As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by Aave’s performance. The 9% surge on Aug. 15 was indeed impressive, placing it atop the crypto market. However, it’s still a far cry from its all-time high, reminding us that even the loftiest peaks are just a part of the rollercoaster ride in this space.

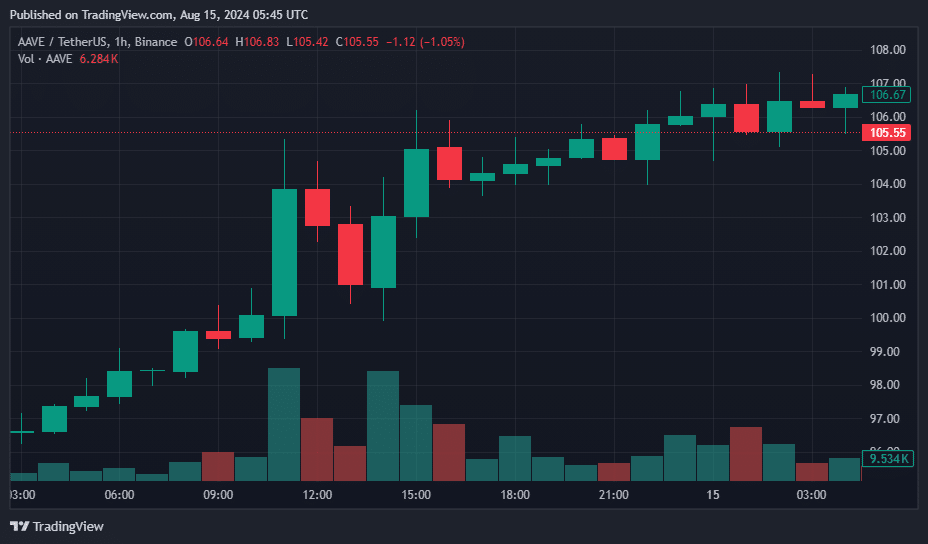

On August 15th’s morning, Aave – a decentralized cryptocurrency lending service – saw a 9% increase in its value, making it the standout leader in the cryptocurrency market.

In the course of compiling this report, I find myself reporting that Aave’s (AAVE) price has climbed a notable 8%, currently standing at $106.4. Notably, its daily trading volume has experienced a substantial boost of around 78%, reaching an impressive figure of approximately $262 million. This surge has elevated Aave’s market capitalization to a significant $1.57 billion, positioning it as the 54th largest cryptocurrency in the market.

Even though Aave’s price has significantly increased lately, it remains 84% lower than its peak of $661.69, a record set on May 18, 2021.

Aave functions as a decentralized lending service spanning 12 different blockchain networks, focusing on secured loans that are backed by more assets than the loan amount. Users can store their cryptocurrency to receive loans, while smart contracts handle every aspect of the process, from funds disbursement and collateral management to fee calculation.

The recent surge in Aave’s price coincides with a broader recovery in decentralized finance protocols, particularly in lending and borrowing platforms.

According to a post by its founder Stani Kulechov on August 14th (X post), Aave has broken its own record for the number of weekly active lenders. The platform managed to reach approximately 40,000 active borrowers in just one week, exceeding the previous peak from late 2022.

The expansion is primarily driven by the advent of innovative lending sectors such as Base and Scroll. Currently, Base (BASE) occupies almost 30% of unique wallets on Aave V3, while Arbitrum (ARB) and Polygon (MATIC), functioning on Layer-2, hold approximately 23.4% and 21% of the wallet shares each, as per Dune Analytics’ data.

As an analyst, I’ve noticed that Kulechov pointed out that the weekly deposit count on Aave is approaching its maximum. Interestingly enough, this month has shown a substantial increase in Aave depositors, as evidenced by data from Dune Analytics.

At present, Aave ranks as the third-largest decentralized finance (DeFi) platform in terms of value locked, with a reported total value of around $11.85 billion, according to DeFiLlama. Despite experiencing a 70% rise in its value locked this year, it still falls short of its October 2021 peak at roughly $20 billion.

right now, the Aave token’s price movement follows a flat band-like pattern, implying a period of moving laterally, with potential resistance points around $115 and support points near $80.

2023’s technical outlook seems favorable based on current indicators. The 50-day moving average suggests an upward trend, while the 14-day Relative Strength Index (RSI) reads 50.74, suggesting a neutral stance and a possible continuation of sideways movement in the market.

As an analyst, I’ve observed that throughout 2023, Aave has rolled out numerous substantial upgrades. These updates have been centered around enhancing both the lending and borrowing functions, boosting security measures, and integrating novel DeFi protocols. Moreover, the community endorsed a fork known as Seamless, which presents an alternative decentralized lending platform for users.

Back in the early part of the year, the value of Aave’s token exceeded $100. By June, wallets containing staked AAVE represented approximately 17.09% of the total token circulation, indicating a rising trend in the use and acceptance of this platform.

Read More

2024-08-15 10:21