As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the current state of Ethereum exchange-traded funds (ETFs). The consistent outflows and the cumulative loss of over $460 million in assets are certainly eye-catching. However, it’s important to remember that this is a dynamic market, and trends can change swiftly.

On August 23rd, there were seven straight days of withdrawals from Ethereum-based exchange-traded funds (ETFs), totaling approximately $5.7 million in assets on that day alone. This daily outflow added to the cumulative total, which now stands at around $464 million, according to data from SoSoValue.

Cumulative net assets locked in these Ethereum (ETH) ETFs stand at about $7.65 billion.

The Grayscale Ethereum Trust boasts a staggering $5 billion, while its smaller counterpart, the Grayscale Mini Ethereum Trust, holds approximately $1.01 billion. These two trusts are followed by ETFs from Blackrock, Fidelity, Bitwise, and VanEck.

Institutional investors reluctance

According to a message sent to Bloomberg, crypto expert Noelle Acheson pointed out that some institutional investors are hesitant about investing in Ethereum ETFs and instead choose to concentrate on Bitcoin (BTC) when it comes to diversifying their investments.

On the other hand, she anticipates that Exchange-Traded Funds (ETFs) focused on Ether could potentially experience increased investments ahead, much like the precious metals sector. For instance, gold ETFs currently hold over $100 billion in assets, while those tracking silver have significantly less than $20 billion.

The opportunity cost

An alternative explanation for the difficulties faced by Ethereum ETFs lies in the comparison between owning them and simply purchasing Ether directly.

Those purchasing the most economical Ethereum ETF called Grayscale Mini Ethereum will incur a minimal management fee of 0.15%. On the plus side, this choice eliminates the need to earn money via staking.

Data by StakingRewards shows that Ethereum yields about 3% or $300 if you invest $10,000 in it.

Over the past 30 days, it’s been observed that Ethereum’s total staking inflow has increased on nearly 20 occasions, surpassing a staggering $93.7 billion. Given that Ether Exchange Traded Funds (ETFs) mirror Ethereum’s price movement, this trend suggests an increasing preference among investors for buying Ether.

Ethereum is underperforming Bitcoin

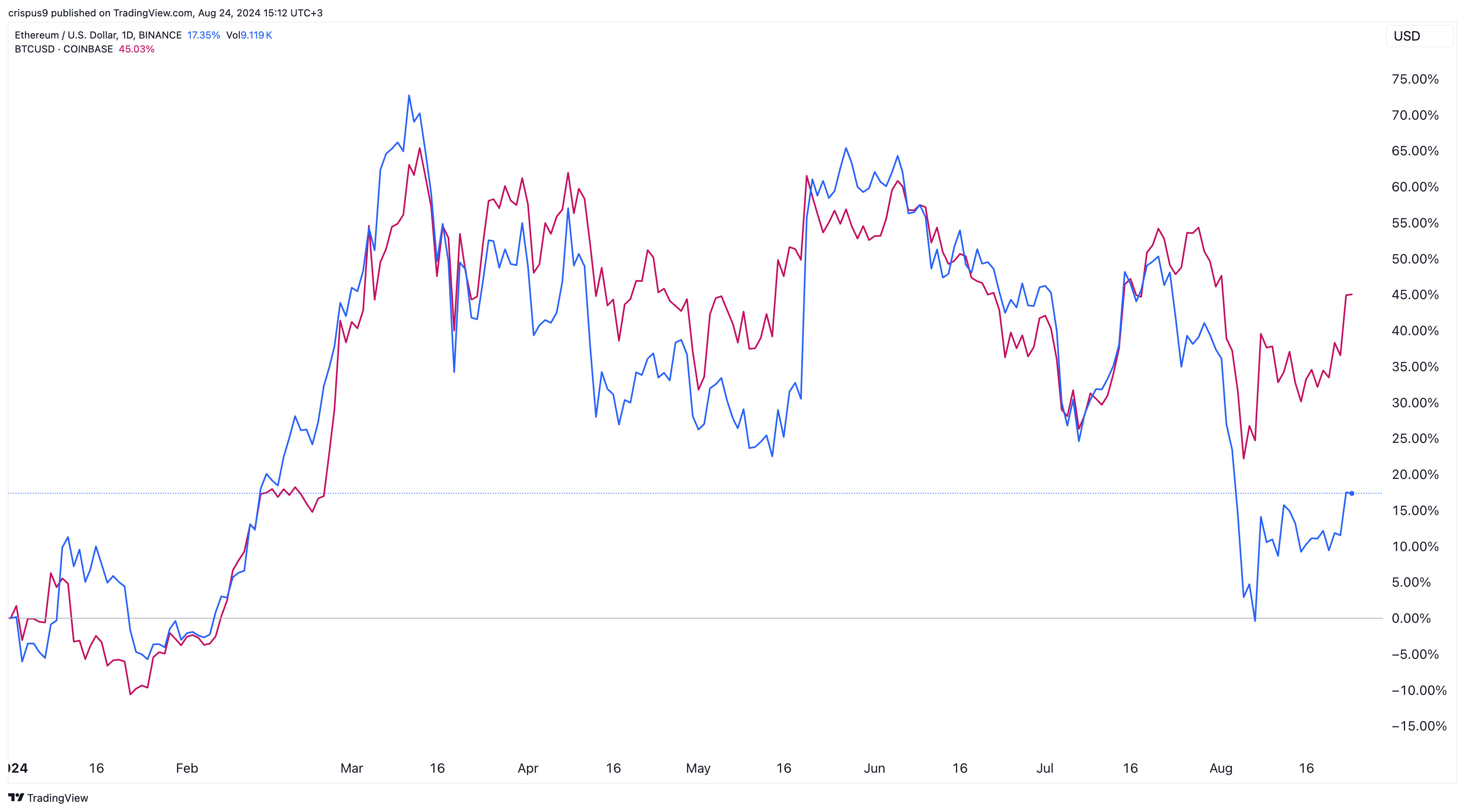

A plausible explanation could be that Bitcoin is outperforming Ether this year. It has surged more than 45%, whereas Ether’s growth has been around 19.6%.

It seems that this performance is due to the significant challenges Ethereum is experiencing from competitors like Solana (SOL) and Tron (TRX).

Tron now dominates the market for stablecoin transactions, processing daily transactions valued at more than $40 billion. Meanwhile, Solana has gained significant popularity due to its meme coins, leading it to become the largest blockchain network in terms of DEX volumes in July, with a total volume of over $58 billion.

The strong performance of Ethereum’s ETF could serve as a warning sign for financial institutions considering the introduction of ETFs based on other cryptocurrencies such as Solana and Avalanche.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-08-24 19:56