As a seasoned researcher with a background in social media and digital currencies, I find myself captivated by the intriguing intersection of technology, law, and human behavior that the recent events surrounding Pavel Durov and Telegram have highlighted. The Streisand Effect, as we all know, has a knack for turning even the most discreet matters into global headlines, and this case is no exception.

On August 24, 2024, French police detained Pavel Durov, the creator of Telegram, on allegations of illegal activities related to his messaging service. However, several people see this action as a threat to free speech. This viewpoint has sparked what’s known as the Streisand Effect, inadvertently boosting the visibility and user base of both Telegram and its digital currency, Toncoin.

Table of Contents

Understanding the Streisand Effect

As a crypto investor, I’ve learned about the Streisand Effect – a fascinating phenomenon that occurs when attempts to hide or silence information actually draw more attention to it. This term was coined in 2003, following Barbra Streisand’s unsuccessful attempt to prevent the release of pictures of her house. Instead, her actions sparked widespread interest in those images, making them far more popular than they would have been otherwise. Numerous real-life instances and theories support this concept, showing that trying to censor or suppress information can often backfire and amplify its impact.

For example, a research article from the International Journal of Communication shows that when information is tried to be suppressed, it tends to spread further and gain more attention than if it were not censored. This happens because the very act of attempting to conceal information piques people’s curiosity, thereby making the information more noticeable.

After Pavel Durov’s arrest, the same situation occurred with Telegram and Toncoin. Although Durov works with authorities to a degree by removing certain content, he has persistently resisted compromising on privacy concerns or limiting freedom of speech. This stance has led to increased attention towards Telegram in various nations like Russia, Iran, and more recently France, where his arrest is perceived as an attempt to push him into more collaboration regarding these delicate issues.

Telegram and Toncoin post-arrest analysis

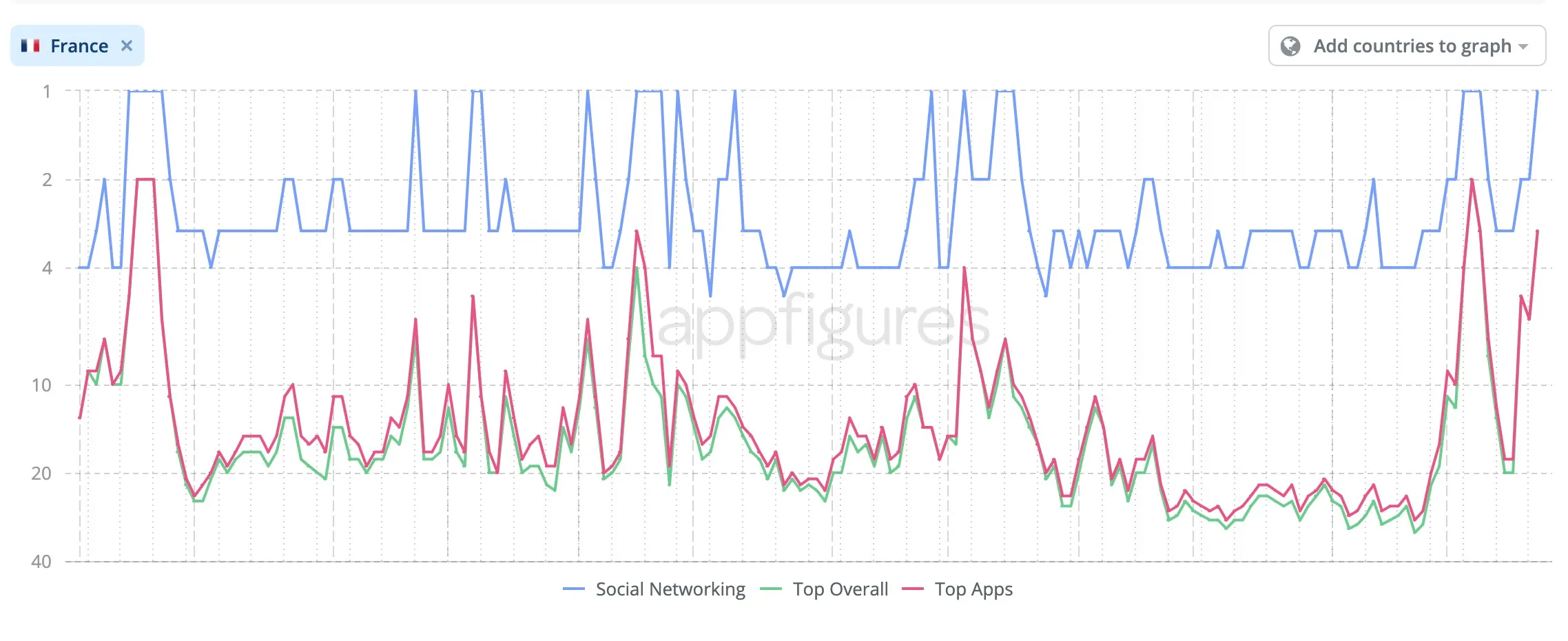

Amidst the news about Durov’s legal issues, the popularity of Telegram soared due to heightened public curiosity. By August 26, 2024, only two days following Durov’s detention, Telegram had climbed to the second position in the U.S. App Store’s Social Networking rankings, seeing a 4% surge in global iOS downloads. In France, where Durov was held, the app rose to the top of the Social Networking category and ranked as the third most popular app overall.

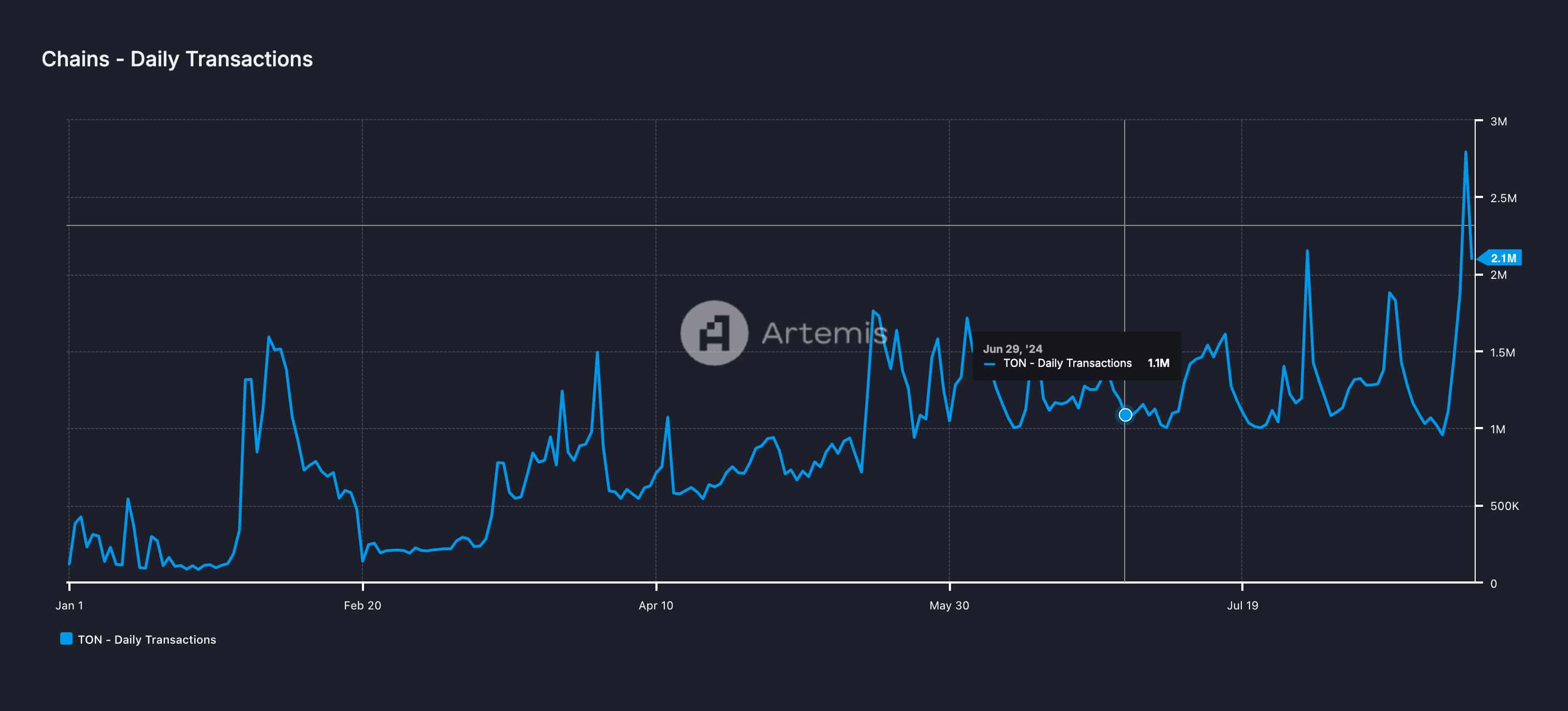

Analyzing Toncoin, it appears that the events surrounding Pavel Durov’s arrest have similar impacts as those seen with Telegram. By August 26th, daily transactions on the Toncoin blockchain surged by a significant 192%, peaking at around 2.8 million. This figure represents the highest level this year and is only second to the all-time high for the blockchain.

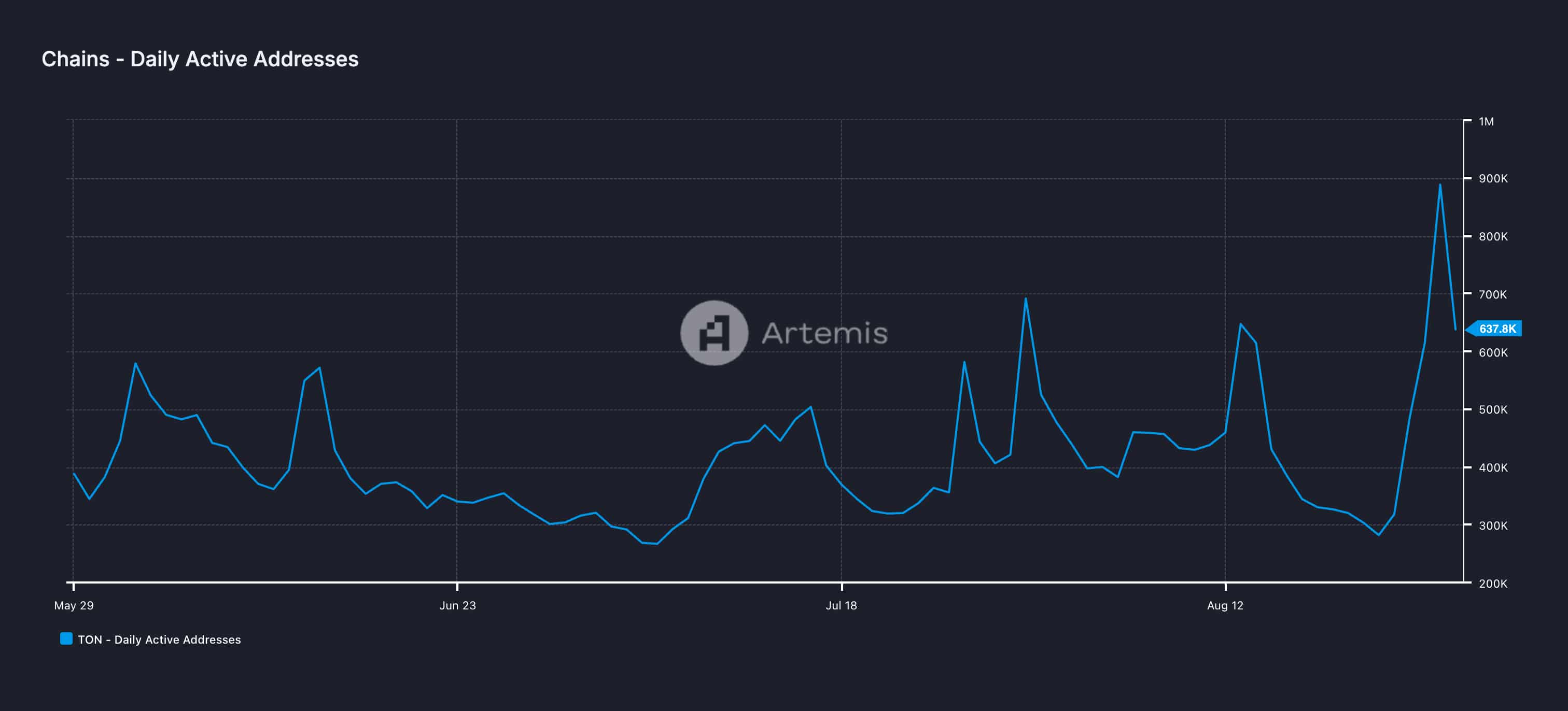

On a daily basis, the number of active addresses experienced a significant jump, reaching an unprecedented peak of 888,900, marking a 215% rise.

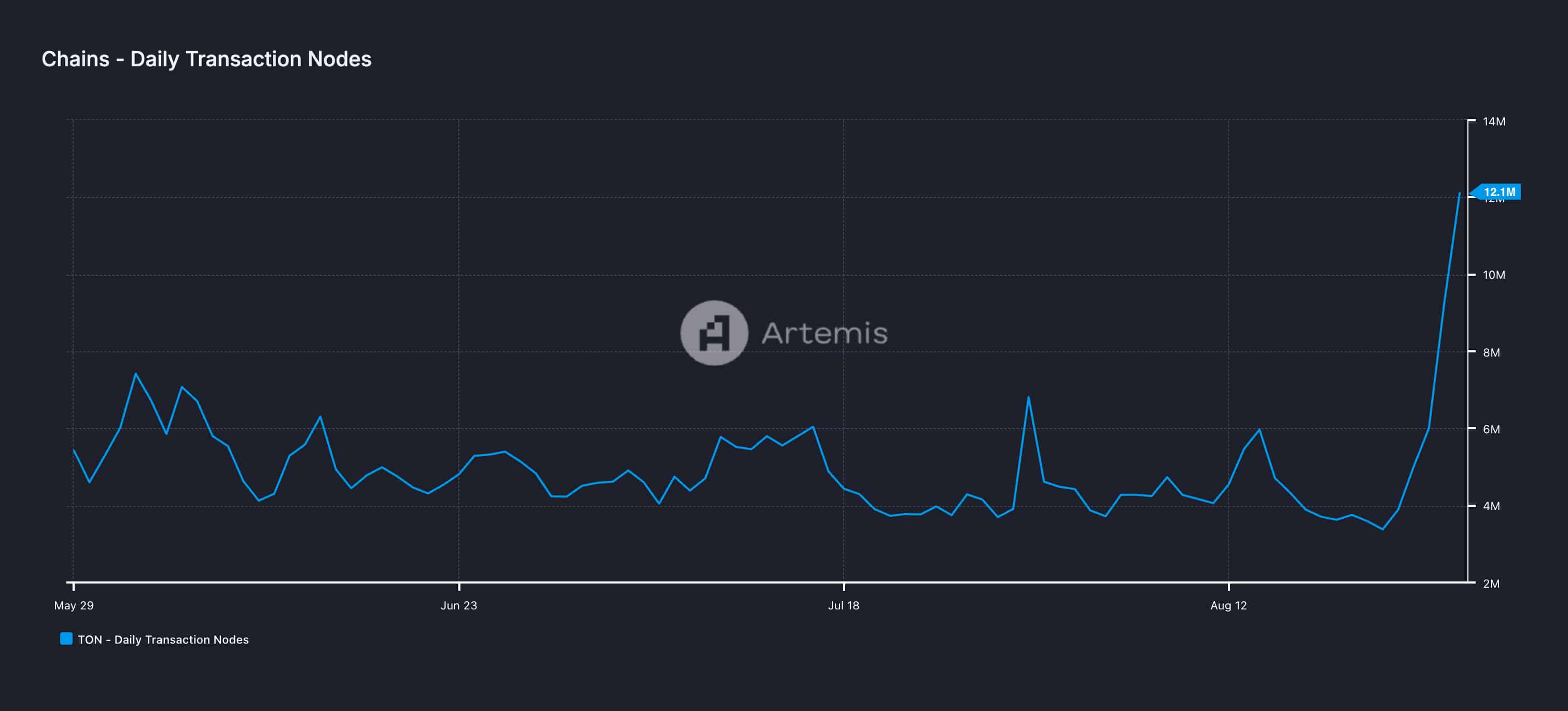

Moreover, there was a significant rise of 174% in daily transaction nodes, bringing the total to an all-time high of 9.3 million for this year, which is only surpassed by a previous record in the blockchain’s history.

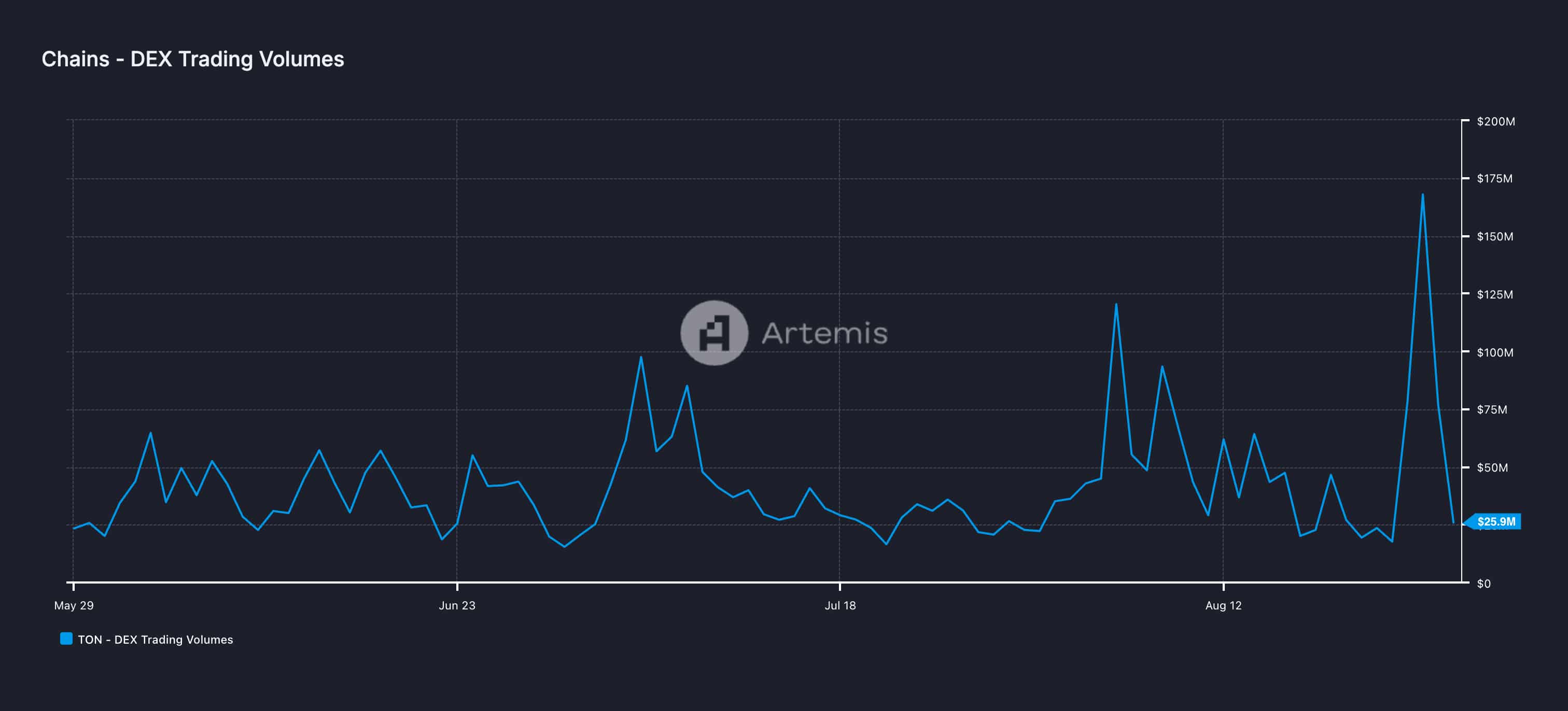

To add to that, the trading activity on Toncoin’s decentralized platforms experienced a significant spike. The volume soared by an impressive 849%, peaking at a record high of $167.9 million.

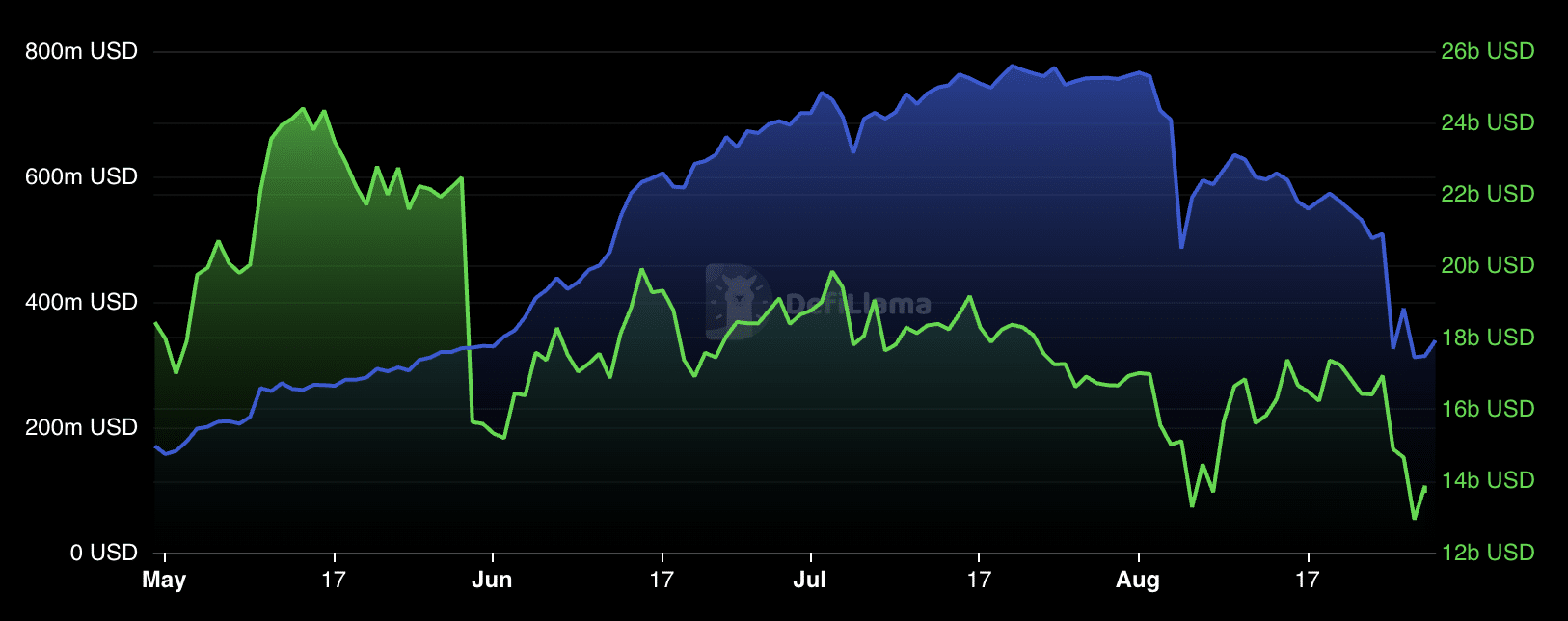

While Toncoin may seem like a beacon of light and color, it’s important to note that not everything is smooth sailing for this cryptocurrency. The Total Value Locked (TVL) within its decentralized applications has experienced a significant decrease of 39%, bringing the current TVL to approximately $312 million. However, it’s not just negative news that’s causing this drop – while it does play a role, it’s not the sole reason.

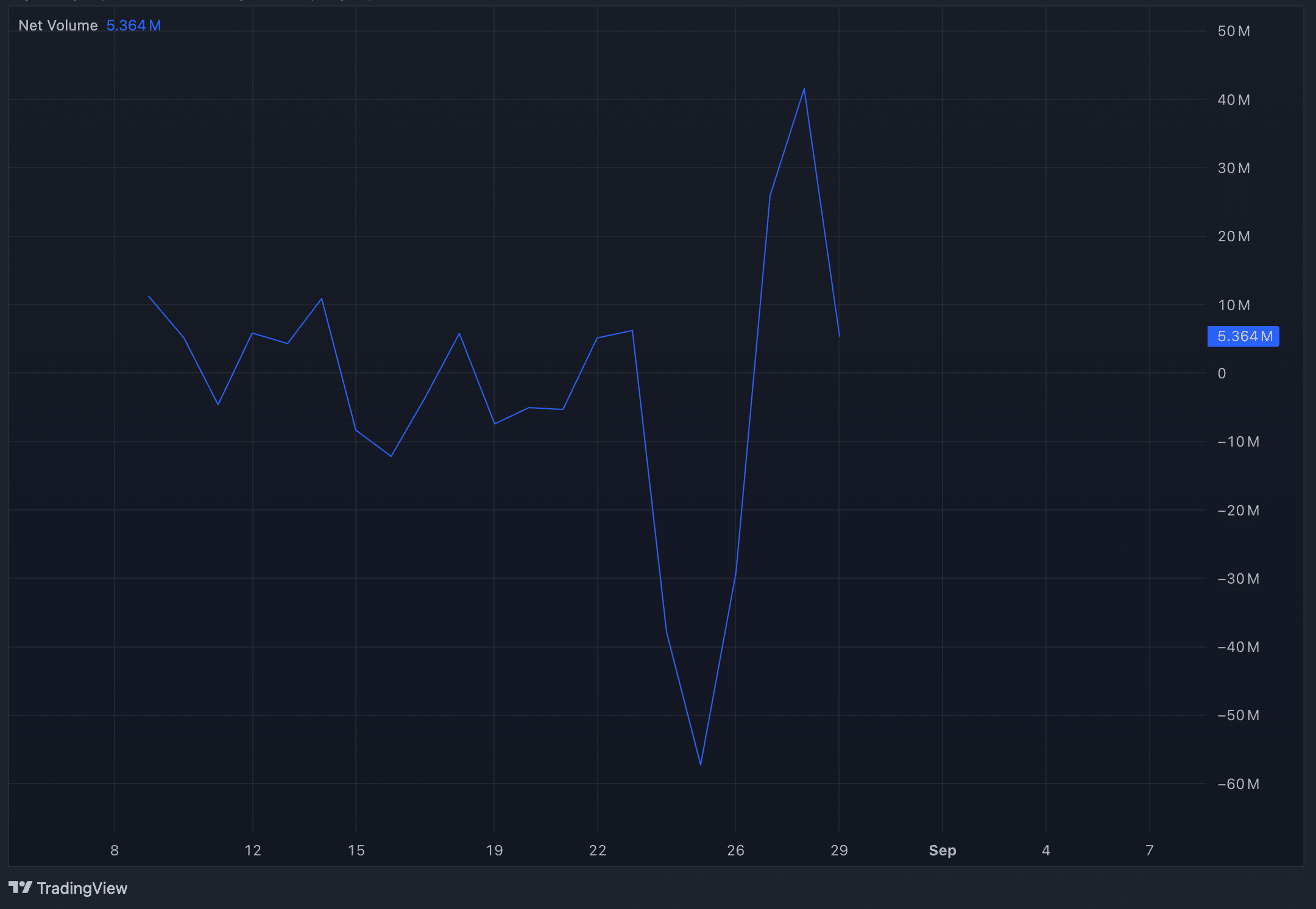

As a researcher examining the market trends of TON, I’ve noticed an intriguing pattern. It appears that some users might have been withdrawing their assets from dApps, potentially offloading them. However, surprisingly, despite this apparent selling pressure, Binance, the leading exchange for TON by volume, experienced a temporary dip in net volume from -$37.83 million to -$57.26 million on the day of Durov’s arrest. Interestingly, this negative volume quickly turned positive, rising to $41.57 million by August 28, representing nearly a $100 million swing back into positive territory. Similar trends were observed on other significant exchanges like OKX and Bybit, where TON also switched from negative to positive net volumes during this timeframe.

Where do Telegram and Toncoin go from here?

It’s intriguing to watch how Pavel Durov’s arrest and the ongoing investigation could influence the future trajectory of Telegram and Toncoin. Whether the increased user engagement and transaction volume on both platforms will lead to long-term growth or simply be a short-lived response to media coverage is yet to be determined. However, one fact remains undeniable: any changes affecting Telegram are bound to have repercussions for TON too.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-08-30 12:26