As a seasoned analyst with over two decades of market experience under my belt, I must admit that predicting the exact trajectory of Bitcoin (BTC) is like trying to navigate a labyrinth in the dark. However, based on the latest report from Grayscale Research, there seems to be a glimmer of light at the end of this cryptic tunnel.

According to Grayscale Research, there’s a possibility that Bitcoin might reach its record peak again this year if the U.S. economy manages to steer clear of a downturn.

In spite of the turbulent fluctuations in the cryptocurrency market lately, experts from Grayscale Research anticipate that prices might surge even further in the upcoming months.

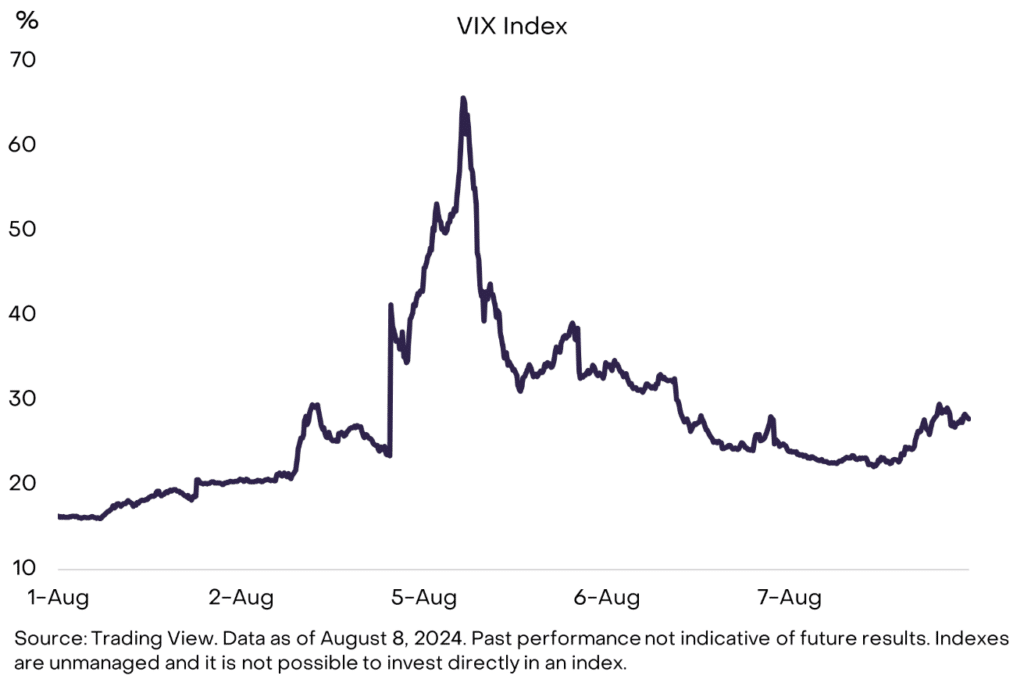

According to a research report published on Aug. 8th, analysts from Grayscale predict that if the U.S. economy manages to navigate a “soft landing” without entering a recession, the value of cryptocurrencies could recover significantly. Bitcoin (BTC) might even reach its previous record high again before the end of this year under such circumstances.

As a market analyst, I’ve been observing changes in the political climate regarding cryptocurrencies within the United States. These shifts could potentially mitigate the downside risks to valuations, contrasting with previous market cycles.

Grayscale

The company highlighted the fact that, despite a less robust economy, potential negative impacts might be “less severe” compared to previous economic cycles, mainly due to consistent demand from freshly listed U.S. stock exchanges and low-yielding cryptocurrencies known as altcoins.

As a crypto investor, I’m eagerly anticipating the impact of upcoming macroeconomic data and central bank policies on the market stability. Grayscale highlights that significant events like the Federal Reserve’s September meeting and the Jackson Hole Symposium will significantly shape our investment landscape.

Bitcoin wins in any scenario

Despite any situation, Grayscale Research maintains its positive outlook. They believe that even an economically challenging phase might strengthen the long-term argument for Bitcoin investments, especially considering the current lax monetary and fiscal policies.

Currently, at the time of reporting, Bitcoin is being traded above $60,000. It recovered from a dip on Monday when its value dropped below $50,000 momentarily, according to information from crypto.news. So far, Bitcoin has managed to maintain its $50,000 floor, leading some to believe that large investors, or “whales,” are still buying at current rates. This could suggest future price increases, particularly during the usual low-price period for Bitcoin in September and October.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- ZEREBRO PREDICTION. ZEREBRO cryptocurrency

- Grimguard Tactics tier list – Ranking the main classes

- DEEP PREDICTION. DEEP cryptocurrency

- Maiden Academy tier list

- Seven Deadly Sins Idle tier list and a reroll guide

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Why ‘The Old Guard 2’ Release Date Keeps Being Postponed

2024-08-09 12:12