As a seasoned researcher with a knack for deciphering the intricacies of blockchain technology and the crypto market, I find myself constantly amazed by the dynamic nature of this ever-evolving landscape. The recent surge in Polygon’s price, propelled by the successes of Polymarket and Pokemon Cards, is a testament to the power of innovation and community engagement in driving adoption and value.

This week, the value of Polygon coins kept increasing, boosted by impressive performances from both Polymarket and Pokemon Card markets.

In the past week, Polygon (POL) experienced an increase of more than 12%, reaching a peak price of about $0.4200. This growth propelled its total market capitalization above $1.3 billion.

The event took place when the system underwent an update and switched its token from MATIC to POL. Following the upgrade, POL emerged as the native and staking token for the Polygon Proof-of-Stake network. In due course, it will serve as the primary token for AggLayer.

The token is experiencing an upward trend alongside the continuous expansion of its ecosystem. Notably, Polymarket, one of the leading prediction platforms, has exhibited significant growth recently. As indicated by statistics from SimilarWeb, the site attracted over 13.8 million visitors in August alone, representing a 52% surge compared to July.

The amount of money in the network has also been growing. The presidential election winner prediction market holds almost $900 million in assets, while the popular winner prediction has $201 million.

According to DeFi Llama’s data, Polymarket currently holds more than $122 million in total assets and accounts for approximately 82% of the market share within the prediction market sector. This trend is expected to persist as the platform gains wider recognition, with notable media entities like CNN and Bloomberg highlighting it.

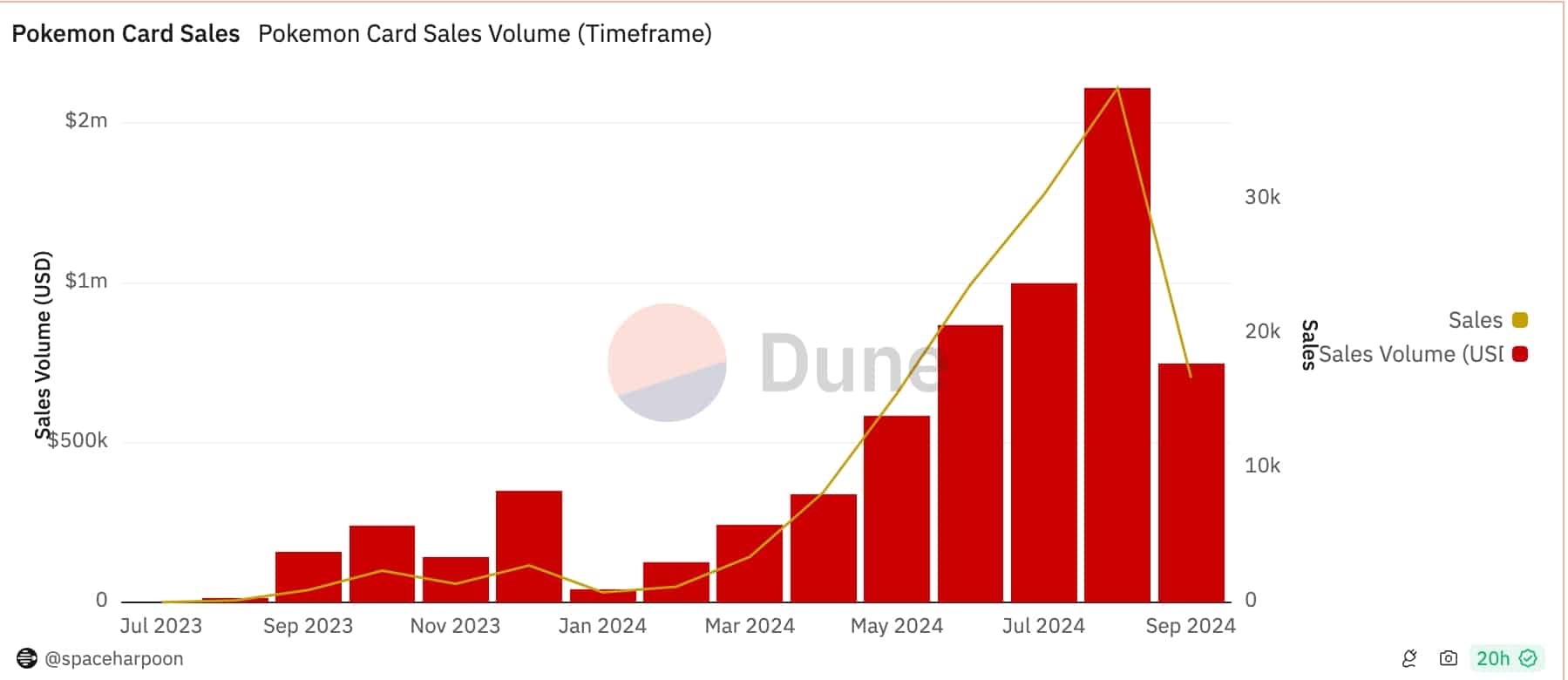

At present, transactions for Pokemon Cards as NFTs are performing quite well. According to Dune Analytics, the monthly sales volume hit a new peak of $1.6 million in August, which is an increase from the $1 million recorded in July. So far in September, sales have totaled approximately $749,000.

Over the past month, the overall value locked within Polygon’s DeFi system has increased by approximately 2.46%, reaching a total of $861 million. Conversely, the value represented in Ethereum (ETH) decreased by around 10%, while both Arbitrum and Base experienced a decline of over 2% during the same timeframe.

Nevertheless, it appears that Polygon’s dominance in the decentralized exchange sector has been waning. Over the past week, the trading volume of coins on its blockchain decreased by 12.2%, reaching approximately $476 million. On the other hand, networks like Base and Arbitrum, which are also widely used, handled transactions worth around $3.18 billion and $3.2 billion respectively during the same timeframe.

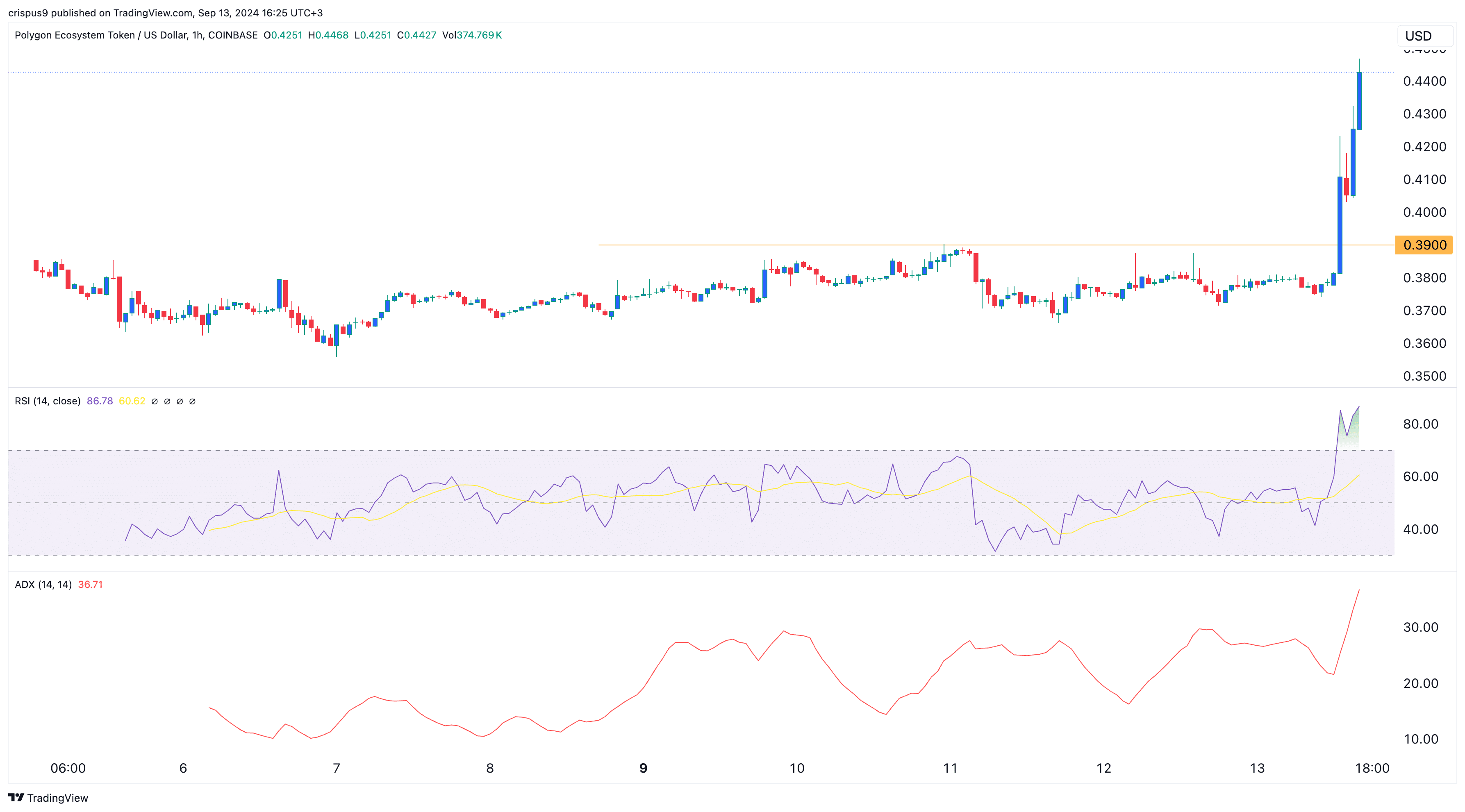

Polygon flips key resistance, gets overbought

Following its debut last week, the POL token entered a period of consolidation. However, this trend changed on September 13th, Friday, as the token experienced a surge, breaking through the significant resistance level at $0.3900, marking its highest peak on Sept. 10.

In simpler terms, the Average Directional Index (ADI), a widely used trend measurement tool, increased to 36. At the same time, the Relative Strength Index (RSI) surpassed the overbought threshold of 87. Given these indicators, it’s possible that POL could experience a pullback soon because of profit-taking activities, potentially leading it to retest its support level at $0.40.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-09-13 17:06