest rate reductions, unfold in a manner analogous to previous market cycles.

As a crypto investor, I’ve noticed that ETH has retreated to a significant trend line. If history repeats itself as it did in 2019, it might hover around these levels for a couple of weeks. However, if the Fed decides to lower interest rates, there’s a possibility it could break down again afterwards. It’s essential to remember that this is not a guarantee, but rather an observation based on the most reliable analogy that has been our best guide this year. As always, it’s advisable to take precautions and hedge your investments accordingly.— Benjamin Cowen (@intocryptoverse) August 5, 2024

As an analyst, I’m sharing insights based on Peter Brandt’s perspective. He posits that Ethereum might be nearing its floor, a significant price level. By observing a rectangle pattern that spans from $4,500 to $2,814, he estimates the potential bottom could be around $2,000. With recent market movements, it appears this target is nearly reached.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- DEEP/USD

- ZEREBRO/USD

- Tap Force tier list of all characters that you can pick

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Cookie Run Kingdom Town Square Vault password

- Summoners Kingdom: Goddess tier list and a reroll guide

- 10 Hardest Bosses In The First Berserker: Khazan

- Grimguard Tactics tier list – Ranking the main classes

2024-08-05 12:46