As a seasoned analyst with over two decades of experience under my belt, I must admit that the recent surge in Nervos Network’s CKB token has caught my attention. The 111% increase in just seven days is nothing short of impressive, especially considering its listing on Upbit and the subsequent spike in demand.

In just seven days, the value of Nervos Network’s own cryptocurrency, CKB, has skyrocketed by more than 111%, primarily due to its recent addition to the South Korean trading platform, Upbit.

On September 16th, a surge in its price made Nervos Network (CKB) stand out as the highest-performing cryptocurrency within the top 100 digital assets ranked by market value. This dramatic increase propelled its price from $0.159 to $0.0176 on that day.

The token’s value has reached a peak not seen since June 10, pushing its market cap up to an impressive $729 million. This places it among the top 92 most substantial digital assets worldwide, based on CoinGecko rankings.

The surge in CKB‘s price can primarily be attributed to its addition to the prominent South Korean exchange, Upbit. This listing has facilitated easier access for traders to buy CKB using U.S. dollars, South Korean won, or Tether (USDT), which has significantly increased demand and caused a notable price increase.

As an analyst, I’ve observed a significant spike in trading activity from South Korean traders based on the data from CoinGecko. The CKB/KRW trading pair on Upbit is leading this surge, accounting for approximately $331.6 million in 24-hour volume. Binance is also seeing strong interest with a trading volume of around $134.7 million.

As a researcher, I’m thrilled to report that the surge in optimism has led to an astounding doubling of our daily trading volume, reaching approximately $381 million at present.

Currently, data from Coinglass indicates that the daily open interest for CKB has risen by 13.4%, reaching $116.6 million. Furthermore, this increase in trading volume points towards a rise in investor activity. This surge could be contributing to CKB’s ongoing upward trend.

The Nervos Network is a layer-2 initiative, built upon a proof-of-work system, that aims to boost the capabilities of Bitcoin (BTC) by integrating programmability and enhancing scalability using the RGB++ protocol as its foundation.

CKB price action

According to previous reports on crypto.news, the increase in CKB‘s price seems to align with the merging of two lines forming a falling wedge shape. This technical configuration often suggests there’s more room for the price to rise in the future.

The price not only exceeded its upper Bollinger Band level ($0.0153), but this surge indicates a powerful uptrend. Moreover, the Relative Strength Index indicates an overbought situation, currently at 78, suggesting that the demand to buy has been particularly strong.

Historically, when the Relative Strength Index (RSI) goes beyond 70, it typically indicates that the market is overbought. However, in circumstances where there’s significant momentum driving prices upward, this overbought condition can persist even during continued price increases.

Considering the present trajectory, it’s advisable for traders to watch closely as the $0.02 level approaches. This could potentially function as the next significant psychological barrier. If this level is broken convincingly along with high trading volume, there’s a chance the price might surge towards $0.025 or even higher.

However, the overbought RSI does raise the possibility of a correction or consolidation in the near term. In the event of a reversal, the middle Bollinger Band, which lies near $0.0096, could act as a potential support level.

Investors should be careful and keep an eye on the market’s pace, because a dip back to this point might signal the start of a temporary holding pattern in the near future.

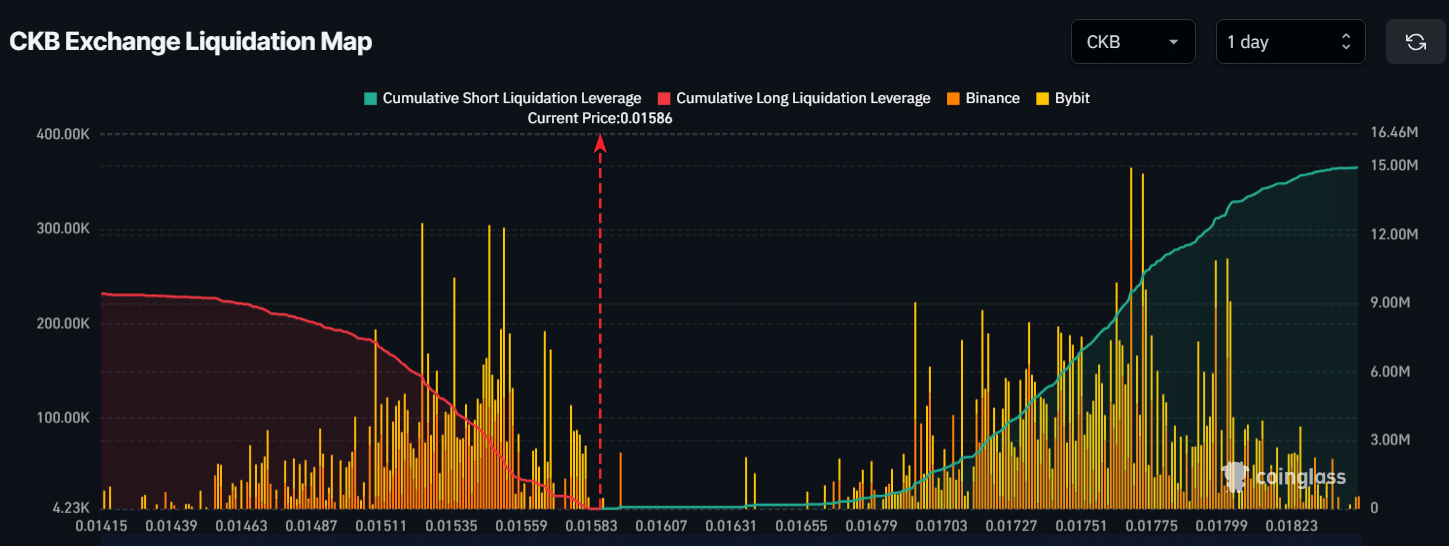

Major liquidation levels

At present, the critical liquidation levels for CKB are roughly around $0.0152 (lower) and $0.0176 (higher). Intraday traders have been seen utilizing high leverage at these price points, as reported by Coinglass.

If the market conditions change and the value of CKB drops to $0.0152, approximately $5.77 million worth of long positions might get liquidated. On the flip side, if the market sentiment improves and the price climbs to $0.0176, around $9.5 million in short positions could be forced to close.

As we speak, the information suggests that the bulls are currently dominating the market, potentially forcing out short positions at higher price points.

Read More

Sorry. No data so far.

2024-09-16 09:58