As an experienced crypto investor who has navigated through numerous market cycles and seen my fair share of price surges, I can confidently say that Alpaca Finance’s recent performance is quite impressive. Seeing it reach its highest level since April 8 and gaining over 250% in a week is a sight to behold. The listing on Binance and WhiteBit certainly played a significant role in this surge.

As an analyst, I’ve noticed a remarkable uptick in the value of Alpaca Finance tokens this week. The peak reached was $0.227, marking the highest point since April 8.

As a seasoned cryptocurrency investor with over a decade of experience in the market, I’ve witnessed countless coins rise and fall. However, it’s rare to see such a dramatic surge as ALPACA (ALPACA) has experienced this year. From its rock-bottom point, ALPACA soared by an astonishing 252%, making it one of the top performers of the week. This rapid growth caught my attention, and I couldn’t help but be intrigued. The market cap of ALPACA climbed to a whopping $37 million, while its 24-hour trading volume skyrocketed to an impressive $142 million. As I delve deeper into the project, I find myself increasingly optimistic about ALPACA’s potential for continued growth and success.

The price increase of the token occurred after it was listed as a perpetual future on Binance, the leading centralized exchange in the sector. This listing could make the token accessible to more than 216 million users on the platform.

Beyond Binance, WhiteBit, an affiliate of FC Barcelona, has likewise made Alpaca Finance’s perpetual futures available for trading. As stated on WhiteBit’s official site, the platform registered a 24-hour trading volume exceeding $6.5 million.

What do we have here? A new futures trading pair:• $ALPACA-PERP: More to come! — WhiteBIT (@WhiteBit) August 23, 2024

Alpaca Finance ranks among the leading decentralized finance applications within the BNB Smart Chain environment, boasting more than $55 million in assets distributed across both its Version 1 and Version 2 networks. Serving as an alternative to AAVE (AAVE), it offers individuals the opportunity to both borrow funds and accrue rewards.

Typically, when an altcoin gets listed on significant platforms such as Binance or Coinbase, it often experiences notable price increases.

Alpaca token gets overbought

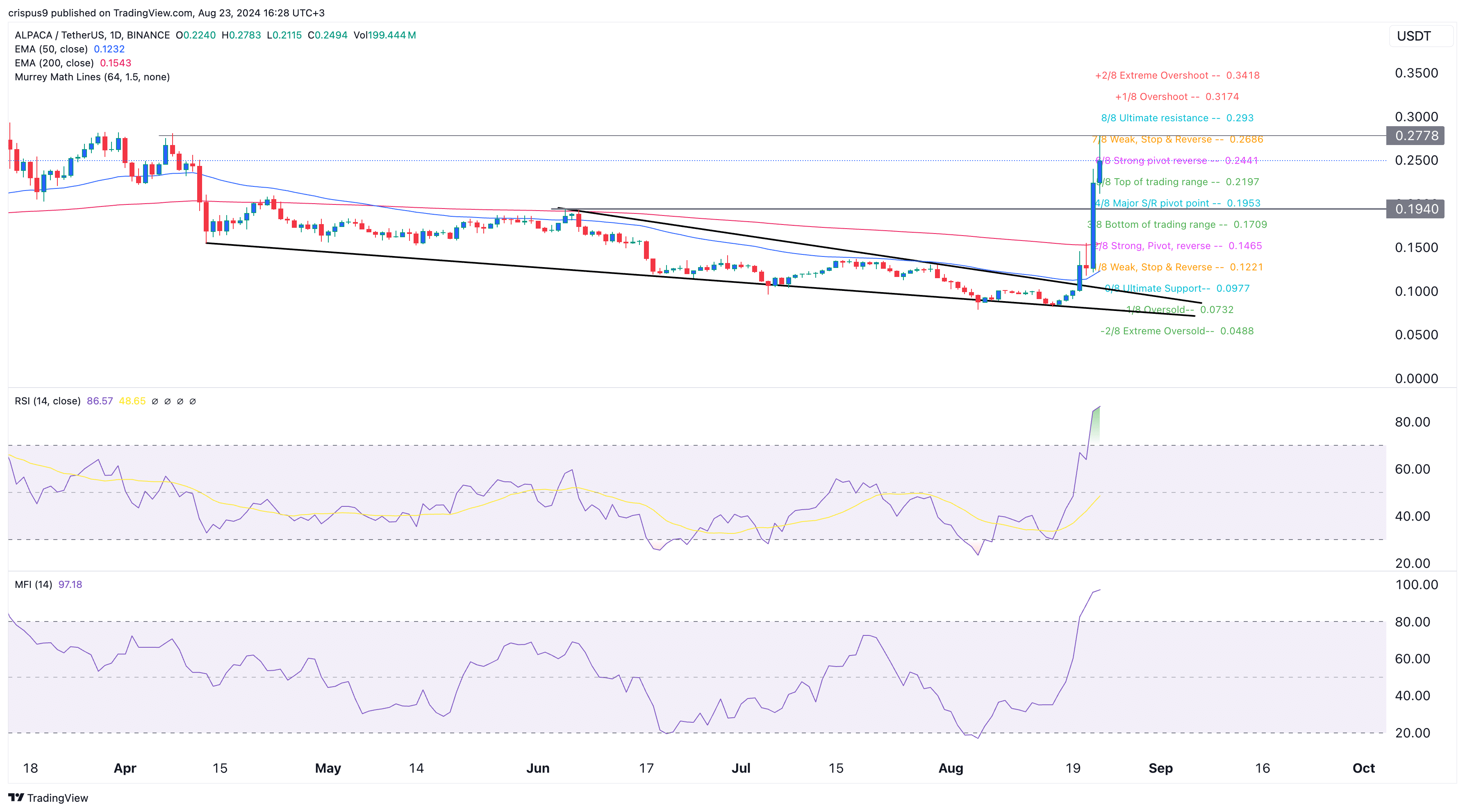

The rise in alpaca prices happened at the same time as the merging of two lines creating a falling wedge shape, a technical configuration often indicative of continued upward price movement ahead.

The price of the token climbed over its significant resistance at $0.1940, marking a new high since June 5, and exceeded not only its 200-day and 50-day average prices. This action suggests that the current bullish trend is robust.

As an analyst, I observed that the price of Alpaca peaked at $0.2778, which corresponds to the feeble, stop-and-reverse point identified by the Murrey Math Lines indicator, signaling a potential reversal or pullback in its price movement.

Nevertheless, indications suggest that the asset might be significantly overbought. For instance, the Relative Strength Index reached an exceptionally high level of 86, and the Money Flow Index reading climbed to 97.

As these overbought conditions show robust bullish energy, they also hint at a possible sharp correction taking place as the initial enthusiasm from the stock exchange listings subsides. If such a pullback occurs, it’s crucial to keep an eye on the $0.1940 level, which corresponds with a significant support or resistance turning point according to the Murrey Math Lines system.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- EUR CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- 9 Most Underrated Jeff Goldblum Movies

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

2024-08-23 16:52