As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and the current state of Solana (SOL) is no exception. The recent drop in SOL’s price by over 30% from its highest point in 2024 has been a stark reminder of the volatile nature of the cryptocurrency market.

The value of Solana has persisted within a prolonged downtrend, experiencing a decline exceeding 30% from its peak reached in the year 2024.

In simpler terms, the value of Solana (SOL), currently the fifth largest cryptocurrency, is currently at around $145 – a decrease from its highest point this year which was $210. Its market capitalization, which peaked at an impressive $86 billion earlier this year, has now lowered to approximately $68 billion.

As an analyst, I’m observing a downtrend in SOL, which appears to be linked to Bitcoin (BTC) and other popular altcoins. Bitcoin has seen a significant dip of nearly 20% from its Year-to-Date high, and coins such as Ethereum (ETH), Avalanche (AVAX), and Cardano (ADA) have experienced even steeper declines, exceeding 30%. This correlation suggests that the bearish sentiment in the crypto market is impacting these digital assets.

In comparison to Bitcoin, alternative cryptocurrencies such as Solana often experience larger price fluctuations. They tend to perform more robustly when Bitcoin is increasing in value and exhibit significantly poorer performance during a bear market. For instance, Bitcoin increased by approximately 70% from January 1st to March 24th, whereas Solana and Ethereum saw their values increase by over 80% within the same timeframe.

Solana is experiencing a pullback due to stiff competition from Tron (TRX), which recently debuted SunPump, a meme coin creator. Notably, the trading volume on decentralized exchanges (DEXs) associated with Solana has decreased by nearly 9% in the last week, whereas Tron’s DEX volume has surged by more than 210% to approximately $1.7 billion.

The majority of meme tokens associated with Solana have seen a decrease in value. For instance, Dogwifhat has plunged nearly 70% from its peak this year, and Book of Meme (BOME) has dipped approximately 80% from its record high.

Tron now leads Solana across various key metrics in the DeFi sector. For instance, Tron boasts over $8.3 billion worth of assets, a significant increase from Solana’s $5.16 billion. In terms of active addresses, Tron has 2.47 million users compared to Solana’s 1.74 million. Lastly, the total value of stablecoins on Tron is nearly double that on Solana, with approximately $60 billion versus $3.9 billion for Solana.

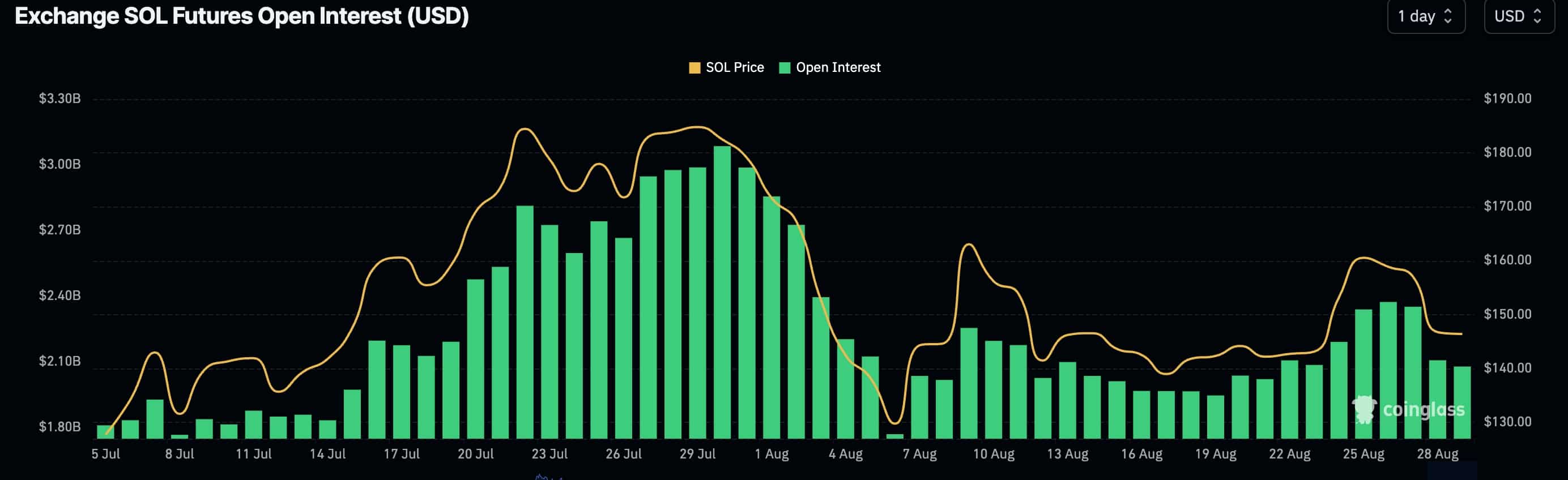

Solana’s futures open interest has fallen

Currently, the demand for Solana’s futures market is on a decline as indicated by the decrease in open interest. Just recently, the peak was at $3 billion in July, but it has since dropped to $2 billion. This suggests a lessening of interest or demand.

The recent dip in Solana’s value can be attributed to the ongoing underperformance of Ethereum-based spot ETFs, as they haven’t gained much traction. In fact, these ETFs have seen a total withdrawal of $481 million and have lost assets for five out of the last six weeks.

Given the current trajectory, it seems probable that prominent firms such as Blackrock, Fidelity, and Franklin Templeton might choose against submitting applications for a Solana ETF, considering the SEC’s hesitance to approve such funds. In fact, this month alone, the agency rejected Cboe Global Markets’ request for a Solana fund through a 19b-4 filing.

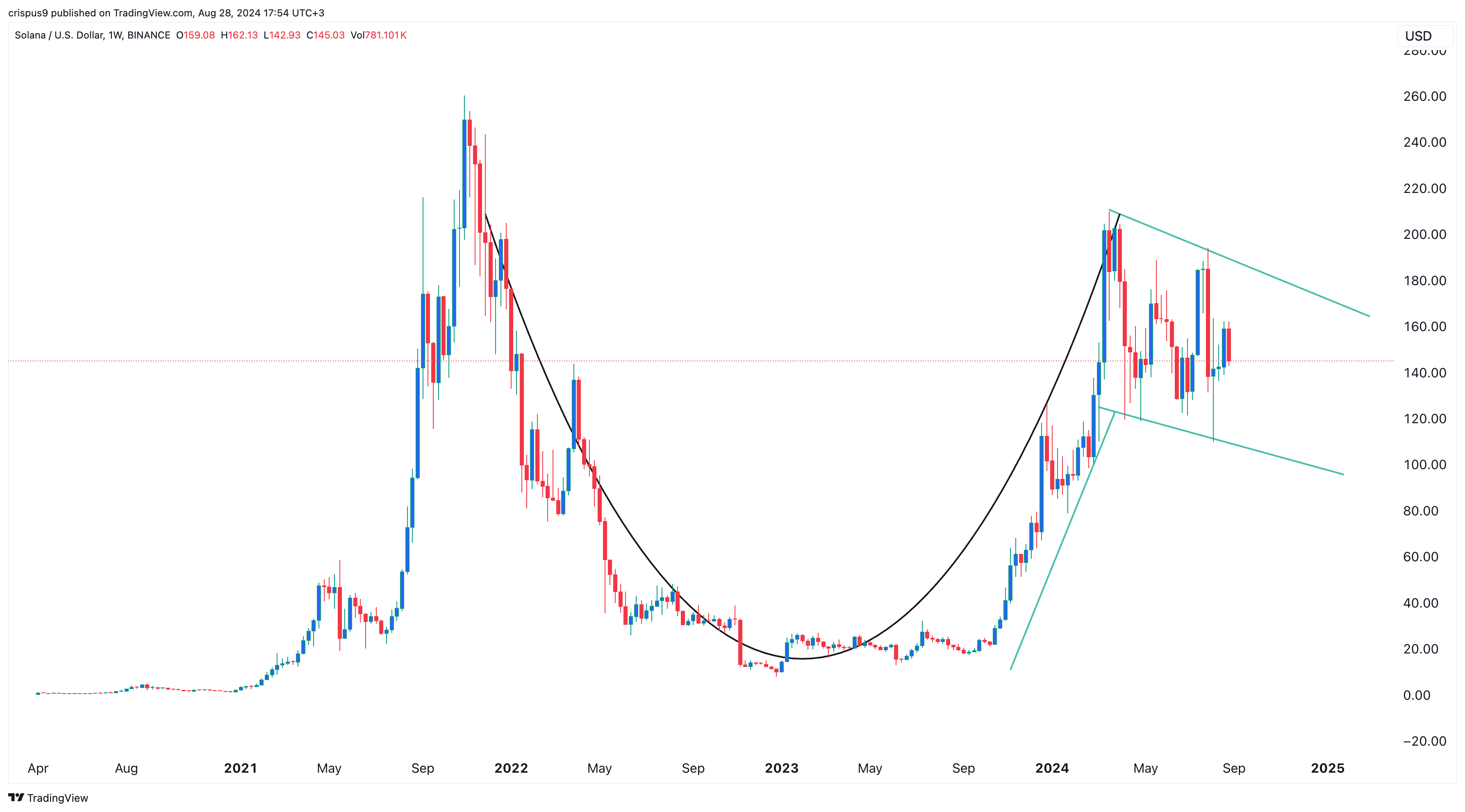

Based on the graph, it appears that the pullback could be contributing to the development of a bullish flag pattern. Additionally, this pullback falls within the ‘handle’ part of the cup and handle pattern as seen on the weekly chart. If these patterns play out favorably, Solana is expected to recover later in the year.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2024-08-28 18:40