As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a sense of deja vu as I watch meme coins implode in this high-volume environment. The fear and greed index slipping to the fear zone is a stark reminder that the crypto market can be as erratic as a rollercoaster ride on a stormy day.

In a bustling digital market, meme coins are experiencing a significant decline. This is due to the fact that the closely monitored Crypto Fear and Greed Index has moved into the “fear” zone.

In the last day, the combined value of all cryptocurrencies dropped by approximately 25%, now standing at around $29.8 billion. Earlier in the year, these digital tokens reached a staggering market worth beyond $63 billion, which indicates a loss of nearly $33.8 billion for investors.

Dogecoin, Shiba Inu, Pepe and other meme coins are slumping

On Monday, the values of cryptocurrencies such as Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF), and Bonk (BONK) experienced a significant drop of over 23%. Additionally, popular tokens like Floki (FLOKI) saw a decrease in value exceeding 30%.

In a bustling trading atmosphere, numerous investors had to offload their meme coins due to liquidations, leading to increased transactions. It appears that the 24-hour transaction volume surged significantly, reaching approximately $9.72 billion, which is a 170% increase.

Simultaneously, their enthusiasm for the futures market kept decreasing, with Pepe’s involvement dropping significantly. As of now, Pepe’s commitment in the futures market is over $93.61 million, a decrease from the peak of $146 million last month. Similarly, Dogecoin’s open interest has dropped to $536 million, down from its July high of over $757 million.

The futures open interest of other meme coins like WIF, Bonk, and Shiba Inu also continued falling.

Generally speaking, meme coins tend to be less stable than Bitcoin due to the fact that they’re often owned by individual investors looking for fast profits. As Bitcoin increases in value, these investors drive up the price of meme coins, but when Bitcoin experiences significant drops, they quickly sell off their meme coins, causing their prices to plummet.

Additionally, they tend to lag behind the overall market when the fear-greed index registers a ‘fear’ reading. Earlier this year, this index dropped from above 90 to 35, reflecting increasing pessimism within the cryptocurrency sector.

Despite the current downturn, it’s worth noting a few encouraging aspects. For starters, this dip isn’t solely affecting crypto; traditional stock markets are also experiencing a pullback. For instance, Nvidia, one of the globe’s largest companies by market value, saw a drop of over 14% on Monday, and tech giant Apple declined more than 5%.

1. Given that stocks tend to increase over the long run, it’s plausible that cryptocurrencies might recover during such periods. Furthermore, meme coins could potentially gain value if the Federal Reserve decides to lower interest rates due to an increase in inflation expectations.

Meme coins have become oversold

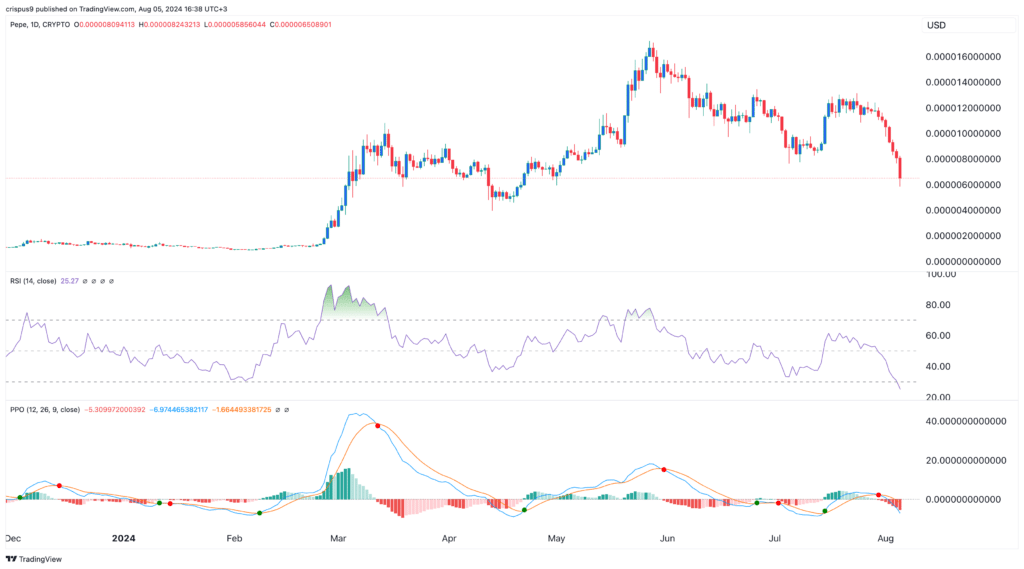

Furthermore, due to extreme selling, meme coins are likely to bounce back within the next few weeks. The RSI (Relative Strength Index) for Pepe has dipped to 25, indicating oversold conditions, while its PPO (Percentage Price Oscillator) has been in the negative zone for six straight days.

As a researcher, I’ve noticed that the Relative Strength Index (RSI) of Dogecoin has dropped to 24, indicating oversold conditions. Similarly, the Moving Average Convergence Divergence (MACD) and the Percentage Price Oscillator (PPO) have also moved into the oversold territory. This trend seems to be mirrored in other tokens such as WIF and Popcat as well.

In other words, when a financial asset experiences a significant drop in price (oversold), there are two possible outcomes. First, the downward trend might persist because of the force behind the sell-off, or second, buyers may see this as an opportunity to purchase at a lower price (buying the dip), causing the asset’s value to potentially rebound.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- DEEP/USD

- Cookie Run Kingdom Town Square Vault password

- ZEREBRO/USD

- Tap Force tier list of all characters that you can pick

- 10 Hardest Bosses In The First Berserker: Khazan

- Realms of Pixel tier list – What are the best heroes in the game?

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

2024-08-05 17:12