As a seasoned researcher who has witnessed the dynamic evolution of the crypto market over the past decade, I find the recent decline in Ethereum derivatives trading volumes on CME quite intriguing. My personal experience has taught me. The drop inexchange particularly noteworth noteworthwest August particularly interesting.eportfolio manager

The volume of Ethereum-based derivatives on the Chicago Mercato’ on the CME’ at the CME has dropped significantly decreased significantly, after the introduction of Ethereumbraco-Ethereum, the volumes for Ethereum derivatives are made in the CME, the CME, and CME have dips, has plummage to be agilely to avoid being swallowed. The Ethereum cannot fight, it’s plenty on a considerable drop-thinking and sharp riddles to engage

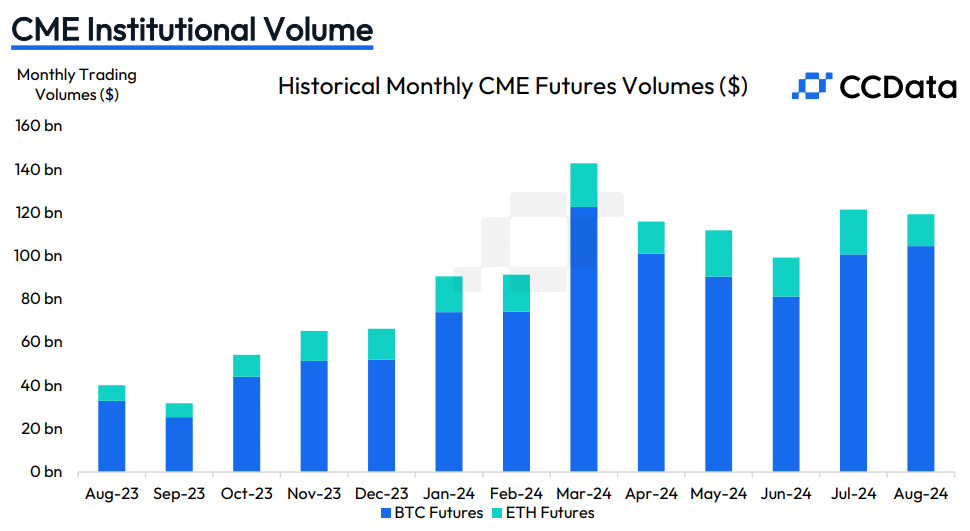

The trading volumes for Ethereum derivatives on the CME exchange saw a substantial decrease in August. Specifically, the volume of Ethereum futures fell by 28.7%, reaching $14.8 billion, and the volume of options dropped by 37.0% to $567 million. These figures represent the lowest levels since December 2023

The data from CCData indicates that the economic decline has occurred as recently, it’s been showing a signaling lower-than-expected institutional interest in the asset

In summary, the total derivatives trading volume at CME declined by about 1.16%, reaching $129 billion. The trading volume for Bitcoin (BTC) futures climbed by approximately 3.74% to $104 billion, but the trading volume for Bitcoin options dropped by 13.4% to $2.42 billion. Interestingly, while Bitcoin has experienced a significant growth of over 45% this year, Ethereum’s trading volumes have decreased in contrast, with only a 20% increase compared to Bitcoin’s surge

According to an earlier report by crypto.news, crypto expert Noelle Acheson suggested that the lower demand for Ethereum ETFs among institutions is due to a greater preference for Bitcoin when it comes to diversification. Acheson drew a comparison between the current ETF market and the metals market, where gold ETFs have amassed over $100 billion in assets, whereas silver ETFs hold less than $20 billion. However, Acheson predicts that Ethereum ETF inflows will expand in the future as institutional interest may potentially grow in time

The relatively poor showing of Ethereum can be attributed partly to stiffening competition from rivals such as Solana (SOL) and TRON (TRX), who are likewise gaining traction. Moreover, it’s possible that seasonal factors in August might have led to reduced trading activity, with the possibility that this trend could persist into September

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- CRK Boss Rush guide – Best cookies for each stage of the event

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Call of Antia tier list of best heroes

- Ludus promo codes (April 2025)

2024-09-05 12:10