As a seasoned analyst with over two decades of experience in the financial markets under my belt, I’ve witnessed countless trends and fluctuations that have shaped the landscape of various asset classes. The recent surge of Sun Token (SUN) has caught my attention, and it seems worth delving into its current position and potential future trajectory.

Sun Token has quickly moved into the ranks of the top 300 cryptocurrencies, thanks to a remarkable monthly surge. However, a decrease in open interest and trading volume indicates that its upward trend might be slowing down.

Over the last month, Justin Sun’s digital currency, known as Sun Token (SUN), has emerged as one of the standout performers. This surge is attributable to a significant 240% rise, with investors expressing enthusiasm following the growth and development of the ecosystem.

Sun Pump’s native token, SUN, functions similarly to Pump.fun’s meme coin deployed on the Solana network. Essentially, both serve as utility tokens within their respective platforms, which are designed for meme coin launches.

As an analyst, I’ve been tracking the trajectory of SUN Token since it was initially introduced as a Bitcoin alternative nearly five years back. However, the year 2021 presented a significant challenge for SUN due to an oversupply predicament. This setback prompted us to reposition our strategy towards decentralized finance on platforms such as Justswap and Justlend. Now, with these new applications in play, our goal is to expand our market capitalization to a whopping $1 billion.

On August 25th, the value of Sun Token reached a record high of $0.0435, marking its highest point since December 2021. This represented an impressive surge of 731% compared to its lowest point in 2023. Additionally, its market capitalization has experienced significant growth, increasing from $101 million on August 17th to over $326 million.

Justin Sun has significantly contributed to this growth spurt through tactics like leveraging meme-tokens and adjusting transaction fees. Notably, his recent innovation, SunPump, has outpaced Pump.fun (which runs on the Solana network) in terms of daily active users and earnings, as of August 21st.

Lately, Justin Sun responded to critics who spoke negatively about the SUN token via a post on his account. To combat the negative comments, he proposed buying back any SUN tokens they held for 3 cents apiece.

Traders are hopeful that Sun’s environment might serve as a significant catalyst for growth, likening it to Solana’s Raydium network. In a similar situation, Raydium’s memecoins gained traction. During this time, Raydium ranked among the top ten decentralized exchanges, processing billions in trading volume every month.

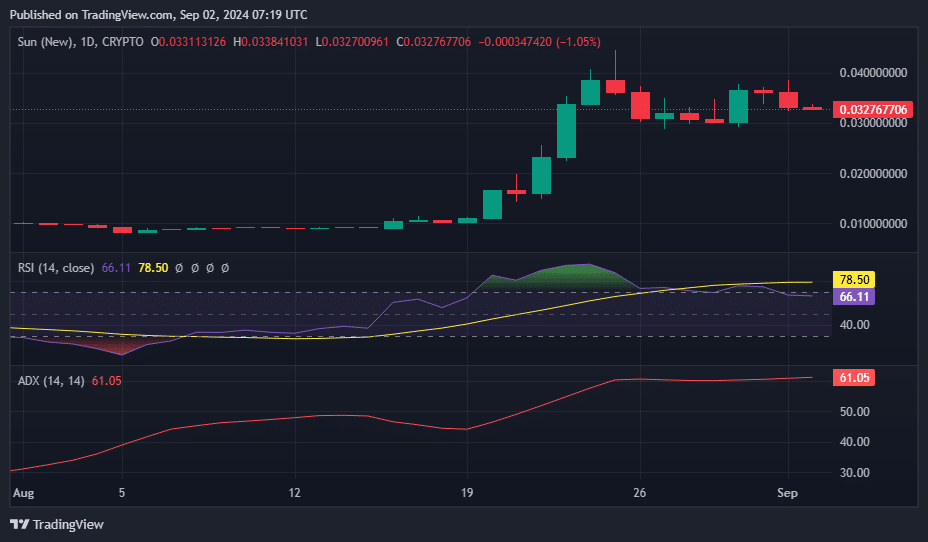

SUN price action

Although Sun Token saw the highest growth among tokens in the past month, it experienced a decrease of 7.2% over the last 24 hours. In the same timeframe, its 24-hour trading activity decreased by approximately 30%, with a volume of around $127 million.

According to Coinglass data, SUN‘s overall open interest decreased by approximately 17.89% within the past day, going from $84.64 million to $69.51 million. This suggests a decrease in trader enthusiasm as the broader cryptocurrency market saw a 2.1% drop, resulting in a total value of around $2.11 trillion.

Data from the market intelligence platform also shows that SUN’s aggregated funding rates are currently at -0.0348%, signaling a bearish sentiment among traders regarding SUN’s price outlook.

The Average Directional Index (ADX) has reached a peak of 61.05, its highest level since June 6, indicating robust momentum, as values above 50 generally signal strength.

Currently, the Relative Strength Index is indicating an extremely overbought condition for SUN. This implies that although SUN might keep climbing temporarily, it’s possible that a price reversal is imminent as traders begin to cash out their gains, signaling a potential shift in market direction.

Keep an eye on the significant support level at $0.030 for Sun’s price. If it dips down to this point, it could potentially be a good time to buy, anticipating a possible recovery. But if it can’t maintain this level, the price might tumble as low as $0.013. On the other hand, if the positive trend persists, Sun could ascend to approximately $0.050.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-02 11:08