As a seasoned crypto investor with over five years of experience under my belt, I find myself intrigued by TRON’s current market position. The 2.2% surge in the past 24 hours has certainly caught my attention, pushing the price to $0.136 at the time of writing. However, a closer look at the Santiment metrics raises some concerns.

Most TRON investors are presently enjoying a profit, yet there’s a blend of conflicting social media and blockchain indicators influencing the asset.

At this moment, TRON (TRX) has increased by 2.2% over the last 24 hours and is being exchanged for approximately $0.136. The current market capitalization stands at a staggering $11.8 billion, with daily trading volume nearing $300 million, according to information from crypto.news.

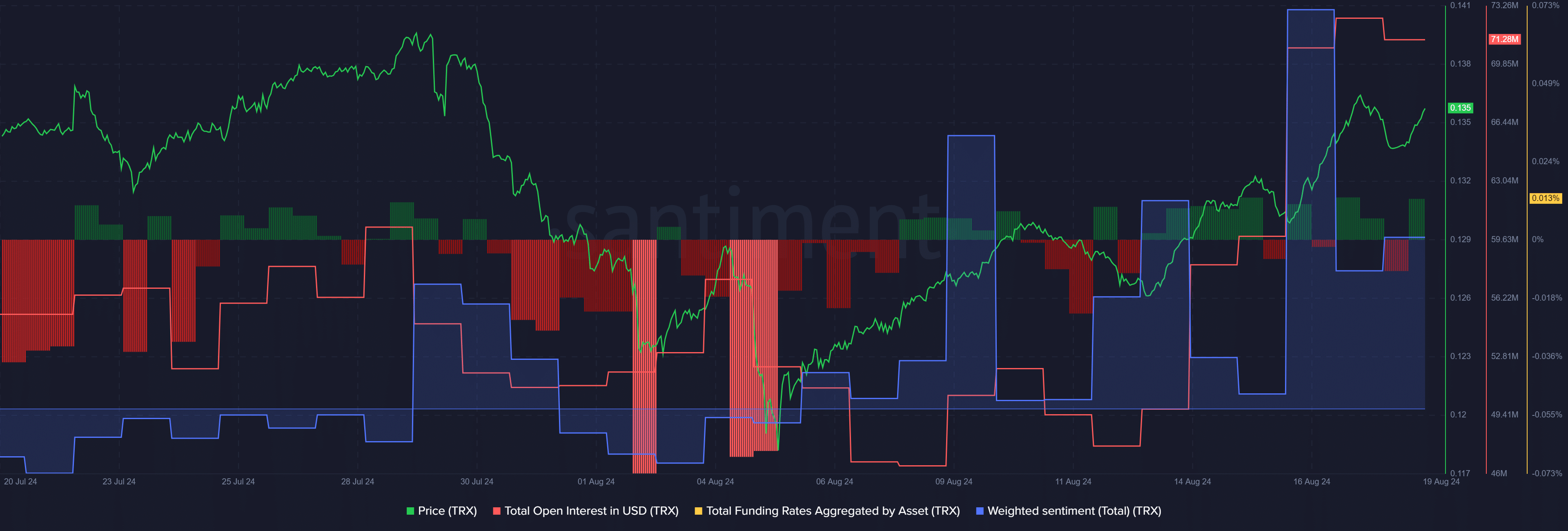

According to Santiment data, the recent jump in TRX‘s price from $0.126 has resulted in a notable rise in total investment, with open interest increasing from $47 million on August 12 to an impressive $71 million at the time of this report, marking a five-month peak.

As an analyst, I’ve noticed a sudden spike in the open interest of TRX. This increase could potentially lead to more liquidations, which in turn might induce significant price swings.

According to market data, the average funding rate for TRX increased to 0.012% (a tiny fraction of 1%) following a dip into negative territory on August 18th. Interestingly, despite traders’ optimistic views towards TRX, the asset has historically experienced price adjustments. In line with this trend, the overall sentiment toward TRON remains predominantly positive, as indicated by Santiment.

TRON’s high concentration raises volatility risks

Approximately 94% of Tron (TRX) owners are currently making a profit on their investment, even though the price has dropped by around 55% from its peak of $0.30 back in January 2018, as suggested by data from IntoTheBlock. Just 3% of TRX accounts have purchased the cryptocurrency between the prices of $0.136 and $0.166. The rest of the TRX tokens are neither making a profit nor showing a loss.

If the number of profitable investors surpasses a substantial threshold, it’s possible that certain wallets might decide to cash out their gains before a price drop occurs.

It’s quite possible that the price of TRX may experience significant fluctuations because a large percentage of its tokens are held by a few large holders (whales) and a smaller percentage is owned by individual investors (retail). According to ITB data, around 56% of Tron tokens are stored in whale wallets, while about 34% are owned by retail investors. Although on-chain indicators suggest a potential price drop, an increase in positive sentiment on social media platforms could cause TRX prices to rise.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-19 12:18