As a seasoned crypto investor with battle-tested nerves and a knack for navigating market storms, I see the current dip as an opportunity rather than a cause for panic. The recent fall below $60,000 might be unsettling to some, but it’s part of Bitcoin’s volatile nature that I’ve grown accustomed to over the years.

The drop in Bitcoin‘s value below $60,000 has sparked a broader market decline, yet its funding rate suggests a potential increase in price is imminent.

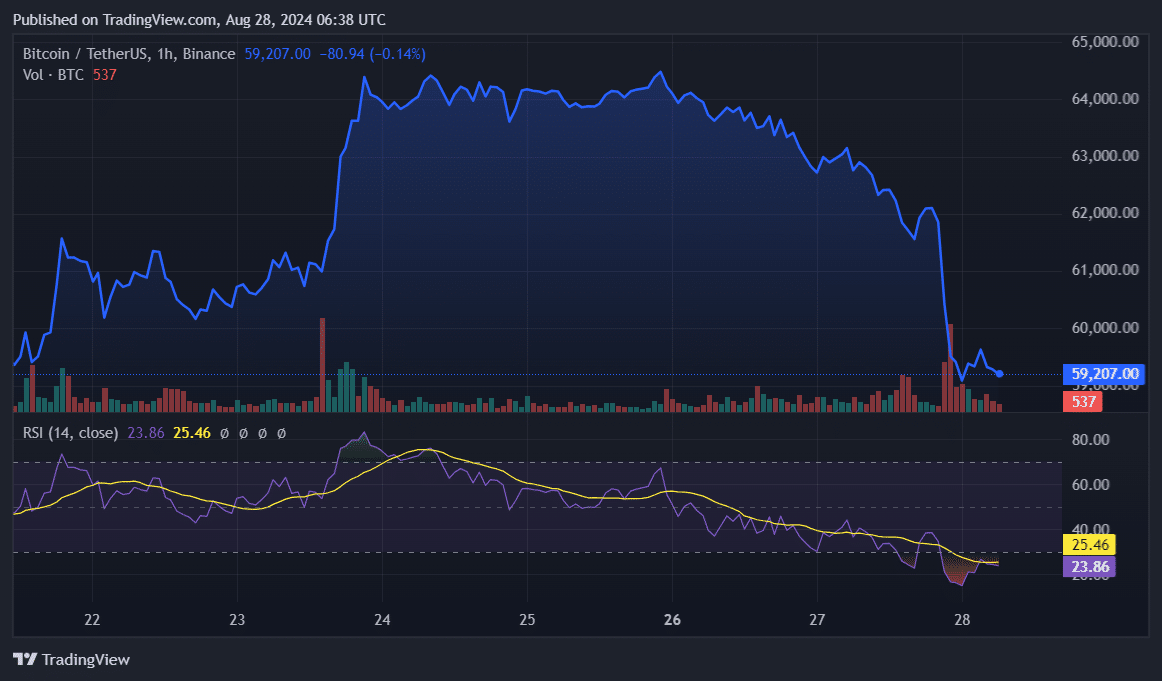

In the last 24 hours, Bitcoin (BTC) experienced a 6% decrease and is currently priced at around $59,200. The daily trading volume for BTC has significantly increased by 46%, reaching approximately $41 billion. Worth mentioning is that the price of BTC briefly dipped to a local minimum of $58,100 amidst widespread fear in the crypto market.

According to a post by CryptoQuant analyst Julio Moreno, it was noted that Bitcoin experienced an increase in exchange inflows on August 27th, prior to the subsequent selloff. Notably, significant Bitcoin holders also contributed to these inflows, as both the cryptocurrency market and the leading asset started to exhibit indications of being overbought.

What is the importance of keeping track of exchange transactions, especially when it comes to Bitcoin? It appears there was a significant increase in Bitcoin inflows to spot exchanges prior to today’s price drop (as depicted in the first graph). Some of this influx seems to have originated from large-scale holders, as indicated by the second chart.

— Julio Moreno (@jjcmoreno) August 28, 2024

As a crypto investor, I’ve noticed some intriguing trends in the Bitcoin market. According to data from crypto.news, the Bitcoin Relative Strength Index peaked at 75 on August 24 and has been steadily dropping over the past four days, now standing at 25. This indicator suggests that Bitcoin is currently oversold at its current price point, potentially indicating a buying opportunity.

Based on information from Coinglass, Bitcoin’s funding rate dropped to a low of 0.004% following a significant market selloff. This rapid change in the funding rate suggests that more trades predicting a decrease in BTC‘s price have been made, as there were approximately $96.5 million worth of liquidations over the last day.

Typically, when there’s a swift change in an asset’s financing cost, its value tends to move in the opposite way. Given this pattern, it’s possible that Bitcoin’s price may experience a brief uptick.

In total, the crypto market witnessed over $320 million in liquidations over the past day — $285 million longs and $35 shorts have been wiped out.

The global cryptocurrency market cap also declined by 7% and is currently sitting at $2.17 trillion with a 24-hour trading volume of $108 billion, per data from CoinGecko.

Keep an eye open for significant economic occurrences and political shifts, as they may have a substantial impact on the financial market.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-08-28 10:16