As a seasoned researcher with a decade of experience in the cryptocurrency market under my belt, I find myself intrigued by the recent surge of AAVE, the native token for the decentralized lending platform Aave. The 30% increase in price over the past week has certainly caught my attention, and it seems that whales are playing a significant role in this rally.

The cryptocurrency known as AAVE, which is used on the decentralized loaning platform Aave, has piqued the interest of large investors (whales) because its value has increased by more than 30% during the last seven days.

Initially, Aave (AAVE) was ranked 47th among cryptocurrencies as of August 20. However, at the time of its recent publication, it had climbed to the 44th spot. The market capitalization of the token surpassed $2 billion and experienced a growth of over 3% within the preceding 24 hours.

Based on information provided by crypto.news, AAVE‘s current price was $137.64, a decrease from its peak for the week at $142.16, which it achieved on August 22nd. Over the last seven days, AAVE had increased by approximately 30.9%, and in the past month, this figure rose to over 47.7%. Despite the recent surge, AAVE remains significantly lower than its previous all-time high of $661.69, reached back in May 2021, with a decrease of about 79.2% from that point.

The main cause behind the increase has been significant whale behavior observed over the last week. Notably, on August 22, data from Lookonchain indicated that a whale purchased approximately $10.4 million worth of AAVE using around 4,000 staked Ethereum (ETH) within a day.

Crazy buying of $AAVE!This whale spent 4,000 $stETH($10.4M) to buy 77,270 $AAVE at $135 in just 1 day!Address:0xa923b13270f8622b5d5960634200dc4302b7611e — Lookonchain (@lookonchain) August 22, 2024

Just prior to this major acquisition, there was noticeable whale activity on August 20th. Specifically, two whales collectively invested around $3.92 million in AAVE. The next day, another substantial investor jumped on board, contributing approximately $6.65 million to the token.

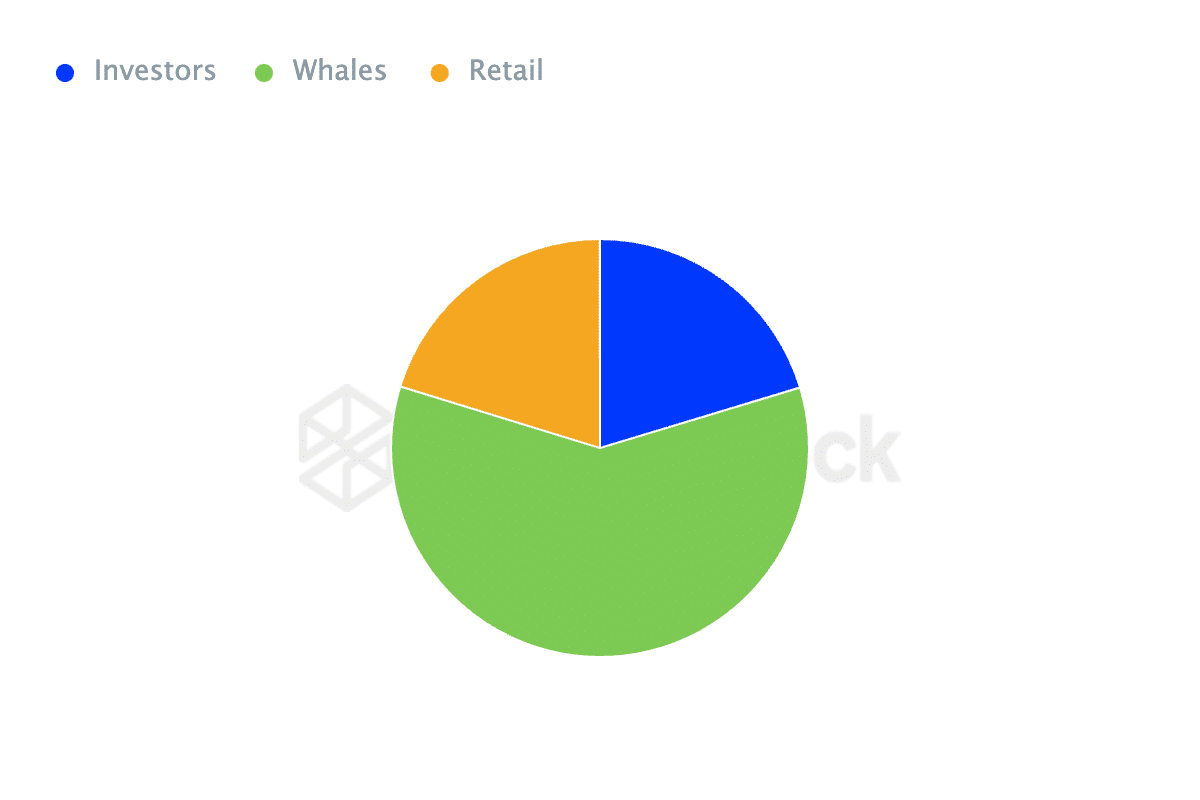

As an analyst, I’ve delved into data from IntoTheBlock, and it appears that entities holding more than 1% of Aave’s circulating supply account for a staggering 59.43% of the total AAVE supply. This significant concentration of whales indicates a potential influence over the token’s price dynamics, suggesting that these large holders play a crucial role in shaping its market movements.

Over the past week, there’s been a substantial rise in the movement of AAVE, particularly among major investors. Specifically, inflows have grown by approximately 90.37%, while outflows have experienced an increase of around 95.79%.

On the other hand, a significant increase of 364.73% in the movement of AAVE among major holders over this timeframe suggests that there’s more buying activity than selling at present. This heightened interest in acquisition is helping to drive the rise in AAVE’s price trend.

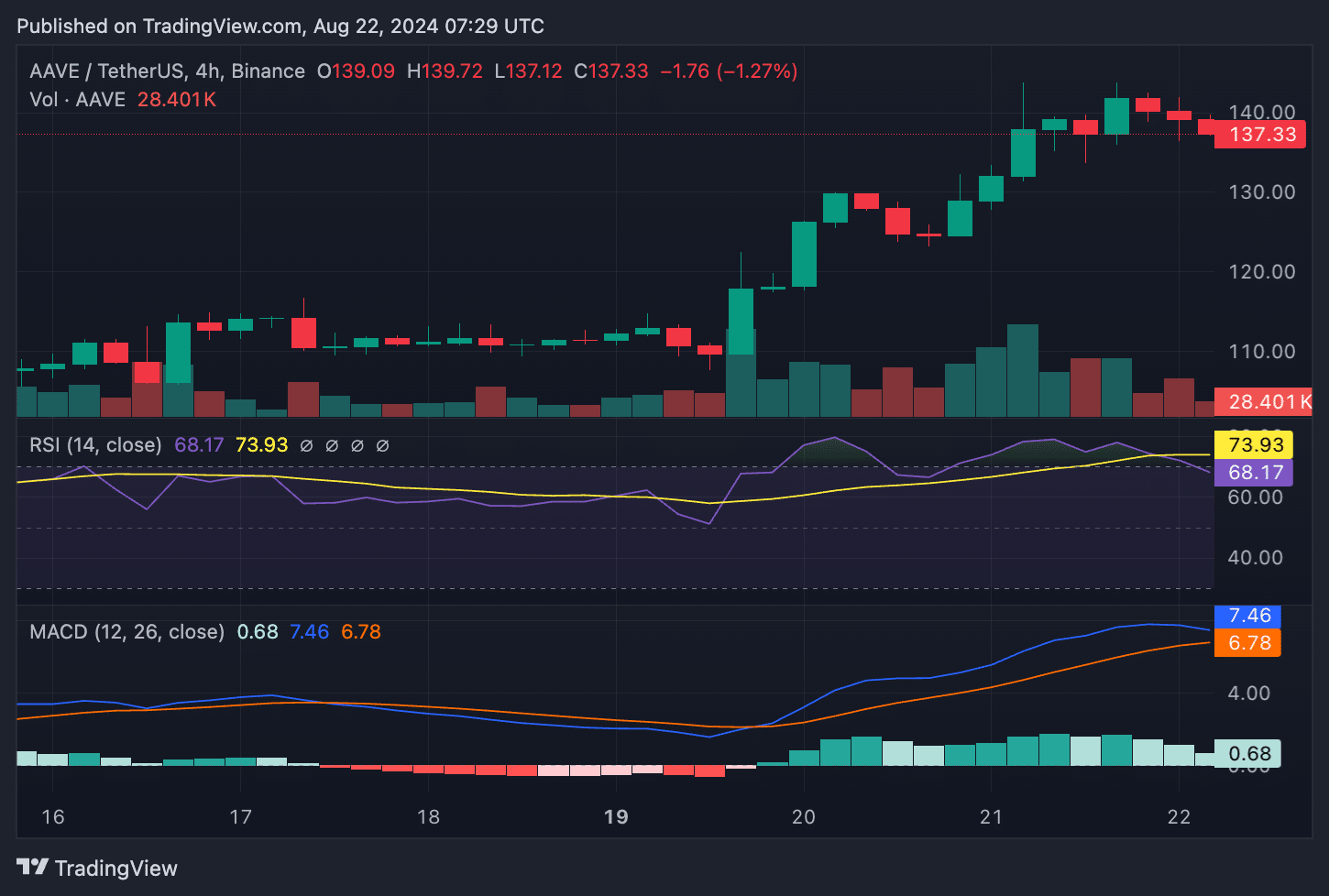

AAVE currently in overbought zone

On the 4-hour AAVE/USDT chart, the Relative Strength Index (RSI) stands at 73.93, implying the token may be overbought at this point. Contrarily, the Moving Average Convergence Divergence (MACD) indicates that the bullish trend is still active, as the MACD line continues to hover above the signal line, accompanied by positive MACD bars.

It’s possible that although AAVE appears to be overbought at the moment, its upward trend may persist for a while due to whale purchases. However, being overbought usually signals a potential correction or consolidation period in the future, so traders might consider cashing out some profits temporarily.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Dragon Ball Z Dokkan Battle tier list

2024-08-22 12:24