As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market cycles and trends. The recent downturn in Bitcoin, while concerning to many investors, is not surprising given the data we are seeing. The movements from dormant addresses, particularly those aged between three months and seven years, suggest that short-term and mid-term holders are cashing out, contributing to the bearish sentiment.

One analyst suggests that a significant factor contributing to Bitcoin‘s recent drop in value could be activities stemming from previously inactive wallets.

As reported by a CryptoQuant analyst, within the last three days, approximately 52,000 Bitcoins that were held for less than three months have been transferred on-chain. Furthermore, an additional 75,228 Bitcoins, aged between three and six months old, have also been moved.

On August 29th, an exchange of 23,345 bitcoins (aged between 1 week and 1 month), 1,220 bitcoins (aged between 6 months and 1 year), and 16,003 bitcoins (aged between 5 years and 7 years) took place, resulting in a sell-off. – By @XBTManager

— CryptoQuant.com (@cryptoquant_com) August 29, 2024

The following assets are held by both short-term and long-term investors. According to CryptoQuant’s statistics, approximately 2,834 Bitcoin tokens that had been inactive for a period of six months to two years have recently become active on the blockchain.

With Bitcoin’s price holding steady under the $60,000 level, it appears that approximately 16,000 Bitcoins, which are between five and seven years old, have recently been put up for sale.

The analyst argues that these actions have been fueling a pessimistic atmosphere across the market, and they should be halted.

When Bitcoins that haven’t been active for a while are transferred, it’s often a sign they will be utilized soon, possibly for transactions such as selling.

CryptoQuant analyst wrote.

Though the funding rate suggests that Bitcoin’s price might increase, an uptick in the quantity of Bitcoin lying dormant may lead to additional declines in its value.

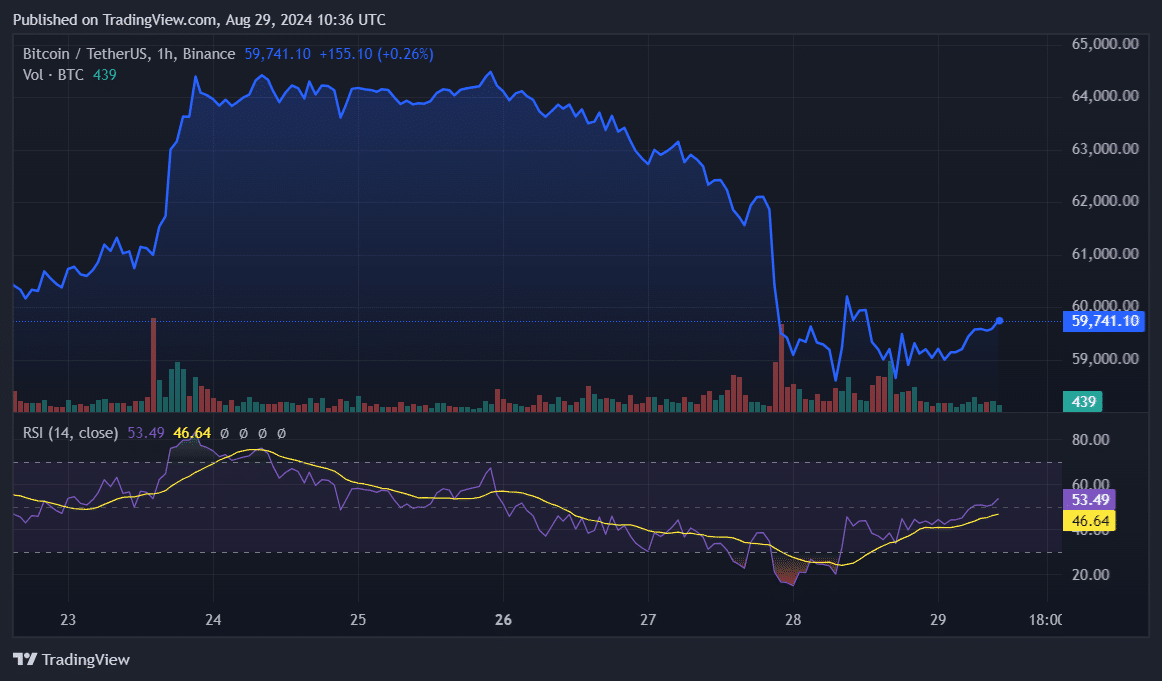

As I’m penning this, it appears that Bitcoin has dipped by 0.2% over the past 24 hours and is presently valued at approximately $59,750. At the moment, its market capitalization hovers around $1.17 trillion with a daily trading volume of roughly $33 billion.

According to information from the crypto.news price page, the Bitcoin Relative Strength Index remains around 46, indicating that the cryptocurrency is overbought at its current price level. However, it’s approaching the neutral zone as Bitcoin hovers close to $60,000.

Read More

2024-08-29 14:02