As a seasoned crypto investor with over two decades of experience under my belt, I can’t help but feel a sense of deja vu when reading about the latest inflows into crypto investment products. It seems that every time there’s a whiff of dovish sentiment from the Fed, investors flock to digital assets like bees to honey.

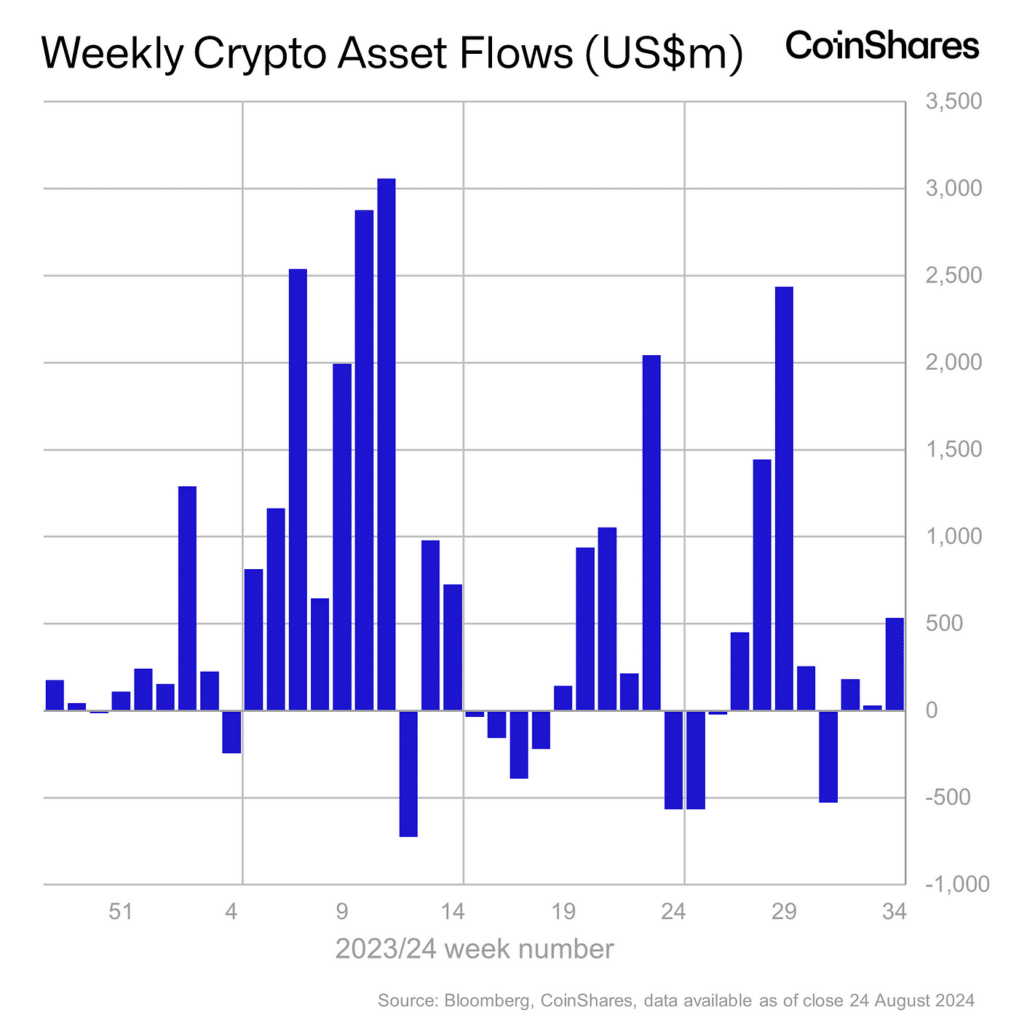

Due to a favorable outlook in the market, there was a significant increase in investments into cryptocurrency products, as reported by CoinShares’ data.

Last week saw a surge of approximately $530 million flowing into cryptocurrency investment products – the highest in five weeks – following dovish remarks from Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium, as per a report by CoinShares’ head of research, James Butterfill. In simpler terms, a significant amount of money flowed into crypto investments last week due to optimistic signals given by Jerome Powell during his speech at the Jackson Hole Symposium, according to James Butterfill’s report.

He noted that even though trading volumes were lower than in recent weeks, they “remained high, reaching $9 billion for the week” as Powell’s remarks, hinting at a potential interest rate cut as early as September, spurred significant market activity.

In contrast to the U.S., which recorded inflows amounting to $498 million, Hong Kong and Switzerland also experienced positive inflows of $16 million and $14 million each. However, Germany went against the trend, experiencing outflows totaling $9 million, making it one of the few countries that has seen net outflows so far this year.

On August 23rd, particularly after Powell’s remarks, Bitcoin (BTC) received inflows amounting to $543 million, highlighting its susceptibility to changes in interest rate expectations. This significant influx of BTC was predominantly observed on Friday, according to Butterfill.

Although Ethereum (ETH) saw contrasting movements with outflows of $36 million last week, new Ethereum ETFs have gained traction, attracting $3.1 billion in inflows over the past month, the CoinShares head of research says, noting that those inflows were “partially offset by outflows from the Grayscale Trust of $2.5 billion.”

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2024-08-26 13:41