As a seasoned researcher with a knack for deciphering market trends and a soft spot for cryptocurrencies, I find myself intrigued by the meteoric rise of Popcat (POPCAT). While it’s always thrilling to witness such rapid recoveries, my life experience has taught me that caution is often the better part of valor in this unpredictable world of crypto.

In simple terms, the popular meme coin Popcat, built on the Solana platform, is leading the way in the recovery of the crypto market, making it the biggest gainer among the top 100 digital currencies currently available.

After plummeting to a two-month low of $0.2580 on August 5, losing 20% in a single day due to a marketwide crash, Popcat (POPCAT) has since experienced a remarkable rise of 128%. At the moment of this writing, it is being traded at $0.5961.

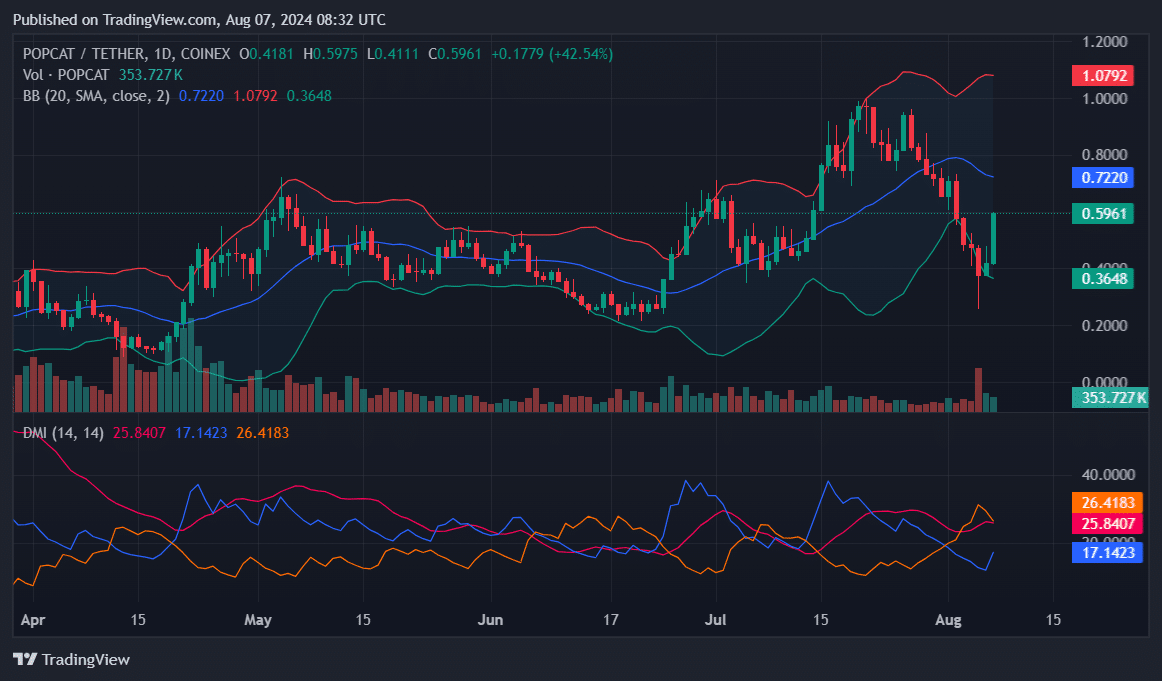

Significantly, the cost of Popcat at present is higher than the lower Bollinger Band ($0.3648), but it’s quite a distance from both the upper band ($1.0792) and the middle band ($0.7220). This arrangement, with such a substantial price increase, is quite unusual.

Despite a substantial price drop keeping POPCAT below its upper Bollinger Band, this suggests that while it’s recovered significantly, it hasn’t quite entered an overbought state yet. The distance from the current price to the upper band implies there might still be potential for additional growth before encountering resistance.

Concurrently, on the Directional Movement Index, the line representing the intensity of uptrend (+DI) is at 17.1423, whereas the line signifying the intensity of downtrend (-DI) stands at 26.4183. In simpler terms, the uptrend’s strength is currently 17.1423, while the downtrend’s strength is 26.4183 on this index.

In simpler terms, the Average Directional Index (ADX), a tool indicating the strength of a market’s trend, stands at 25.84. Since the ADX is above 25, we’re looking at a moderately strong trend. However, the lower +DI compared to the -DI hints that there might be growing downward pressure or bearish sentiment in the market.

Popcat RSI suggests cautious outlook

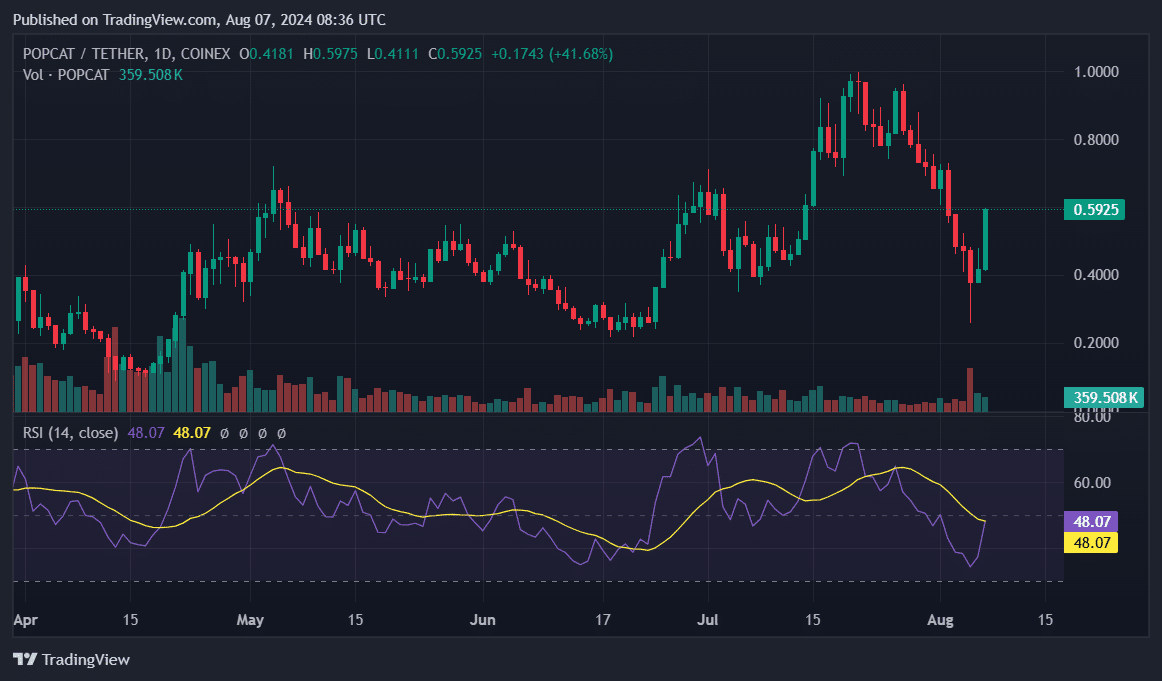

Using a Relative Strength Index (RSI) of 48.07, POPCAT exhibits a neutral position, suggesting a moderate stance rather than a bullish or bearish one. This indicates that the asset is neither experiencing an extreme buying phase (overbought), nor a heavy selling phase (oversold). As such, there’s currently no imminent risk of a sudden price reversal caused by overvaluation.

In other words, the RSI reading at present doesn’t suggest a robust extension of the upward trend. Currently, the price could be poised to shift in either direction without showing signs of excessive movement.

Lately, there’s been a significant rise in the cost of POPCAT, and this increase has been followed by higher trading activity. This increased activity seems to show strong buying enthusiasm. Nevertheless, if the trading volume decreases while the price stays high, it might suggest a weakening trend, possibly causing a drop or pullback.

Keeping a close eye on trading volume fluctuations and the DMI (Directional Movement Index) lines is crucial. A substantial decrease in trading volume, or a crossover point where the negative DMI (−DI) exceeds the positive DMI (+DI), might suggest an upcoming adjustment or correction in the market trends.

Instead, prolonged high trading activity and an increasing Positive Diagnostic Indicator (DI) may encourage more growth. Although the current surge has been impressive, conflicting messages from technical signals call for attention to possible signs of a potential reversal. This suggests that the rally might still have some energy left, but it’s crucial to remain cautious.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2024-08-07 12:37