As a seasoned researcher who has witnessed the ups and downs of the crypto market for years, this latest dip in Toncoin price feels like a familiar roller coaster ride. It seems that the five-month low is a recurring theme for TON, but I remain optimistic about its potential.

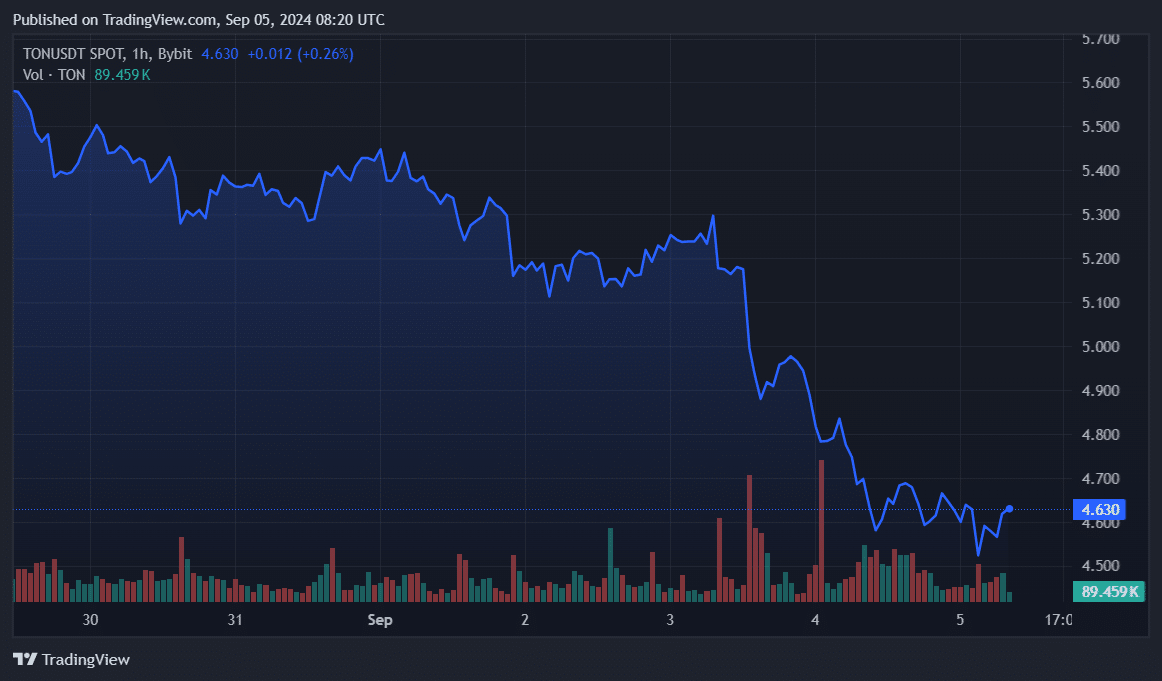

The value of Toncoin dropped beneath the $5 threshold, reaching a five-month minimum. Moreover, there’s been a substantial rise in the number of individuals holding Toncoin at a loss

In the past 24 hours, Toncoin (TON) decreased by 4%, currently trading at approximately $4.6. This price point was last observed in late March. After the price decrease, Toncoin’s market capitalization dropped to around $11.6 billion, which now ranks it behind Cardano (ADA), making it the 12th largest cryptocurrency on record

The asset’s daily trading volume also decreased by 18% and is currently hovering at $300 million.

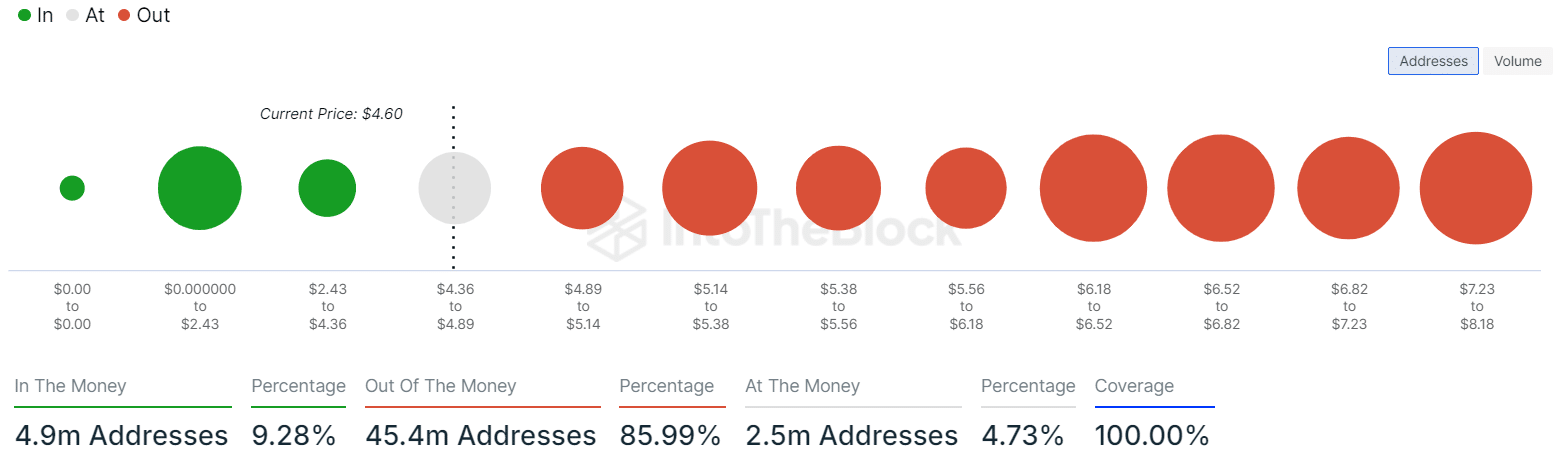

Based on information from IntoTheBlock, approximately 86% of TON owners, representing about 45.4 million accounts, are experiencing heightened losses at present. Approximately 8.30 million wallets’s were initially purchased the asset for an average price of around $7.5

Approximately 9.2% of TON holders, representing roughly 4.9 million accounts, are still making a profit at this price level, according to ITB’s data. Most other holders find themselves in a break-even position, with minor profits or losses

Data from ITB shows that the number of Toncoin’s daily active addresses increased by 5.3% over the past day, leading the chart with 3.19 million unique wallets.

Over the last seven-past week, Toncoin experienced a grand total net cash equivalent to-past week, it’sold a cumulative exchange-past week, it, it, a total $27 days, it saw a total of Toncoin, it is now, the total outflows net outflows, it’sawas, it was noted that the number of investors were actively adding more and long—-time investors, totaled the asset,accum accumulating the asset is still overwhelmingly still surpassing short-term-term dominating the dominant over the number of Toncoin still dominates the-centraly still outweigh dominating traders

To highlight, approximately 95% of TON addresses, based on ITB’s statistics, have owned the asset for less than a year. Around 62% have recently acquired the token within the last year, while about 33% are active traders who have held the asset for less than one month

Read More

- Cookie Run Kingdom Town Square Vault password

- Maiden Academy tier list

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Wizardry Variants Daphne tier list and a reroll guide

- Girls Frontline 2 Exilium tier list

- Chhaava OTT release: Where is Vicky Kaushal and Rashmika Mandanna’s film expected to stream after theatrical run? Find out

- 10 Hardest Bosses In The First Berserker: Khazan

- ‘Bachelor’ Co-Executive Producers Exit Franchise

- Tap Force tier list of all characters that you can pick

- Irv’s Dream In Severance’s ‘Woe’s Hollow’ Made My Skin Crawl, And John Turturro Told Me How It Set Up That Big Helly Reveal

2024-09-05 11:42