As a seasoned crypto investor with a few battle scars from past bear markets, I find myself bracing for the chill of September once again. The increased liquidations and market capitalization drop are all too familiar signs that have graced my screen every year since the dawn of Bitcoin.

Just as anticipated, the initial downtrend in September led to a higher level of sell-offs within the cryptocurrency market.

As per information from Coinglass, the overall crypto liquidation figure has surged by an impressive 176% over the last 24 hours, reaching a staggering $155 million at present. A significant portion of these liquidations, approximately $45.6 million, can be attributed to Bitcoin (BTC). More specifically, this amount consists of long positions totaling $36.7 million and short positions accounting for $8.9 million.

In data from Coinglass, it was observed that a total of approximately $39.7 million worth of Ethereum (ETH) positions were liquidated. This included the closing of $32.2 million long positions and $7.5 million short positions.

Over the last 24 hours, there’s been a rise in sell-offs within the crypto market, as its total value has decreased by approximately 2.7%. Currently, it stands around $2.1 trillion, based on information from CoinGecko.

As a crypto investor, I’ve noticed a slight dip today: Bitcoin fell by 1.5%, now sitting at around $57,500 as I pen this down. Similarly, Ethereum dipped by 2%, trading at approximately $2,440 in the current market.

According to data from Coinglass, it was Binance, the top crypto exchange for trading volume, where a massive liquidation order for approximately $10 million in the Bitcoin-Tether (BTC/USDT) pair took place.

Binance saw a total of $74.5 million in liquidations, followed by OKX’s $49.9 million.

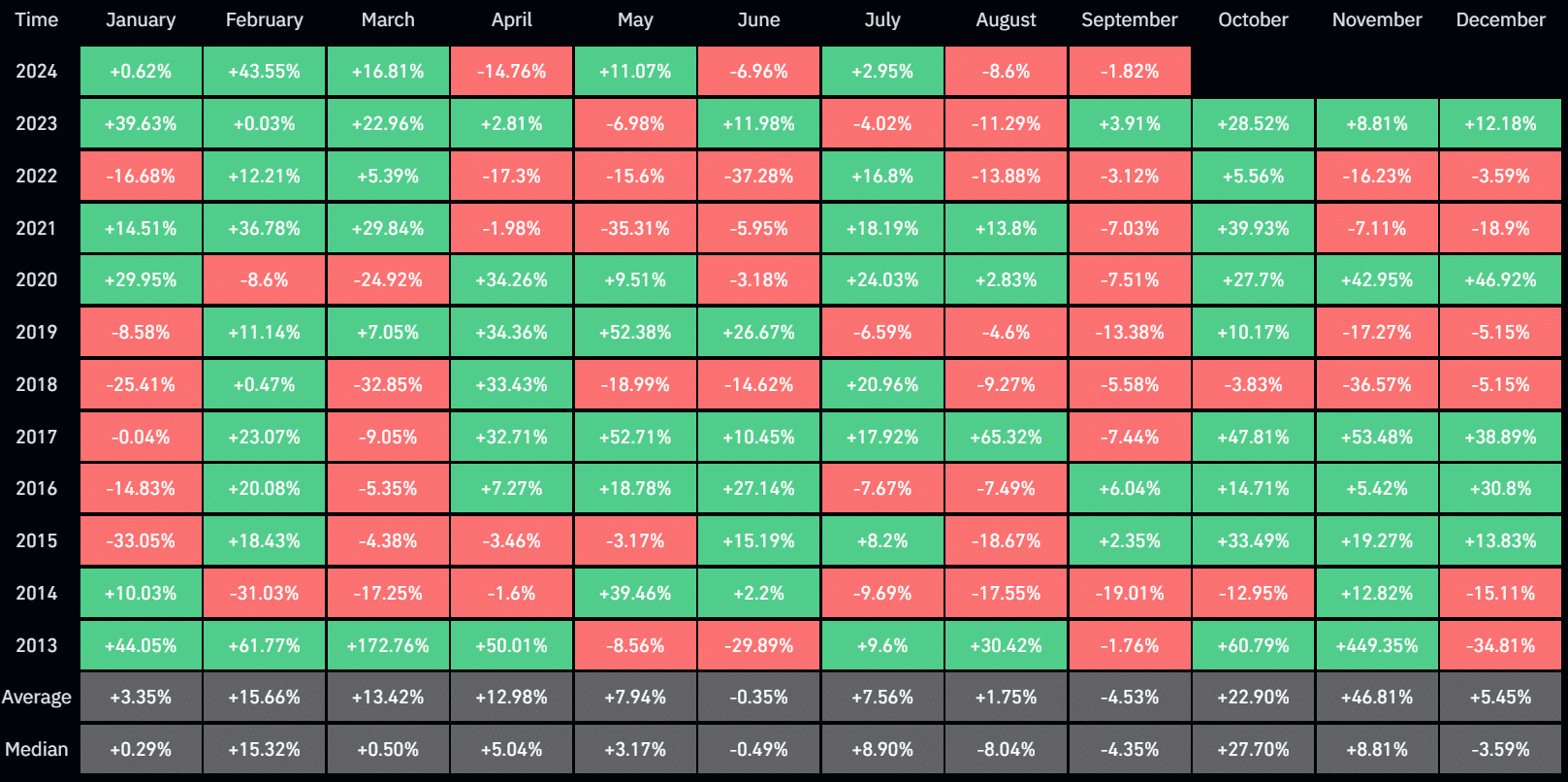

Based on data from Coinglass, it’s typically bears (those who expect prices to fall) that have had the upper hand in September. The Bitcoin price has generally shown a downward trend in eight out of the last 11 years during this month. On average, Bitcoin has decreased by approximately 4.53% over the past 11 years in September.

To put it simply, Bitcoin’s value showed a downward trend during the third quarters of both 2022 and 2023. According to Coinglass, there was a decrease of 2.5% in Q3 2022 and a more significant drop of 11.5% in Q3 2023.

Keeping tabs on larger economic happenings remains crucial, as they might have the power to shift the market’s course.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-09-02 12:05