As a seasoned analyst with a decade of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent upward trend in Cardano (ADA) and Quant (QNT) prices. While these tokens have had a tumultuous ride this year, their resilience is evident as they continue to attract investor attention.

On September 8, both Cardano and Quant experienced an upward trend in their prices as the temporary crypto market downturn showed some signs of improvement.

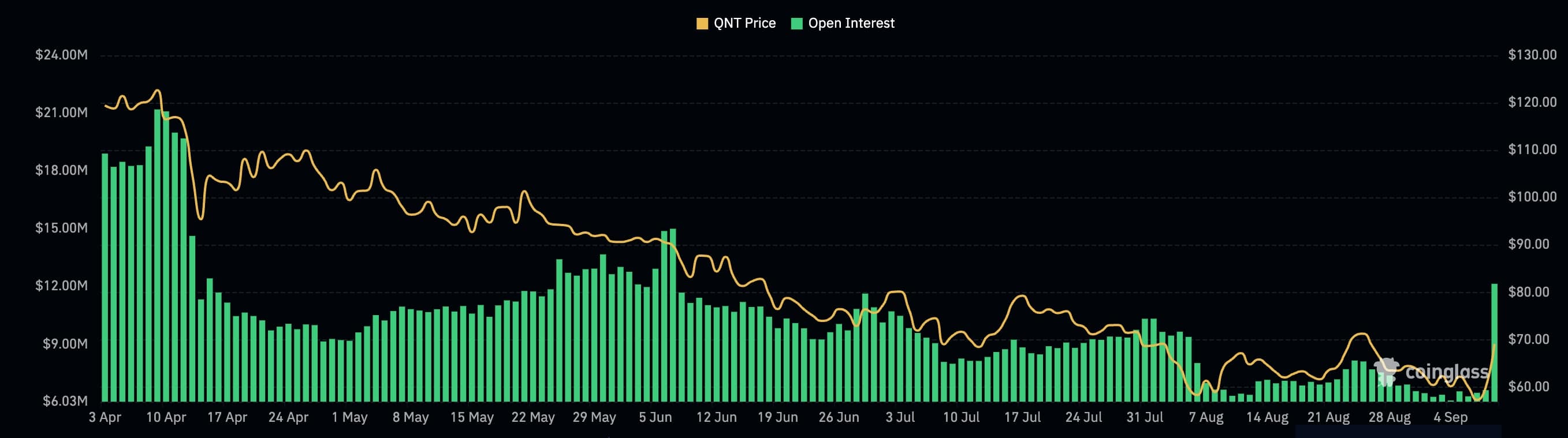

For two days straight, the QNT token experienced an increase, peaking at $70 – its highest spike since August 26th. This surge represents a jump of more than 23% from its recent low last week, but it still lags behind its peak this year by approximately 54%.

Cardano and Quant have higher wallet activity

Cardano (ADA) rose to $0.3390, much higher than Friday’s low of $0.30. Like other coins, it has dropped by almost 60% from the year-to-date high.

The price of these digital tokens increased slightly due to a decrease in the intensity of Bitcoin‘s (BTC) price drop. On Friday, Bitcoin dipped to $52,900, but by Sunday it had rebounded to $54,500, as some investors took advantage of the lower price. Normally, alternative cryptocurrencies follow the trend set by Bitcoin’s price movements.

The costs for Cardano and Quant increased, as it appears that there’s been an increase in transactional activity from more addresses – a sign that some investors might be amassing these assets, which could potentially trigger a price rebound, according to Santiment’s analysis.

Traders are eagerly watching for Bitcoin/crypto market recovery, and three noteworthy tokens – Cardano, Quant, and Holo – have recently experienced increased activity at their addresses. Historically, a sudden rise in activity for declining assets can signal an upcoming bounce. 📈

— Santiment (@santimentfeed) September 7, 2024

An additional piece of information is that the open interest in Cardano’s futures market is increasing. According to data from CoinGlass, the open interest reached approximately $177 million on Sunday, marking the third straight day of growth.

On Saturday, the number of active Cardano addresses surpassed 31,000, marking an increase compared to the previous day’s figure of $167 million, as per DeFi Llama’s data.

Just like Quant’s futures open interest, it skyrocketed to a peak of $12.15 million, the highest point since June 7, and significantly surpassing the previous week’s minimum of $6.50 million.

Futures open interest is an important metric in the financial market because it shows the volume of unfilled orders.

Quant, Cardano: Big players in crypto

As an analyst, I find myself regularly examining two significant contenders within the dynamic landscape of cryptocurrency: Cardano and Quant. Cardano, boasting a market capitalization of approximately $12 billion, currently ranks as the 11th coin. Its vision is to emerge as a robust and innovative alternative to Ethereum (ETH).

Despite the passage of time, this network has faced challenges in drawing in developers and users. Consequently, it boasts only a few DeFi dApps and a total value locked amounting to $191 million. Compared to newer layer-1 and layer-2 networks such as Arbitrum and Sui, its size is relatively smaller.

The developers recently launched the Chang hardfork, which its developers hope will lead to more activity.

Quant is a unique network designed to aid businesses in creating blockchain-powered apps, particularly focusing on financial transactions and payment services.

In many instances, it’s recognized as a leading contender within the rapidly expanding field of Real World Asset tokenization, thanks to its groundbreaking overledger technology.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Maiden Academy tier list

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Fortress Saga tier list – Ranking every hero

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-08 19:58